| Category | Assignment | Subject | Finance |

|---|---|---|---|

| University | Singapore University of Social Science (SUSS) | Module Title | FIN205 Data Technologies for Financial Modelling |

| Assessment Type | Group-Based Assignment |

|---|---|

| Academic Year | 2025 |

This assignment is worth 20% of the final mark for FIN205 Data Technologies for Financial Modelling.

This is a group-based assignment. You should form a group of 4 members from your seminar group. Each group is required to upload a single report via your respective seminar group site in Canvas. Please elect a group leader. The responsibility of the group leader is to upload the report on behalf of the group.

It is important for each group member to contribute substantially to the final submitted work. All group members are equally responsible for the entire submitted assignment. If you feel that the work distribution is inequitable to either yourself or your group mates, please highlight this to your instructor as soon as possible. Your instructor will then investigate and decide on any action that needs to be taken. All group members don't need to be awarded the same mark.

You are to include the following particulars in your submission: Course Code, Title of the GBA, SUSS PI No., Your Name and Submission Date.

You must answer ALL questions. (Total 100 marks)

Unless specified, all future cash flows are at the end of the period. If there are inconsistencies between the given financial statements and the data in question, the data in question is preferred.

You just joined a fund management company as a financial analyst. You are assigned to work in the US-based and US-dollar Tech-Fund Management Team. Your first assignment is to research two publicly listed companies: one technology company and one fintech company. The main objective is to explore the possibility of including one or both stock(s) into the current Tech-Fund portfolio. The Tech-Fund portfolio consists of cash and equities only, without any financial derivatives.

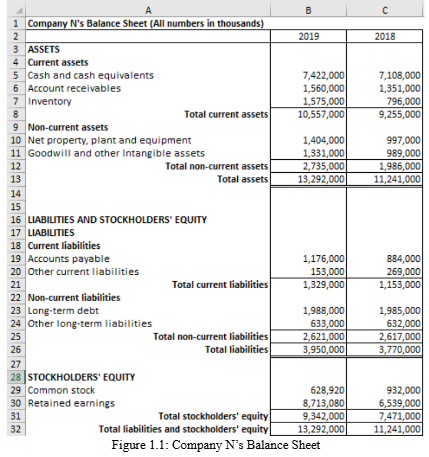

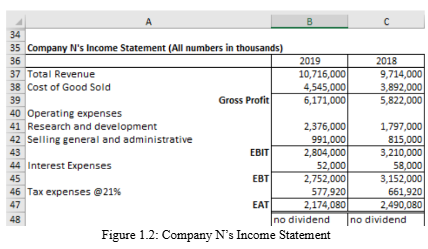

You are given the Balance Sheet and Income Statement of Company N. Company N is a leading computer hardware manufacturer focusing on selling computer graphics cards. To expand the operation facility, Company N declared that they are going to borrow more money from banks. You are asked to carry out an analysis on their new capital structure, especially their new cost of debt.

Based on historical daily price time series data, your financial model revealed these data: Covariance of the excess Company N’s stock returns and excess Tech Market Index returns,

Variance of the excess Tech Market Index returns over the risk-free rate of returns,

Annualised expected Return for Tech Market Index RM,

annualised yield for 10-year Treasury Bond Rf, the fund management company uses the 10-year Treasury Bond yield as the risk-free rate or cost of borrowing,

Show your workings for the calculations below:

(a) Calculate the Beta coefficient, which is the measure of sensitivity of Company N’s common stock to the movements in the Tech Market Index. Round off to two (2) decimal places. (5 marks)

(b) State the financial model you are using and calculate the expected return for the common stock of Company N in %. Round off to two (2) decimal places. (5 marks)

(c) Based on the data on 2019 alone, you observed that Company N funded its operation merely with fixed-rate bonds and common stock issuance. Given the Corporate Tax rate is 21%, N’s bond coupon yield of 3.2% and a ratio of debt D/equity E of 0.25. Calculate the Weighted Average Cost of Carry, WACC of Company N for the year 2019 in %. Round off the answer to one (1) decimal place. (5 marks)

(d) As mentioned, Company N wants to fund its future operation with more new fixed-rate bond issuance, to a new ratio of debt D/equity E of 1. The Company N wants to maintain the same Weighted Cost of Capital as that of 2019. Given that the Corporate Tax rate and cost of equity remained unchanged. Calculate the new overall cost of debt in %. Round off the answer to two (2) decimal places. (5 marks)

