| Category | Case Study | Subject | Management |

|---|---|---|---|

| University | London South Bank Univesity | Module Title | BUS_7_SLM Strategic Leadership Management |

Headquartered in Seattle, Washington, and the world’s largest coffee company, Starbucks is a premier roaster, marketer, and retailer of specialty coffee in the world, with over 24,000 stores in 76 countries. The company provides customers with the “Starbucks Experience”—comprised of excellent customer service, clean stores, appropriate music, and a comfortable setting. Currently, Starbucks in the United States segment generates about 69 percent of total revenues. Millions of people, every day, meet at Starbucks to talk, do business, and chat with friends. The music selected to play in the stores enhances the relaxed look and feel of the coffeehouse. Starbucks offers a full coffeehouse experience, complete with premium teas, fine pastries, and other sweets. The company also sells a variety of coffee and tea products through licensed stores, grocery stores, and foodservice accounts. Several brands associated with Starbucks are Teavana, Tazo, Seattle’s Best Coffee, Evolution Fresh, La Boulange, and Ethos.

In February 2018, Starbucks and JP Morgan Chase began offering the Starbucks Rewards Visa Card, a co-brand credit card integrated directly into the Starbucks Reward loyalty program. Customers using this Visa card earn Stars with every purchase, both in and out of Starbucks stores, and can redeem their Stars for food and beverage items at more than 8,000 participating Starbucks locations. Cardholders also become members of the Starbucks Rewards loyalty pro- gram comprised of more than 14 million members. Later in 2018, Starbucks and Chase plan to offer a second co- branded product, the Starbucks Rewards Visa Prepaid Card.

Starbucks’ strategic plan is to add about 600 new stores annually in China during 2018– 2022, adding stores in 100 new cities to reach 230 cities across the country. The company plan is to more than triple revenue and more than double operating income in China between 2017 and 2022. This plan calls for the company to double the number of Starbucks stores in China from the end of FY2017 to 6,000.

Starbucks’ fiscal year ends on September 30. For the company’s fiscal Q1 2018 that ended December 31, 2017, revenues increased 6 percent to a record $6 billion, with comparable store sales up 2 percent. For that Q1, company’s revenues from stores in China increased 30 percent, with comparable store sales up 6 percent. Starbucks as a whole is performing really well.

Do You Need BUS_7_SLM Case Study of This Question

Order Non Plagiarized Case StudyStarbucks was founded in Seattle in 1971 as a roaster and retailer of whole bean and ground coffee, teas, and spices in a single store in Seattle’s Pike Place Market. The company was named after the first mate in Herman Melville’s Moby Dick. The Starbuck logo was inspired by the sea and features a twin-tailed siren from Greek mythology. The company was incorporated in 1985 and went public in 1992.

In November 2017, the company opened its first store in Jamaica and entered its seventy- sixth market globally. Together with its local business partner, Baristas del Caribe, LLC, Starbucks opened its first store in Puerto Rico.

In December 2017, Starbucks completed the sale of its Tazo Tea brand to Unilever; Starbucks desires to focus on a single tea brand, specifically its super premium tea brand, Teavana. Also, that month, Starbucks was named fifth in Fortune’s World’s Most Admired Companies survey. Additionally, the company completed its acquisition of the remaining 50 percent share of its East China business from long-term joint venture partners, Uni-President (UPEC) and President Chain Store Corporation (PCSC). With this transaction, Starbucks assumed 100 percent ownership of over 1,400 Starbucks stores in Shanghai and in the Jiangsu and Zhejiang Provinces, bringing the total number of company-owned stores in China to over 3,100. On this same day, UPEC and PCSC acquired Starbucks 50 percent interest in President Starbucks Coffee Taiwan Limited and assumed 100 percent ownership of Starbucks operations in Taiwan.

On December 5, 2017, Starbucks opened its Reserve Roastery in Shanghai, China, now the largest Starbucks store in the world. The Roastery features onsite baking by Italian food purveyor Rocco Princi, for the first time ever in China, and features onsite roasting and brewing of Starbucks Reserve coffees.

