| Category | Assignment | Subject | Business |

|---|---|---|---|

| University | Singapore University of Social Science (SUSS) | Module Title | BUS356 Business Negotiation |

This assignment is worth 20% of the final mark for BUS356 Business Negotiation.

The cut-off date for this assignment is 06 March 2025, 2355 hrs.

This is a group-based assignment. You should form a group of 4 members from your seminar group. Each group is required to upload a single report via your respective seminar group site in Canvas. Please elect a group leader. The responsibility of the group leader is to upload the report on behalf of the group. It is important for each group member to contribute substantially to the final submitted work.

All group members are equally responsible for the entire submitted assignment. If you feel that the work distribution is inequitable to either yourself or your group mates, please highlight this to your instructor as soon as possible. Your instructor will then investigate and decide on any action that needs to be taken. It is not necessary for all group members to be awarded the same mark.

Note to Students:

Compose your report using Microsoft Office Word, and save either as .doc or .docx (preferred).

You are to include the following particulars in your submission: Course Code, Title of the GBA, SUSS PI No., Your Name, and Submission Date.

The use of generative AI tools is allowed for this assignment.

Buy Answer of BUS356 Group-Based Assignment & Raise Your Grades

Order Non Plagiarized AssignmentMarks awarded to your assignment are based on the following guidelines:

Note: This is a fictitious case.

Caring Heights Precinct (CHP) is located in the southern city suburb of the Country of Mega dreams. Raito Development (RD), a leading real estate firm in Mega dreams owned the land, developed, and managed several buildings (e.g., Megamall, Community Club, etc.) RD also sold land parcels to various businesses to develop and manage various amenities in CHP.

The majority of the 400,000 residents and visitors who live, work, and play in the modern and bustling metropolis enjoy the wide variety of amenities there. CHP has its own sports stadium, theatre, etc., but not a hospital. Residents in CHP have been wishing for a new hospital to be built in CHP for many years.

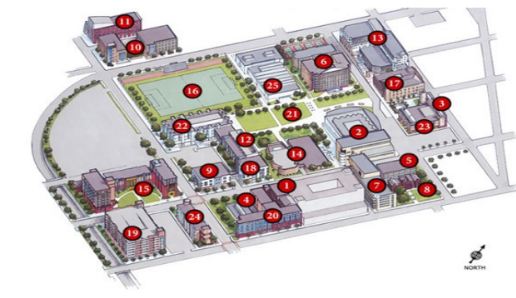

Figure 1: Location Map of Various Buildings in the Caring Heights Precinct (CHP)

Are You Looking for Answer of BUS356 Group-Based Assignment

Order Non Plagiarized Assignment(Source: Adapted from New Jersey Institute of Technology (2012). Warren Street Villae Break Ground. NTIJ Magazine, Spring 2012, p. 13.

https://magazine.njit.edu/sites/magazine/files/lcms/2012/spring/sp12-warren-street.pdf)

The school in Megadreams had seen a huge reduction in enrolment numbers over the years due to the low and declining birth rates in CHP. The Private School Operator had just given notice to RD (the landlord) that it would not renew the rental lease once it expired at the end of the month. Students would have to travel much further out of CHP for their studies. There are 60 years remaining on the lease for the land parcel on which the two school buildings sit on, herein referred to as Parcels 19 and 24. RD intended to sell this parcel of land to any commercial organisation keen to develop the land.

Ms. Toh (herein called Toh) was the CEO of RD. She has been the CEO in charge of managing CHP for the past twenty years. Toh had developed strong strategic partnerships with several established companies in the hotel, sports, and nursing industries. The successful synergy of the various businesses within CHP could largely be attributed to Toh’s management of these strategic partnerships. These companies have set up their businesses in CHP. Toh built trust and won respect from one such partnership, Agape Nursing. It owned a chain of nursing homes throughout the country and ten years ago, Toh had courted the chain to set up a Nursing Home called Agape Nursing Royale. The Home had three buildings (catering to the low, mid, and high-end customers) in CHP. The partnership was so successful that it led the Agape Nursing chain to collaborate with RD to set up a Nursing Training Institute several years ago to train nurses to work in other parts of the country.

RD’s major shareholders decided to replicate its success with CHP and expand its business to other emerging countries. Recently, RD secured a huge plot of land in the Country of Aspirations to fund a huge Megamall. RD needed to secure at least $90M in cash facilities to fund the construction of the Megamall urgently. Other real estate developers were also bidding to build the Megamall. As RD had maxed out its banking facilities, its next best option was to sell Parcels 19 and 24 in Megadreams for around the same price.

