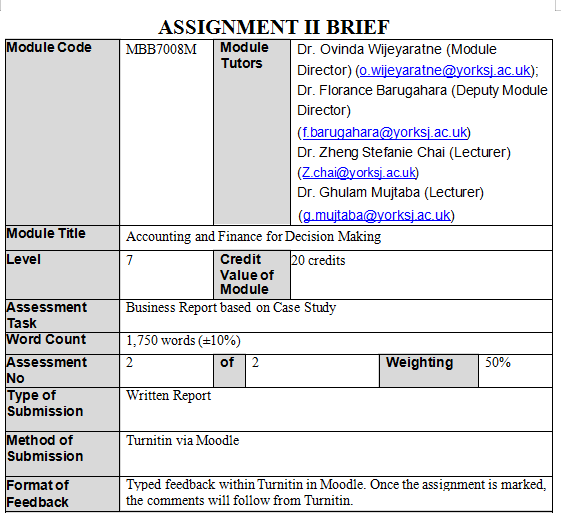

| Category | Assignment | Subject | Accounting |

|---|---|---|---|

| University | York St John University (YSJU) | Module Title | MBB7008M Accounting and Finance for Decision Making |

| Word Count | 1,750 words (±10%) |

|---|---|

| Assessment Type | Written Report |

| Assessment Title | Assignment 2: Business Report based on Case Study |

Upon successful completion of the module students will be able to: LO.1 Master the various aspects of financial analysis;

LO.2 Be able to determine the value, value creation and investment decisions of a firm;

LO.3 Apply risk management techniques in a business to hedge risky projects;

LO.4 Have an overall appreciation of the application of financial management theories to practice.

This assessment covers the following LO’s:

LO.2 Be able to determine the value, value creation and investment decisions of a firm; LO.3 Apply risk management techniques in a business to hedge risky projects;

LO.4 Have an overall appreciation of the application of financial management theories to practice.

Individual Case Study (1750 words, 50% of assessment weighting)

For this individual case study, you are required to analyse the company that you have been allocated for Assessment 1.

The COVID-19 pandemic has affected the businesses and economy dramatically. The Board of Directors is currently considering diversifying its business risk and plans to make some investments that would help the business sustain and grow in the long term. Assuming you were the Chief Financial Officer of the company/organisation, you were tasked to produce a report to the Board of Directors that identifies a potential investment project to help the business grow in the post COVID-19 environment.

Write a business report to the Board of Directors of your allocated company. In your report, you shall propose an investment project, and the cashflows for the proposed investment project is provided to you in the Moodle page. For the proposed project you need to consider the risk and return, evaluating the investment opportunity and analysing its potential impact on the company/organisation with consideration of its financial performance before you make recommendation, including the following discussions:

1.Executive Summary (250 words)

2.Motivation of the proposed investment (200-300 words)

3.Conduct investment appraisal using both quantitative and qualitative information (700-800 words)

4.Critically discuss the risk and return and its potential impact on its financial performance (300-400 words)

Do You Need MBB7008M Assignment 2 of This Question

Order Non Plagiarized AssignmentRelevant

Data can be assessed via FAME for publicly traded UK company, stock exchange, Yahoo Finance, as well as the annual report and official website.

Analysis, links, examples and applications of the concepts and discussion should be made to current businesses and situations to show understanding of this module and its contents.

Reference should follow Harvard Referencing Guide. Please do not copy and paste other resources in your report. The appendices of the report shall include relevant supporting

Please see the assessment criteria below.

|

|

PASS GRADES |

FAIL GRADES |

|||||

|

(100-85) |

(84 - 70) |

(69 - 60) |

(59 - 50) |

(49 - 40) |

(39 - 20) |

(19 - 0) |

|

|

Overarching |

All learning |

All learning |

All learning |

All learning |

One or more of the |

A significant |

Most of the learning |

|

indicators: |

outcomes/assessment |

outcomes/assessment |

outcomes/assessment |

outcomes/assessme |

learning |

proportion of the |

outcomes/assessmen |

|

|

criteria have been |

criteria have been |

criteria have been met |

nt criteria have been |

outcomes/assessment |

learning |

t criteria have not |

|

|

achieved to an |

achieved to a high |

fully, at a good or very |

met. |

criteria have not been met. |

outcomes/assessment |

been met. |

|

|

exceptionally high level, |

standard, and many at an |

good standard. |

|

|

criteria have not been |

|

|

|

beyond that expected at |

exceptionally high level. |

|

|

|

met. |

|

|

|

Level 7, with features |

|

|

|

|

|

|

|

|

consistent with Level 8 |

|

|

|

|

|

|

|

|

(doctoral study). |

|

|

|

|

|

|

|

SUMMARY DESCRIPTOR: Learning accredited at Level 7 (Master’s) will reflect the ability to display mastery of a complex and specialised area of knowledge and skills, employing advanced skills to conduct research or advanced technical/professional activity, accepting accountability for related decision-making, including use of supervision. |

|||||||

|

Criteria |

Characteristics |

||||||

|

Subject knowledge & understanding (30% weighting) |

Exceptional investment appraisal knowledge and conceptual understanding at the forefront of the discipline. Authoritative approach to complexity investment appraisal using quantitative and qualitative approaches, and linking to the sensitivity of the investment and impact to the financial performance |

Comprehensive investment appraisal knowledge and conceptual understanding, informed by recent developments in the discipline, demonstrating reading/research at significant depth/breadth. Informed & confident approach to complexity about investment appraisal using quantitative and qualitative approaches and linking to the sensitivity of the investment. |

