| Category | Assignment | Subject | Finance |

|---|---|---|---|

| University | University of the West of England ( UWE Bristol) | Module Title | UBLMKW-15-M Managerial Finance for the Built Environment |

| Word Count | 3000 Words |

|---|---|

| Assessment Type | Coursework |

| Academic Year | 2025 |

The coursework is intended to provide you with the opportunity to demonstrate understanding and integration of the various aspects of the programme and this module. The aim should be to obtain, analyse and interpret financial information; assess the financial viability of a project and integrate them into a balanced decision- making framework.

MF4BE, a leading local housing developer of the Southwest is considering a new housing development to be built under a quasi-social housing agreement with a national house-building firm. Several sites were identified in the initial feasibility studies, however, many of these required substantial demolitions of existing dwelling houses and relocation during construction and have thus been rejected.

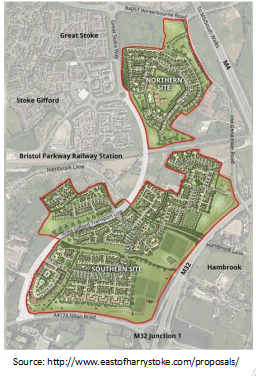

The proposed development will take place on a site in a new neighbourhood called East of Harry Stoke (EoHS) near Stoke Gifford situated on the urban edge of north Bristol near the University of the West of England and close to the M32 and M4 motorways. This site is mostly owned by Crest Nicholson and South Gloucestershire Council who intend to deliver about 2000 houses, while some parts are owned by other private landowners. This site is in high demand owing to its accessibility. MF4BE has purchased 3.75 hectares of the EoHS land from private landowners for £3.85 million per hectare to enable it to carry out this development. MF4BE plans to develop the site to provide a mix of housing (including family housing, flats and sheltered accommodation), together with commercial uses in future and provide some open spaces. In keeping with this, the average dwelling per hectare (density) for this development should NOT exceed 32.

To achieve this undertaking, MF4BE is considering engaging a reputable construction company or housebuilder from a list of firms that have expressed interest.

You are required to provide a report that will contain the following:

An assessment of the suitability of the chosen construction or housebuilder firm as a construction company or housebuilder for this project (1800 words).

To deliver this, you are required to obtain the most recently published “FULL ANNUAL REPORT” for an existing construction company or housebuilder of your choice. The annual report must be for a UK PLC that is listed/quoted on the UK Stock Exchange and must be in the English language.

You are required to assess the suitability of the chosen construction company or housebuilder, as a building contractor by preparing a report on the financial “health” of this company, including a short introduction and background on the chosen company. This should be done by making use of financial ratios as revealed or implied by the most recent FULL annual report and its financial statements. You must provide figures and calculations for all the financial ratios (excluding the investment ratios) presented in the first half of this module.

Your report should be clear and succinct as if prepared for your boss (with no accounting knowledge) who is a very busy person with limited time to read it before an important meeting. All relevant information in the annual report should be used as necessary.

The detailed calculations of all ratios, (from the basic equation to the final figure calculated) must be shown in FULL and must be attached separately as part of the Appendices either in Microsoft Word or Microsoft Excel.

You must analyse the ratios and comment on:

Your conclusion to Part 1 must contain a recommendation as to whether the company analysed is suitable to help undertake the project. It should also draw on the rest of your report in order to reflect the key reasons for your recommendation.

(Note: Please restrict yourself to just the ratios covered in class, you need not calculate the investment ratios).

A complete copy of the FULL ANNUAL REPORT must be attached as a separate file in the submission. DO NOT use the interim (half-year) annual report.

The full annual report can be obtained online from the respective company’s website or by carrying out a search using your preferred internet “search engine". Use the FAME database (accessible through the UWE Library) to check this and only use companies that are “Active and Publicly quoted”. Note that FAME should only be used to compare the ratios, but all the ratios should be calculated manually.

You must use the most recent annual report available to you. A UK PLC must file its financial statements within 6 months of its year-end or face substantial penalties so this will help you ensure you have the most recent accounts.

Note: If the most recent annual report is not used, your mark will be penalised.

Do You Need UBLMKW-15-M Assignment of This Question

Order Non Plagiarized AssignmentDevelopment decision-making (1200 words)

You are required to propose two (2) housing schemes on the site for MF4BE to pick from. Decide on the total number of residential dwellings proposed for this site and the housing mix and types (e.g., 1 bedroom, 2 bedrooms etc). Note: a minimum of three house types is required for both proposed schemes.