(e) Apart from calculating the expected return for the common stock of Company N, the financial model you recommended in (b) is used extensively by financial analysts (not employed in Company N) for cost analysis. Discuss one (1) reason. (5 marks)

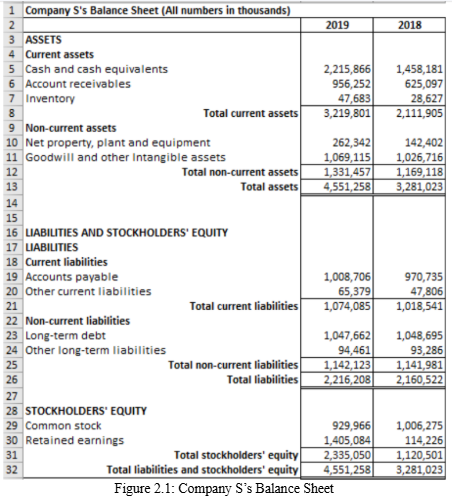

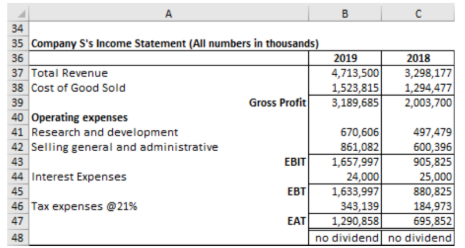

You are given the Balance Sheet and Income Statement of Company S. Company S is a leading fintech company focusing on eCommerce, digital wallet, and mobile payment.

Figure 2.2: Company S’s Income Statement

The Fund Manager wants you to carry out a DuPont Analysis for Company S.

(a) Calculate the Net Profit Margin (NPM) for the year 2019 in %. Show the working. Round off to one (1) decimal place. (5 marks)

(b) Calculate Return on Assets (ROA) for the year 2019 in %. Show the working. Round off to one (1) decimal place. (5 marks)

(c) Determine the Return on Equity (ROE) for the year 2019 in %. Show the working. Round off to one (1) decimal place. (5 marks)

(d) Illustrate two (2) strengths and two (2) drawbacks for using DuPont Analysis. (10 marks)

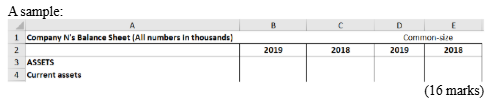

(a) Show your common-size Balance Sheet and Income Statement, for companies N and S, respectively, by taking a screen-shot of your Excel tables and pasting them in your report. Ensure good clarity and resolution of your screenshots.

(b) Calculate the current ratio for both companies in 2019. Show the working. Round off to two (2) decimal places. (2 marks)

(c) Calculate the inventory turnover for both companies in 2019. Show the working. Round off to zero (0) decimal place. (2 marks)

(d) State one (1) benefit of knowing and understanding the impact of the current ratio and likewise, one (1) benefit of knowing inventory turnover, for the management of the companies of concern. (5 marks)

To facilitate the investment decision-making process of the Tech-Fund manager, determine if stock inclusion should take place by preparing an investment proposal. The investment proposal should provide a logical flow that leads to a recommendation for stock inclusion or otherwise. The logical flow comprises a detailed financial analysis of both companies, especially with the help of common-size financial statements. Include at least four (4) different aspects in your financial analysis. The recommendation is about whether to include either one or both companies’ stocks in the current Tech Fund portfolio.

The report should be around 600-700 words. (20 marks)

You will be evaluated based on the presentation (formatting, layout, diagram, etc.) and logical flow of your analysis that leads to your conclusion. (5 marks)

Achieve Higher Grades with FIN205 Assignment Solutions

Order Non-Plagiarized AssignmentAre you having trouble completing your FIN205 Data Technologies for Financial Modelling? Our Finance Assignment Help service is the best for you. You can even check our free assignment samples before placing your order. We promise on-time delivery and 24/7 support, no matter your academic needs. From Business Management to technical subjects, we cover it all. We also provide Singapore University of Social Science (SUSS) Assignment Samples that the phd expert writers have written. Contact us now!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content