In April 2018, Starbucks opened its first store in Uruguay, the city of Montevideo. The new store offers Starbucks 100 percent Arabica coffees from Latin America and around the world. International retail and restaurant operator Alsea exclusively owns and operates Starbucks stores in the country. Starbucks plans to open 10 stores and create 130 new jobs in Uruguay by 2020.

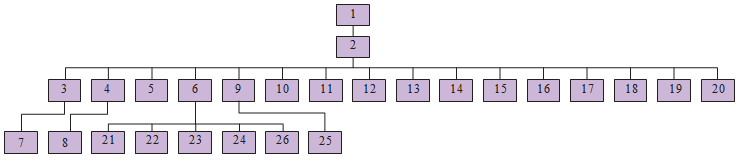

Organizational Structure

As indicated in Exhibit 1, Starbucks operates from using a strategic business unit (SBU) type of organization with numerous regional presidents reporting to four CEOs and four COOs in the company. An illustration of the Starbucks organizational structure is depicted in Exhibit 1. Probably no one but Starbucks insiders know exactly who reports to who—but what is important for students is to devise a recommended reporting relationship, perhaps deleting some positions and creating others, to more clearly reveal for all insiders and outsiders the Starbucks chain of command.

Are You Looking for an Answer of This BUS_7_SLM Case Study

Buy Non Plagiarized Case Study

|

1. Howard Schultz, Executive Chairman |

14. Gerri Martin-Flickinger, EVP, Chief Technology Officer |

|

2. Kevin Johnson, CEO and President |

15. Tony Matta, President, Global Channel Development |

|

3. Takafumi Minaguchi, CEO, Starbucks Japan |

16. Scott Maw, EVP, CFO |

|

4. Belinda Wong, CEO, Starbucks China |

17. Hans Melotte, EVP, Global Supply Chain |

|

5. Sumitro Ghosh, CEO, Tata Starbucks, Private Ltd. |

18. Sharon Rothstein, EVP, Global Chief Product Officer |

|

6. Rosalind (Roz) Brewer, COO and Group President |

19. Matthew Ryan, EVP, Global Chief Strategy Officer |

|

7. Brady Brewer, COO, Starbucks Japan |

20. Vivek Varma, EVP, Public Affairs |

|

8. Leo Tsoi, COO, Starbucks China |

21. Mark Ring, President, Starbucks Asia Pacific |

|

9. Jason Dunlop, COO, Starbucks EMEA |

22. Rossann Williams, President, Starbucks Canada |

|

10. Chris Carr, EVP, Chief Procurement Officer |

23. Bernard Acoca, President of Teavana |

|

11. Michael Conway, EVP, President Licensed Stores, U.S. & Latin America |

24. Kris Engskov, President, U.S. Retail |

|

12. John Culver, Group President, Int. and Channel Development |

25. Martin Brok, President, Starbucks EMEA |

|

13. Lucy Helm, EVP, Chief Partner Officer |

26. Cliff Burrows, Group President, Siren Retail |

Values/Vision/Mission

Starbucks’ vision statement is “To establish Starbucks as the premier purveyor of the finest coffee in the world while maintaining uncompromising principles while we grow.”

Starbucks’ mission statement blends a grand and uplifting goal—nourish the human spirit— with a message about how it delivers this—by catering to its individual customers and communities.

Segments

Starbucks is divided into four major operating segments:

All segments are comprised of stores, except “Channel Development” that includes all the Starbucks beverages and other branded products sold throughout the world through “channels” such as grocery stores, warehouse clubs, specialty retailers, convenience stores, and food- service accounts. The company has a few non-reportable operating segments, such as Teavana retail stores and Seattle’s Best Coffee, and Siren Retail that offers taste testing operations. The non-reporting segments are simply classified as Other Segments in the company’s financial reports. For fiscal 2017, Starbucks’ revenues by segment as a percentage of total net revenues were as follows: Americas (70%), CAP (14%), EMEA (5%), Channel Development (9%), and All Other Segments (2%). Thus, the Americas is by far the dominant segment for Starbucks. The Americas, CAP, and EMEA segments include both company-operated and licensed stores. In order to examine what Starbucks is doing currently, Exhibit 2 provides a summary of Starbucks operations across segments for Q1 2018. Notice that 700 new Starbucks stores were opened that quarter, but the company’s overall operating income declined 1 percent, primarily due to the 11 percent drop in operating profits in the EMEA segment. That segment is lagging the others in overall performance. Starbucks provides in their financial documents a breakdown of revenue by type of store. Revenue from company- operated stores accounted for 57 percent of total net revenues during fiscal 2017. Exhibit 3 reveals that there are slightly more licensed stores than company-owned stores because outside of the Americas, Starbucks prefers to utilize licensed stores rather than owning stores.