To enable MF4BE in decision-making you must carry out the following tasks: -

a.Undertake breakeven analyses (charts included) based on only the development of houses on both proposed schemes. Based on the breakeven analyses, advise MF4BE on which of the two schemes is the best.

Market information can be gleaned from a variety of databases e.g., “Rightmove” that will provide reasonable comparables. Cost information can be obtained from sources such as the Building Cost Information Service (BCIS) or Spon’s. (18 marks)

b.With the use of the information from (a) above, advise MF4BE on the viability of the two proposed schemes by carrying out capital budgeting using the Return of Capital Employed (ROCE), Payback Period (PP), Net Present Value (NPV) and Internal Rate of Return (IRR). Discuss which of these appraisal methods IS the most suitable for this task and advise which of the two proposed schemes is the best.

Make appropriate assumptions regarding the timing of the construction and sale of the units. (22 marks)

Overall Presentation (5 marks)

You need to start by obtaining a most recent annual report of a construction company or housebuilder which is a PLC and whose shares are quoted on the stock exchange

Please refer to the assessment criteria

How does the learning and teaching relate to the assessment?

The aim of this coursework is to assess your knowledge of how financial & management accounting and financial management can be used for decision-making in the built environment.

What additional resources may help me complete this assessment?

UWE Bristol offers a range of Assessment Support Options that you can explore through this link, and both Academic Support and Wellbeing Support are available.

For further information, please see the Academic Survival Guide.

Use the support above if you feel unable to submit your own work for this module.

While it is encouraged to share ideas with your colleagues, avoid colluding with your colleagues by ensuring that you complete your work independently.

Do not copy from previous student’s coursework as this will be picked up by the system and

the markers.

|

% |

Descriptor Total 100 |

Part A: Ratio Calculations

(17) |

Part A: Financial health analysis

(40) |

Part B: Calculations

(20) |

Part B: Analysis and viability assessment (18) |

Presentation (5) |

|

Distinction |

Outstanding

An outstanding report will completely meet all aspects of the brief and show evidence of independent /innovative thought and/or critical analysis. |

All the relevant ratios for both years of the most recent annual report of either a construction company or housebuilder which is a plc will be calculated accurately, showing all the workings in the appendix. |

All the relevant ratios will be clearly defined, with correct, detailed analysis, and where possible compared with the peers/industry when analysing each ratio to assess the financial health of the company. The information in the annual report will be used as appropriate. Recommendations will also be provided as tasked in part 1. The significance of the findings will be evaluated in a manner which meets the requirements of the brief and demonstrates an outstanding level of insight, consistency and understanding of the relevant concepts. There will be evidence of reading, analysis, and presentation beyond the conventional styles. |

All the relevant calculations used needed to undertake breakeven analyses and the four capital budgeting methods will be accurate for both proposed schemes using the appropriate and relevant information based on the site and the parameters of the brief. These will be presented professionally in spreadsheets as appropriate. For the calculations to be considered outstanding, the cash flow should be extended beyond the conventional. |

The relevant analyses for the breakeven measures will be offered to help select the best scheme. For capital budgeting, the analyses will be based on all the methods highlighting the viability to help recommend the best method and scheme. The significance of the findings will be evaluated in a manner which meets the requirements of the brief and demonstrates an outstanding level of insight, consistency and understanding of the relevant concepts. There will be evidence of reading, analysis, and presentation beyond the conventional styles. |

The report will be written to the highest standards of literacy and professionally presented and well-referenced. |

|

Exceptional

An exceptional report will meet all aspects of the brief. |

All the relevant ratios for both years of the most recent annual report of either a construction company or housebuilder which is a plc will be calculated accurately, showing all the workings in the appendix, with perhaps only very minor errors. |

The relevant ratios will be clearly defined, with correct, detailed analysis, and where possible compared with the peers/industry when analysing each ratio to assess the financial health of the company. The information in the annual will be used as appropriate. Recommendations will also be provided as tasked in part 1. The significance of the findings will be evaluated in a manner which meets the requirements of the brief and demonstrates an exceptional level of insight, consistency and understanding of the relevant concepts. Where appropriate, there will be evidence of reading, analysis, and presentation beyond the conventional styles. |

