| Category | Assignment | Subject | Accounting |

|---|---|---|---|

| University | Western Sydney University | Module Title | ACT201 Principles of Accounting |

| Assessment Type | Group Assignment |

|---|---|

| Academic Year | 2025 |

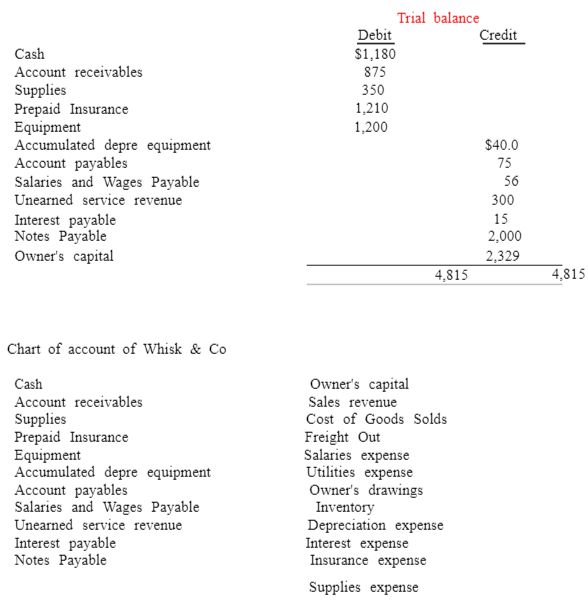

Whisk & Co., a business owned by Emma, specializes in providing cooking classes.Following a successful launch, Emma is now exploring ways to expand the business. Onepromising opportunity is to become a distributor of premium European mixers through apartnership with Kzinski Supply Co.

To manage inventory for this new product line, Whisk & Co. has decided to adopt theperpetual inventory system and use the FIFO (First-In, First-Out) method for cost flow.The following transactions happen during the month of January. Jan. 4 Bought five deluxe mixers on account from Kzinski Supply Co. for $2,875, FOBshipping point, terms n/30.

6 Paid $100 freight on the January 4 purchase.

7 Returned one of the mixers to Kzinski because it was damaged during shipping.Kzinski issues Whisk & Co. credit for the cost of the mixer.

8 Collected $375 of the accounts receivable from December 2013.

12 Three deluxe mixers are sold on account for $3,450, FOB destination, terms n/30.(Cost of goods sold is $595 per mixer.)

14 Paid the $75 of delivery charges for the three mixers that were sold on January 12.

14 Bought four deluxe mixers on account from Kzinski Supply Co. for $2,300, FOBshipping point, terms n/30.

17 Emma invested an additional $1,000 in Whisk & Co. to address cash concerns.18 Paid $80 freight on the January 14 purchase.

20 Sold two deluxe mixers for $2,300 cash. (Cost of goods sold is $595 per mixer.)

28 Emma paid her assistant for 20 hours of work in January, plus $56 accrued fromDecember. (Hourly rate: $8)

28 Collected the amounts due from customers for the January

12 transaction.

30 Paid a $145 cell phone bill ($75 for the December 2016 account payable and $70for the month of January). (The cellphone is used only for business purposes andrecorded under “Utilities expense account).

31 Paid Kzinski $3,900 amounts.

31 Emma withdrew $750 cash for personal use.

As of January 31, the following adjusting entry data is available.

Question:

Struggling ACT201 Group Assignment ? Deadlines Are Near?

Hire Assignment Helper Now!Whisk & Co. recently expanded into manufacturing and retail. During February 2025, the company acquired and disposed of various non-current assets, with all transactions settled in cash.

(a) Food Processor – Business Context

On February 10, Whisk & Co. purchased a second-hand industrial food processor from a local supplier for $3,800.

Additional costs incurred include:

- $250 for transportation to Whisk & Co.’s premises

- $150 for installation and testing

- $200 for an annual maintenance contract commencing in February

The processor has an estimated useful life of 4 years or approximately 4,800 operating hours, with a residual value of $400. Its use is irregular and dependent on customer bookings and seasonal demand. In February, the processor was used for 100 hours. Asset performance is primarily tied to actual operating hours rather than the passage of time.

(b) Dough Rolling Machine – Business Context

On February 20, Whisk & Co. purchased a dough rolling machine for $6,000. The machine isexpected to operate for 12,000 hours over its useful life, with an estimated residual value of$600. In February, the machine was used for 400 hours.

(c) Imported Commercial Oven

– Business ContextOn February 14, Whisk & Co. imported a new commercial oven from Europe. The related costs were:

- Invoice price: $12,000

- Shipping: $1,000

- Import duty: 5% of the invoice price- Non-refundable local sales tax: 10% of the invoice price

- Installation and testing: $400The oven has an estimated useful life of 5 years with a residual value of $1,000.

It is expected to be used intensively in the first two years to support a high-volume product launch and a marketing campaign targeting professional chefs, with usage tapering off in subsequent years.

Questions:

6.1. Determine and calculate the total capitalized cost of each of the three assets acquired inFebruary (the food processor, dough rolling machine, and imported oven

6.2. Prepare the journal entries to record all transactions related to the acquisition of the food processor, dough rolling machine, and imported oven in February.

Your entries must reflect both capitalizable and non-capitalizable amounts (e.g., maintenance fees, non-refundable taxes, transportation, installation, etc.).Hint: You may create appropriate account names if they are not provided.

6.3. For each of the three assets above, select the most appropriate depreciation method based on its business use and context. Justify your choice using the matching principle and asset definition.

6.4. Calculate the depreciation expense for February for each asset using the depreciation methods selected in 6.3.

6.5. Prepare the journal entries to record depreciation for all three assets for the month of February.

6.6. Prepare a classified balance sheet schedule for Whisk & Co. as of February 28, 2025, presenting all Property, Plant and Equipment (PPE), including the baking equipment that was already included in the balance as of January 31, 2025 and is still in use in February 2025.

Your schedule must:

- Clearly list each asset by name and category (e.g., PPE, intangible asset).

- Present the following information for each item: Original cost, Accumulated depreciation/amortization, Net Book Value (NBV)

- Provide subtotals by asset class (e.g., subtotal PPE, subtotal intangible assets).

- Indicate Total Non-current Assets at the bottom.

- Specify: Entity name, Reporting date, Currency unit

Using information from part A, prepare the Net Cash from Operating Activities section in the Statement of Cash Flows. You need to show all the calculations/ working that lead to the Net Cash from operating activities.

Buy Custom Answer Of ACT201 Group Assignment & Raise Your Grades

Get A Free QuoteGet expert Australia Assignment Help for ACT201 Principles of Accounting Group Assignment? We specialize in offering high-quality Accounting Assignment Help, with an option for students to pay our experts to take on their assignment challenges. Need a reference? We also provide a free list of assignment examples to help you get started. With years of experience, our writers deliver 100% plagiarism-free content and offer unlimited revisions to meet your needs. Trust us to help you excel in your studies!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content