|

|

Q1 2018 |

Q1 2017 |

Change |

|

Total Company Data |

|

|

|

|

Net New Stores |

700 |

649 |

51 |

|

Revenues $ |

6,074 |

5,733 |

+6% |

|

Operating Income $ |

1,116 |

1,132 |

-1% |

|

Americas Segment Data |

|

|

|

|

Net New Stores |

278 |

271 |

27 |

|

Revenues $ |

4,266 |

3,991 |

+7% |

|

Operating Income $ |

979 |

956 |

+2% |

|

CAP Segment Data |

|

|

|

|

Net New Stores |

300 |

303 |

(3) |

|

Revenues $ |

844 |

771 |

+9 |

|

Operating Income $ |

197 |

163 |

+20 |

|

EMEA Segment Data |

|

|

|

|

Net New Stores |

123 |

95 |

28 |

|

Revenues $ |

284 |

262 |

+8% |

|

Operating Income $ |

39 |

44 |

-11% |

|

Channel Development |

|

|

|

|

Revenues $ |

560 |

553 |

+1% |

|

Operating Income $ |

243 |

243 |

- |

Source: Based on the company’s Q1 2108 quarterly report.

|

|

Americas |

% |

CAP |

% |

EMEA |

% |

All other |

% |

Total |

|

Company- owned |

9,413 |

57% |

3,070 |

41% |

502 |

17% |

290 |

89% |

13,275 |

|

Licensed |

7,146 |

43% |

4,409 |

59% |

2,472 |

83% |

37 |

11% |

14,064 |

|

Total |

16,559 |

100% |

7,479 |

100% |

2,974 |

100% |

327 |

100% |

27,339 |

Source: Based on the company’s 2017 Annual Report, p.3.

Buy Answer of This Case Study & Raise Your Grades

Request to Buy AnswerFor Q2 2018 that ended 3-31-18, Starbucks reported that its same store sales increased 2 percent both globally and in the United States and were up 4 percent in China. The company’s revenues in Q2 increased 14 percent to a record $6 billion. Specifically, for Q2, Starbucks’ revenues from company-owned stores increased 15.1 percent to $4.828 billion, while revenues from licensed stores increased 14.4 percent to $625.6 billion. In the company’s Americas and EMEA segments, the trend is to add licensed stores, but in the China/Asia segment, Starbucks is primarily adding company- owned stores.

Finance

During Q1 of fiscal 2018 that ended December 31, 2017, active membership in Starbucks Rewards in the United States grew 11 percent versus the prior year to 14.2 million, with member spending comprising 37 percent of U.S. company- operated sales, and Mobile Order and Pay representing another 11 percent of U.S. company-operated transactions.

The Starbucks Card was used for 42 percent of U.S. and Canada company-operated transactions. During Q1 2018, Starbucks opened 700 net new stores globally, bringing total store count to 28,039 across 76 counties. Also, during Q1, the company returned a record $2 billion to shareholders through a combination of dividends and share repurchases. Specifically, Starbucks repurchased

28.5 million shares of common stock in Q1; approximately 52 million shares remain available for purchase under current authorizations.

Starbucks income statements and balance sheets for fiscal 2016 and 2017 are provided in Exhibit 4 and Exhibit 5, respectively. Notice all the green arrows pointing upward, signifying that the company is performing quite well.

Coffee Industry Overview

Coffee is the most commonly consumed beverage worldwide. The coffee market can be segmented into growers, roasters, and retailers. On the coffee-growing level, South America was ranked as the major coffee-producing region. Brazil produced and exported 43.2 million 60-kg bags of coffee in 2016. Other major producers are Vietnam and Columbia. Exporting countries tend to consume less coffee than their importing counterparts.