The relevant calculations used needed to undertake breakeven analyses and the four capital budgeting methods will be accurate but perhaps with only minor errors for both proposed schemes using the appropriate and relevant information based on the site and the parameters of the brief. These should be presented professionally in spreadsheets as appropriate. For the calculations to be considered exceptional there should be an attempt to extend the cash flow beyond the conventional. |

The relevant analyses for the breakeven measures will be offered to help select the best scheme. For capital budgeting, the analyses will be based on all the methods highlighting their viability to help recommend the best method and scheme. The significance of the findings will be evaluated in a manner which meets the requirements of the brief and demonstrates an exceptional level of insight, consistency and understanding of the relevant concepts. Where appropriate, there will be evidence of reading, analysis, and presentation beyond the conventional styles. |

The report will be written to high standards of literacy and neatly presented and well-referenced. |

|

|

Excellent

An excellent report will meet all aspects of the brief. |

The relevant ratios for both years of the most recent annual report of either a construction company or housebuilder which is a plc will be calculated accurately, showing all the workings in the |

The relevant ratios will be clearly defined, with correct, detailed analysis, and where possible compared with the peers/industry when analysing each ratio to assess the financial health of the company. The information in the annual report will be used as appropriate. Recommendations will also be provided as |

The relevant calculations used needed to undertake breakeven analyses and the four capital budgeting methods will be accurate but perhaps with only minor errors for both proposed schemes using the appropriate |

The relevant analyses for the breakeven measures will be offered to help select the best scheme. For capital budgeting, the analyses will involve all the methods highlighting their viability to help recommend the best method and scheme. The significance of the findings will be |

The report will be written to high standards of literacy and neatly |

|

% |

Descriptor Total 100 |

Part A: Ratio Calculations

(17) |

Part A: Financial health analysis

(40) |

Part B: Calculations

(20) |

Part B: Analysis and viability assessment (18) |

Presentation (5) |

|

|

|

appendix, with perhaps only minor errors. |

tasked in part 1. The significance of the findings will be evaluated in a manner which meets the requirements of the brief and demonstrates an excellent level of insight, consistency and understanding of the relevant concepts. Where appropriate, there will be evidence of reading, analysis, and presentation beyond the conventional styles. |

and relevant information based on the site and the parameters of the brief. These should be presented professionally in spreadsheets as appropriate. |

evaluated in a manner which meets the requirements of the brief and demonstrates an excellent level of insight, consistency and understanding of the relevant concepts. Where appropriate there will be evidence of reading, analysis, and presentation beyond the conventional. |

presented and well referenced |

|

Merit 60-69 |

MERIT

A good /very good report will meet almost all aspects of the brief, although there might be some minor omissions of detail. |

The relevant ratios for both years of the most recent annual report of either a construction company or housebuilder which is a plc will be calculated accurately, showing all the workings in the appendix, although there may be some minor errors and omissions. |

The relevant ratios will be defined, with correct, analysis, and where possible compared with the peers/ to assess the financial health of the company. The information in the annual report will be used as appropriate Recommendations will also be provided as tasked in part 1. The significance of the findings will be evaluated in a manner which meets the requirements of the brief and demonstrates a good understanding of the relevant concepts. Where appropriate, there will be evidence of reading, analysis and presentation beyond the conventional |

The relevant calculations used needed to undertake breakeven analyses and the four capital budgeting methods will be accurate although there may be some minor errors and omissions for both proposed schemes using the appropriate and relevant information based on the site and the parameters of the brief. These should be presented professionally in spreadsheets as appropriate. |

The relevant analyses for some breakeven measures will be offered to help select the best scheme. For capital budgeting, the analyses will involve most of the methods highlighting the viability to help recommend the best method and scheme. The significance of the findings will be evaluated in a manner which meets the requirements of the brief and demonstrates a good understanding of the relevant concepts, though there may be some lapses. Where appropriate there will be evidence of reading and good application of concepts. |

The report will be clearly written and professionally presented with good referencing. |

|

Pass |

PASS

An adequate / competent report will meet most aspects of the brief. |

The relevant ratios for both years of the most recent annual report of either a construction company or housebuilder which is a plc will be calculated appropriately, showing some workings in the appendix, although there may be some errors and omissions. |

The relevant ratios will be defined, with reasonable analysis, and where possible compared with some peers/ in order in a generic manner to assess the financial health of the company. Partial recommendations will also be provided as tasked in part 1. The significance of the findings will be evaluated in a manner which meets the requirements of the brief and demonstrates a sound and substantive understanding of the relevant concepts though there could be some misunderstandings, errors, or omissions. |