A few parties, including two private universities and a hospital, have expressed interest in buying Parcels 19 and 24. While the universities could commit to a higher bid, Toh preferred that these parcels of land be used to house a new hospital. This is in line with RD’s and her vision of having a hospital in the vicinity for the increasing numbers of CHP elderly residents. Today, young and old have to travel 2.5 hours to the nearest hospitals in the east or west most part of Mega dreams for their medical treatment and hospitalisation.

Three independent valuers engaged by Toh had valued Parcels 19 and 24 between $95M to $100M. However, being astute and business-savvy, Toh would like to sell the parcel of land for at least 10% above $100M (the highest valuation) or $110M. She felt that there would be several serious bidders who would likely compete for the land parcel and bid up the price.

One of the serious bidders was the Beh Medical Group (BMG). The founder and CEO was Mr. Beh (herein known as Beh). He foresaw strong customer demand for a hospital in CHP and would like to acquire Parcels 19 and 24 to develop it into a hospital. He had a vision of setting up more hospitals in aging precincts to offer best in class hospital treatments at very affordable rates to serve the growing pool of ageing citizens in the country. Beh had been sourcing for a suitable site for six months ever since he committed to other key BMG investors/shareholders to develop a new hospital within three to four years. Beh had set aside some cash on hand to fund the design and construction of the hospital. He would also need to secure additional bank financing for the land parcel. After consulting with his Finance Director, he figured out that the maximum amount he was willing to pay for Parcels 19 and 24 was $100M. He considered another available land site further south of CHP. It was reasonably priced at $90M and was the same size as Parcels 19 and 24. However, Beh preferred Parcels 19 and 24 due to its integrated facilities and amenities, such as the Nursing Home and Nursing Training Institute. The Nursing Training Institute could also train qualified nurses to work in BMG’s proposed hospital.

Toh and Beh have met each other on three occasions while viewing the amenities at CHP and negotiating for Parcels 19 and 24. However, both parties adopted the contending mode of managing conflicts. They could not agree on the final price for the land parcel.

Toh was confident and quite vocal in selling Parcels 19 and 24 to influence potential buyers to bid more for the plot of land. It was an attractive site for commercial use. She reminded potential buyers how RD had forged excellent partnerships with renowned companies, government bodies, etc. This resulted in the high footfall at the various amenities.

Beh told Toh that he was only prepared to pay close to the market valuation for Parcels 19 and 24. BMG would have to spend a huge sum of money to demolish the existing buildings and construct a new hospital from scratch. Beh told Toh that his own reputable valuer had given him a valuation report for Parcels 19 and 24. His reasonable offer of $80M to Toh was very close to that valuation. Beh was careful not to disclose the source and valuation to increase his information power. His valuer, Knight Frank, valued both parcels at $90M. Beh used this $90M amount as his reference price for negotiation.

BMG uncovered a few issues with respect to the land area. However, Beh did not tell Toh about this at their first three meetings. Firstly, Parcels 19 and 24 have limited space, yet the local government had a key requirement that the winning bidder for the land must apply for the use of the land (hospital preferred) and must maximise the number of hospital rooms. Hence, there was no space to build car parks for the medical staff. The only solution was that 80 medical staff with cars park outside Parcels 19 and 24. It would be a long 20-minute walk to the hospital from the car park for them.

Secondly, Beh would like to retain School Building 24 and perform minor renovations to save costs. Some classrooms could be adapted for hospital use. However, he would need detailed information on the existing school buildings on the land parcel and material used to confirm his construction and renovation plan and cost. Furthermore, Beh discovered that the Private School’s older Building, Number 19, was constructed in 1985 and its roofs contained asbestos.

Building 24 was built in 2000 and was constructed without the use of asbestos. It would cost at least $500,000 to properly remove and dispose of all the toxic asbestos in the roof ceilings of Building 19.

To secure a bank loan of around $90M to purchase Parcels 19 and 24, Beh would need critical information from Toh to develop a business plan with sales projection, etc., and present it to his banks. For example, CHP’s masterplan, detailed profile of its residents and visitors, etc. He was very keen to sign the purchase agreement with RD in the next few months so that the hospital could be built in three to five years.

Based on the information from the case, including the key issues, as the Lead Negotiator, propose a ten-step negotiation planning process on how you and Beh could continue the negotiation with Toh to achieve a win-win outcome. BMG must be successful in purchasing Parcels 19 and 24. State your assumptions (if any) to support your proposal. Your answer should not exceed 1,200 words. State the word count at the end of your answer.

Achieve Higher Grades with BUS356 Assignment Solutions

Order Non Plagiarized AssignmentSeeking with your assignment BUS356 Business Negotiation? Look no further! We are here for business management assignment help. We also provide free assignment solutions written by PhD expert writers—100% original content, no plagiarism! Plus, we also provide assignment help, that too by completing it before the deadline. Quality and accuracy are taken care of completely. So contact us today and be stress-free!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content

ksghl5i7u

ksghl5i7u