The United States has the largest market share with 45.8 percent of global retail coffee sales in 2016, followed by single-cup coffee. Starbucks and Dunkin' Donuts dominate out-of-home retail market, with a combined market share of over 65 percent. Growth in coffee cup per capita consumption is recently up 18 percent in China, 13 percent in the United Kingdom, and 3.5 percent in Japan. Consumers drink, on average, 1.64 cups of coffee per day, reporting that they drink it at home, on the way to work, and at work. People drink coffee to wake up in the morning or receive a burst of energy throughout the day. People drink more and more coffee as they get older, with the over-60 age group drinking more coffee than any other group.

Income Statement 10/2/16 10/1/17 percent Change

|

Revenues |

$21,315,900 |

|

5.02% |

|

Cost of Goods Sold |

8,511,100 |

|

6.19% |

|

Gross Profit |

12,804,800 |

|

4.25% |

|

Operating Expenses |

8,524,900 |

|

4.85% |

|

EBIT |

4,279,900 |

|

3.04% |

|

Interest Expense |

81,300 |

|

13.78% |

|

EBT |

4,198,600 |

|

2.83% |

|

Tax |

1,379,700 |

|

3.83% |

|

Non-Recurring Events |

(1,200) |

|

-83.33% |

|

Net Income |

2,817,700 |

|

2.38% |

Source: Based on company documents.

|

balance Sheet |

10/2/16 |

10/1/17 |

|

percent Change |

|

Assets |

|

|

|

|

|

Cash and Short-Term Investments |

$2,263,200 |

$2,690,900 |

|

19% |

|

Accounts Receivable |

768,800 |

870,400 |

|

13% |

|

Inventory |

1,378,500 |

1,364,000 |

|

-1% |

|

Other Current Assets |

347,400 |

358,100 |

|

3% |

|

Total Current Assets |

4,757,900 |

5,283,400 |

|

11% |

|

Property Plant & Equipment |

4,533,800 |

4,919,500 |

|

9% |

|

Goodwill |

1,719,600 |

1,539,200 |

|

-10% |

|

Intangibles |

516,300 |

441,400 |

|

-15% |

|

Other Long-Term Assets |

2,784,900 |

2,182,100 |

|

-22% |

|

Total Assets |

14,312,500 |

14,365,600 |

|

0% |

|

Liabilities |

|

|

|

|

|

Accounts Payable |

2,975,700 |

2,932,200 |

|

-1% |

|

Other Current Liabilities |

1,571,100 |

1,288,500 |

|

-18% |

|

Total Current Liabilities |

4,546,800 |

4,220,700 |

|

-7% |

|

Long-Term Debt |

3,185,300 |

3,932,600 |

|

23% |

|

Other Long-Term Liabilities |

696,400 |

762,200 |

|

9% |

|

Total Liabilities |

8,428,500 |

8,915,500 |

|

6% |

|

Equity |

|

|

|

|

|

Common Stock |

1,500 |

1,400 |

|

-7% |

|

Retained Earnings |

5,949,800 |

5,563,200 |

|

-6% |

|

Treasury Stock |

0 |

0 |

NA |

NA |

|

Paid in Capital & Other |

(67,300) |

(114,500) |

|

70% |

|

Total Equity |

5,884,000 |

5,450,100 |

|

-7% |

|

Total Liabilities and Equity |

14,312,500 |

14,365,600 |

|

0 |

Source: Based on company documents.

