| Category | Assignment | Subject | Finance |

|---|---|---|---|

| University | University of Sunderland (UOS) | Module Title | MGT104: Finance and Financial Decision Making for Managers |

| Deadline | 2 pm on 12th May 2025. |

| Level | 4 |

Part A carries a weighting of 45% and students should write 1,000 words (+ or – 20%).

Note: trial balance, financial statement of performance and financial statement of position can go in the appendix and do not count toward word count.

Part B carries a weighting of 30% and students should write 1,000 words (+ or – 20%).

Note: calculations can go in the appendix and do not count toward word count.

Note: Appendix A comes from the MGT104 Module Handbook pp. 3 and 4 (available on the module canvas site).

Part C carries a weighting of 25% and students should write 500 words (+ or – 20%).

Note: calculations can go in the appendix and do not count toward word count.

As the weightings for the tasks are not identical, this should be considered in word allocation.

The submission date for all parts of the assessment is 2 pm on 12th May 2025. Students are required to submit electronic versions to Turnitin.

Please write your Tutor’s name clearly on the front of the assignment.

Please note that this is an individual assignment, and the policy of the University on “Policy on Cheating, Collusion and Plagiarism” applies.

Please note that ‘Late Work Penalties’ apply for this piece of work.

To obtain a high mark, you should

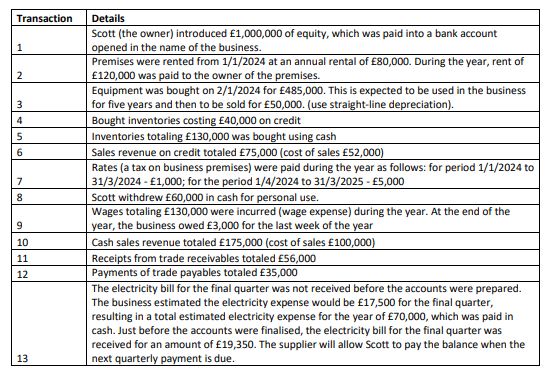

Scott Ridley is a sole trader who started trading on 1st January 2024. As a trainee financial manager, you have been presented with a summary of transactions that occurred during the first year of trading.

The business uses the straight-line method for depreciating non-current assets.

Do You Need MGT104 Assignment for This Question

Order Non-Plagiarised Assignment“Financial statements are a vital communication tool for key stakeholders”. Discuss this statement considering the role of financial record keeping in the survival and growth of small businesses.

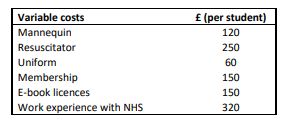

The university wants to explore whether to offer a new one-year medical short-course to complement its existing suite of medical and pharmacy courses.

The course would start in August 2025 and run for 12 months. Employers, such as the Local Authorities, would sponsor students to undertake the course, so they would pay the fees. Market research and conversations with possible employers have shown that a fee above £4,000 would be unlikely to attract many students. A fee of £3,500 would be ideal, but employers may be willing to pay £4,000.

Estimated fixed costs are £150,000. These include lecture staff, the hire of the building, standard advertising costs, electricity, IT equipment and the use of an ambulance. A list of the variable costs is below:

The module included a group formative assessment where you were a member of the management team of a new start-up business introducing a product to the market with the objective of increasing stakeholder value.

Using appendix A, please reflect and explain how this module has helped you:

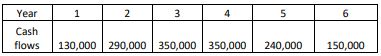

Sunderland film studios is considering a major investment project. The initial outlay of £-750,000 will, in subsequent years, be followed by positive cash flows, as shown below. (These occur on anniversary dates.)

After the end of the sixth year, this business activity will cease, and no more cash flows will be produced.

The initial £-750,000 investment in plant and machinery is to be depreciated over the six-year life of the project using the straight-line method. These assets will have no value after Year 6.

The management estimate that the cash inflows shown above are also an accurate estimation of the profit before depreciation for each of the years. They also believe that the appropriate discount rate to use for the firm’s projects is 15 per cent per annum.

The board of directors are used to evaluating project proposals on the basis of a payback rule which requires that all investments achieve payback in five years.

As the newly appointed executive responsible for project appraisal you have been asked to assess this project using a number of different methods.

Do this in the following sequence

Achieve Higher Grades with MGT104 Assignment Solutions

Order Non Plagiarized AssignmentBy the end of this module successful students will be able to do the following:

The learning outcomes will be developed within the module through an exploration of the role of the financial manager. A variety of different business and finance theories and activities will address the tools of the trade of finance:

1. Accounting for business transactions. Accounting for business transactions is a very important means of communicating business performance to key stakeholders as well as a precursor for budgeting and ensuring strategic goals are achieved.

1.1 : Examine the important role of the financial manager in an organisation.

1.2 : Summarise the key financial statements of performance, position and cash flow.

1.3 : Convert business transactions into financial statements using the double-entry bookkeeping system.

2. The costing, pricing and investment decision. The costing and pricing decisions are influenced by numerous internal and external factors, whilst the investment decision involves allocating funds to assets that will generate value for the business.

2.1 : Review economic and business concepts informing the costing, pricing and investment decision making process.

2.2 : Introduce fixed and variable costs and how the contribution margin can improve financial decisions in various business scenarios.

2.3 : Explain the difference between discounted and non-discounted investment appraisal techniques, considering the opportunity cost of capital.

3. Employability and CV Impact:

3.1 : Provide students with foundation skills for a career in business and finance.

3.2 : Develop negotiation and communication skills underpinning HRM, marketing and management concepts from a finance perspective.

Buy Answer of This Assignment & Raise Your Grades

Order Non Plagiarized AssignmentIf you are stressed about the assignment of MGT104: Finance and Financial Decision Making for Managers, then there is no need to worry now! Whether you need Finance Assignment Help or Management Assignment Help in UK, with us you will get expert guidance and help on assignment which will strengthen your concepts. We also provide you free assignment solutions which will help you in understanding. And the best part? All the content is 100% original written by PhD expert writers, and well researched so that you get the best quality. So don't delay now, boost your grades with our help!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content