Detailed investment appraisal knowledge and conceptual understanding demonstrating purposeful reading/research. Developing awareness of complexity about investment appraisal using quantitative and qualitative approaches |

Broad investment appraisal knowledge and conceptual understanding, demonstrating directed reading/research. Some awareness of complexity about investment appraisal using quantitative and qualitative approaches. |

Reproduction of taught content and/or tendency to describe or report facts rather than demonstrate complex ideas surrounding investment appraisal through quantitative or qualitative approaches. Any errors or misconceptions are outweighed by the overall degree of knowledge & understanding demonstrated. |

Insufficient evidence of knowledge and understanding of investment appraisal using quantitative or qualitative approaches, and its underlying concepts. |

Little or no evidence of knowledge and understanding of investment appraisal using quantitative and qualitative approaches, or its underlying concepts. |

|

Higher cognitive |

Rigorous and sustained |

Strong and sustained |

Detailed criticality and |

General criticality |

Limited criticality and |

Mainly descriptive |

Little or no evidence |

|

skills & originality |

criticality, independent |

criticality and independent |

evidence of independent |

and some evidence |

independent thought, |

and/or inadequately |

of criticality and |

|

(30% weighting) |

thinking and original |

thinking/original insight; |

thinking/original insight; |

of independent |

leading to conclusions |

supported conclusions |

independence of |

|

|

insight; convincing |

persuasive conclusions |

logical and sustained |

thinking; logical |

and/or application to the |

and/or application to |

thought about the |

|

|

conclusions and/or |

and/or application to the |

conclusions and/or |

conclusions and/or |

motivation of the proposed |

the motivation of the |

motivation of the |

|

|

application to the |

motivation of the proposed |

application to the |

application to the |

investment that is poorly |

proposed investment. |

proposed investment. |

|

|

motivation of the proposed |

investment and linked to |

motivation of the |

motivation of the |

supported. |

|

|

|

|

investment and linked to |

the investment appraisal |

proposed investment. |

proposed |

|

|

|

|

|

the investment appraisal |

discussion. |

|

investment. |

|

|

|

|

|

discussion. |

|

|

|

|

|

|

|

|

PASS GRADES |

FAIL GRADES |

|||||

|

(100-85) |

(84 - 70) |

(69 - 60) |

(59 - 50) |

(49 - 40) |

(39 - 20) |

(19 - 0) |

|

|

Advanced |

Exceptional demonstration |

Purposeful, systematic, |

Purposeful, systematic, |

Skilled |

Developing expertise. |

Limited demonstration |

Little or no |

|

technical, |

of advanced technical, |

and sophisticated |

and skilled |

demonstration of |

Inconsistent |

of advanced technical, |

demonstration of |

|

professional |

professional and/or |

demonstration of |

demonstration of |

advanced technical, |

demonstration of |

professional and/or |

advanced technical, |

|

and/or research |

research expertise. |

advanced technical, |

advanced technical, |

professional and/or |

advanced technical, |

research conduct |

professional and/or |

|

expertise (30% |

Innovative. Work may |

professional and/or |

professional and/or |

research expertise |

professional and/or |

within investment |

research conduct |

|

weighting) |

challenge the existing |

research expertise within |

research expertise |

within investment |

research conduct within |

appraisal or sensitivity |

within investment |

|

|

boundaries of knowledge |

investment appraisal and |

within investment |

appraisal and |

investment appraisal or |

analysis. |

appraisal or sensitivity |

|

|

and/or practice within |

sensitivity analysis. |

appraisal and sensitivity |

sensitivity analysis. |

sensitivity analysis. |

|

analysis. |

|

|

investment appraisal and |

|

analysis. |

|

|

|

|

|

|

sensitivity analysis. |

|

|

|

|

|

|

|

Professionalism |

Professional, |

Professional and fluent |

Fluent and coherent |

Mostly fluent and |

Communication that is |

Limited clarity and/or |

Highly limited clarity |

|

[e.g., of |

sophisticated/innovative |

communication, that holds |

communication, which |

coherent |

difficult to follow at times |

structure in |

and/or structure in |

|

information, results |

communication, with |

the attention of its |

demonstrates consistent |

communication; |

because of poor |

communication, and/or |

written and/or oral |

|

of research, ideas, |

exceptional clarity and/or |

reader/audience |

and accurate academic |

demonstration of |

clarity/structure; |

inadequate |

communication. |

|

concepts and |

audience-engagement, |

throughout and which |

conventions. |

appropriate |

inconsistent demonstration |

demonstration of |

Inadequate |

|

arguments etc] |

and exemplary academic |

demonstrates academic |

|

academic |

of academic conventions. |

academic |

demonstration of |

|

and adherence to |

conventions. |

conventions that are |

|

conventions, which |

|

conventions. |

academic |

|

academic |

|

accurate and relevant to |

|

may include some |

|

|

conventions. |

|

conventions (10% |

|

the level of study/beyond. |

|

errors or |

|

|

|

|

weighting) |

|

|

|

inconsistencies. |

|

|

|

Buy Custom Answer Of MBB7008M Assignment 2 & Raise Your Grades

Get A Free QuoteGet expert assignment help for MBB7008M Accounting and Finance for Decision Making Assignment 2: Report? We specialize in offering high-quality Accounting Assignment Help, with an option for students to pay our experts to take on their assignment challenges. Need a reference? We also provide a free list of York St John University Assignment Examples to help you get started. With years of experience, our writers deliver 100% plagiarism-free content and offer unlimited revisions to meet your needs. Trust us to help you excel in your studies!

View the assignment sample of this brief here: MBB7008M Assignment 2 Sample

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content