From 2012 through 2016, coffee retail sales in the United States grew at a compounded annual growth rate (CAGR) of 4.6 percent. During this period of time, there was, however, a shift from single-cup coffee brands that made up just 21 percent of dollar sales, to now ac- counting for 41 percent. This means that all other categories of coffee shrunk during those 5 years. For example, instant coffee and whole beans were both down by 11 percent, while ground coffee declined 9 percent. However, the single-cup market has matured, and 2017 reveals virtually zero growth. A study by the National Coffee Association (NCA) shows that household penetration of single-cup brewing machines in the United States has peaked at around 30 percent, after growing rapidly from just 9 percent in 2011. Fewer consumers today are shifting from drip coffee makers or from instant coffee to single-cup, resulting in slowing growth rates. Prices of single-cup coffee have declined over recent years to a level of what they were 10 years ago. Although retail sales are slowing, out-of-home channel sales of coffee are accelerating. U.S. foodservice coffee sales ended 2016 at around 3.3 percent higher than in 2015. This upward trend in out-of-home purchases of coffee is partly due to low unemployment and continued economic growth, both of which enable consumers to increase their coffee consumption out-of-home; this trend should continue in 2018–2019. Shifts in household composition are favoring the steady rise in out-of-home coffee sales. Additionally, more single households and fewer homes with underage children are reasons why fewer families have sit-down breakfast meals and choose foodservice alternatives in the morning, when the majority of coffee sales take place.

Competition

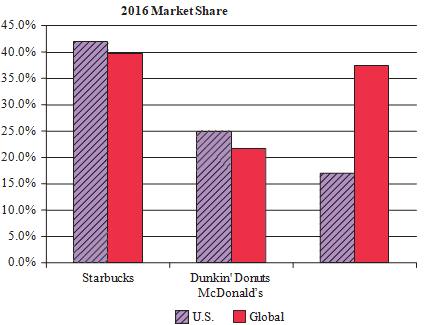

Starbucks’ primary competitors for coffee beverage sales are specialty coffee shops and quick- service restaurants (QSRs). In almost all markets, there are hundreds of competitors in the specialty coffee beverage business, but Dunkin' Brands and McDonald’s Corporation are the two major rivals to Starbucks. Exhibit 6 provides a market share breakdown of coffee market share across these companies. Note that Starbucks is in the lead, but not by much, and McDonald’s leads outside the United States.

Dunkin' Brands Group (DNKN)

Based in Canton, Massachusetts and founded in 1950, Dunkin' Brands is arguably America’s favorite all-day, everyday stop for coffee and baked goods—and is Starbucks’ major rival firm. The Dunkin' Donuts segment of the company is a market leader in the hot regular/decaf/flavored coffee, iced coffee, donut, bagel, and muffin categories. The company has earned the number- one ranking for customer loyalty in the coffee, donut, bagel, muffin, and breakfast sandwich categories by Brand Keys for 9 years running. Dunkin has more than 11,500 restaurants in 40 countries worldwide. The other big segment of the company is Baskin Robbins. Actually, the company operates through four segments: Dunkin' Donuts U.S., Dunkin' Donuts International, Baskin-Robbins International, and Baskin-Robbins U.S. Its restaurants offer hot and cold coffee, baked goods, donuts, bagels, muffins, breakfast sandwiches, hard-serve ice cream, soft-serve ice cream, frozen yogurt, shakes, malts, floats, and cakes.

In February 2018, Dunkin' Brands announced plans to add about 1,000 net new Dunkin' Donuts locations in the United States in 2018-2020 and says more than 90 percent will be built outside of the Northeast. In this same press release, Dunkin reaffirmed its intention to eventually have more than 18,000 Dunkin' Donuts restaurants in the United States. This is a shot over the bow to Starbucks.

Dunkin is determined to maintain and increase the U.S.-based Dunkin' Donuts share of the morning before-11 a.m. food and beverage sales, which account for 60 percent of Dunkin’s system-wide sales—as well as strengthening the company’s afternoon growth opportunities through menu innovation and national value offers. Dunkin is also doing the following in 2018-2020.

Source: Based on information at a variety of sources.

The following are the validated learning outcomes for BUS_7_SLM Strategic Leadership Management - the relevant learning outcomes assessed by this assignment are highlighted in green:

“On completion of the module students should be able to:

Do you need help with BUS_7_SLM Strategic Leadership Management Case Study? Our assignment help service is ready to assist you. If you need someone to do my assignment for me in UK, we’ve got the solution. We also specialize in case study writing help services. we also provide free case study samples that are written by the phd writers. UK students can easily hire our experts to excel in their coursework. Let us help you achieve your academic goals!

If you want to see the related solution of this brief then click here:-Strategic Leadership

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content