The relevant calculations used needed to undertake breakeven analyses and the four capital budgeting methods will be reasonably accurate although there may be some minor errors and omissions for both proposed schemes using the appropriate and relevant information based on the site and the parameters of the brief. These should be presented in spreadsheets as appropriate |

The relevant analyses for some breakeven measures will be offered to help select the best scheme. For capital budgeting, the analyses should involve some methods highlighting the viability to help recommend the best method and scheme. The significance of the findings will be evaluated in a manner which meets the requirements of the brief and demonstrates a sound and substantive understanding of the relevant concepts though there could be some misunderstandings, errors, or omissions. |

The report must be clearly written and neatly presented and referenced. |

|

A weak report will meet more than half of the |

The relevant ratios for both years of the most recent annual report of either a construction company or |

Some ratios will be defined, with reasonable analysis assessing the financial health of the company. The significance of the findings will be evaluated in a manner which meets the |

The relevant calculations used needed to undertake breakeven analyses and the four capital budgeting methods will be |

Reasonable analyses for some breakeven measures will be offered to help select the best scheme. For capital budgeting, the analyses should involve some methods |

The report must be comprehensible and neatly |

|

% |

Descriptor Total 100 |

Part A: Ratio Calculations

(17) |

Part A: Financial health analysis

(40) |

Part B: Calculations

(20) |

Part B: Analysis and viability assessment (18) |

Presentation (5) |

|

|

requirements of the brief. |

housebuilder which is a plc be calculated reasonably accurately, showing some workings in the appendix, although there may be some omissions and/or errors. |

requirements of the brief and demonstrates adequate understanding of the relevant concepts though there could be some misunderstandings, errors, or omissions. |

accurate for both proposed schemes using the appropriate and relevant information based on the site and the parameters of the brief. There may, however, be some omissions and/or errors. These should be presented in spreadsheets as appropriate. |

highlighting the viability to help recommend the best method and scheme. The significance of the findings will be evaluated in a manner which meets the requirements of the brief and demonstrates an adequate understanding of the relevant concepts though there could be some misunderstandings, errors, or omissions. |

presented and adequately referenced. |

|

Fail 0-49 |

FAIL A very weak and/or incomplete report showing a lack of understanding of the brief and little evidence of engagement with the coursework |

Some ratios for the annual report of either a construction company or housebuilder will be calculated, showing a few workings in the appendix, but contain several errors and omissions. |

Poor and incomplete analysis that could be largely incomplete, missing key aspects of the brief, or perhaps be characterised by an excessive number of errors and inaccuracies |

Some calculations needed to undertake breakeven analyses and some capital budgeting methods will be provided, but contain several errors and/or omissions |

Poor breakeven and capital budgeting analyses that will be largely incomplete, and missing key aspects of the brief, or perhaps be characterised by an excessive number of errors and inaccuracies |

Levels of literacy, presentation and referencing may be poor. |

|

Incomplete ratio calculation that does not meet the substantive aspects of the brief and is likely to be a partial submission and/or has substantial errors. |

Incomplete or very poor analysis that does not meet the substantive aspects of the brief and is likely to be a partial submission and/or a completely inappropriate/incorrect application of the ratio analysis. |

No calculations were undertaken for part 2 or most calculations needed to undertake breakeven analyses and some capital budgeting methods will be provided, but contain several errors and omissions |

No analyses were undertaken for part 2 or very poor breakeven and capital budgeting analyses that are largely incomplete, missing key aspects of the brief, or perhaps characterised by an excessive number of errors and inaccuracies. |

Levels of literacy, presentation and referencing may be poor or lacking. |

Buy Custom Answer Of UBLMKW-15-M Assignment & Raise Your Grades

Get A Free QuoteLooking for expert guidance in UBLMKW-15-M Managerial Finance for the Built Environment Assignment? Worry, no need! We are here to help you with assignments. Whether you need Online Finance Coursework Help or well-structured solutions, we will provide everything. You will get free UWE Bristol Assignment Examples that will make your study material stronger. Our expert team is providing all assignment services, you will get accurate, clear, and original content. Now stop worrying about marks and complete your assignments hassle-free with expert support. So what's the delay? Get connected with us now and make your academic journey easy!

See the solution of this brief click here: UBLMKW-15-M Coursework Example

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content