| Category | Assignment | Subject | Finance |

|---|---|---|---|

| University | RMIT University | Module Title | BAFI3192 Derivatives and Risk Management |

| Assessment Type | Report |

|---|---|

| Assessment Title | Assessment 2 |

| Academic Year | Sem 2 2025 |

*You should adhere to the word limit for each assessment part. Any words beyond the wordlimit will not be marked. Appendices, references, and citation pages at the end and in thefootnote will not be counted towards the word limit. Tables of mathematical calculations (ifany) and titles of tables/figures will also not be counted towards the word limit.

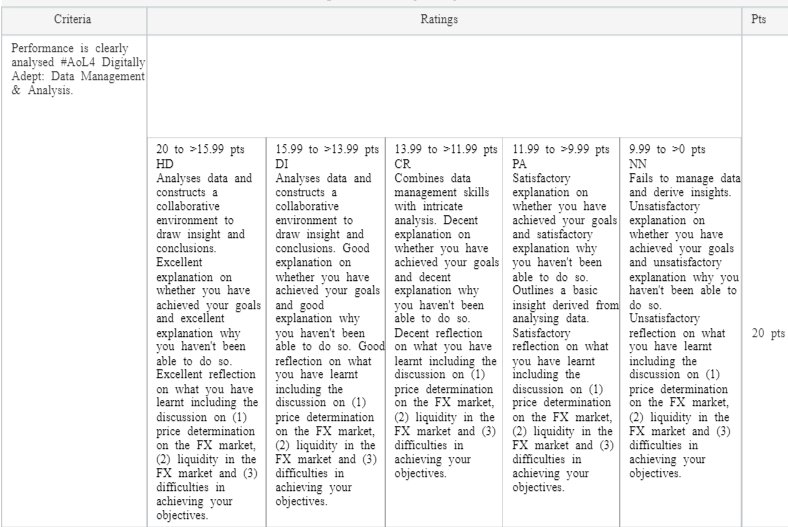

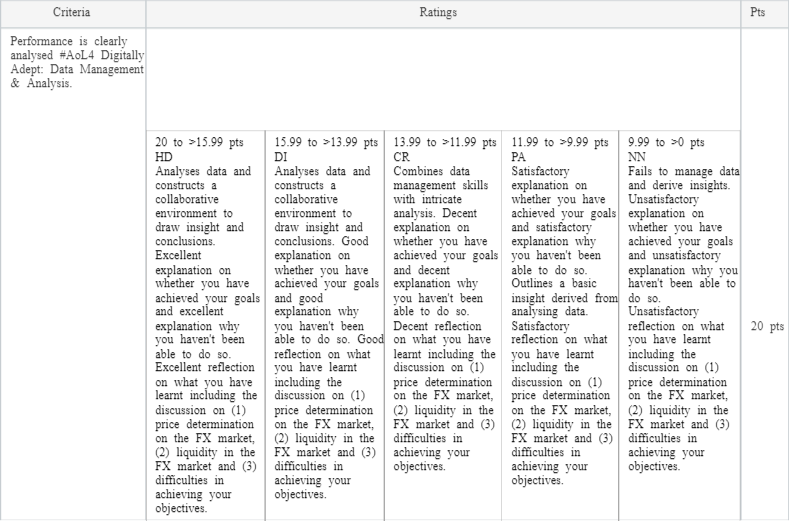

Task A1 (75 marks): Group FX Trading Report (1,100 words +/- 10%)

For this element of the assessment, we will be simulating the activities on the Foreign Exchange market by trading Cash Spot and Forex via Stocktrak 1. Each group will be assigned to act as a Price Taker during the simulation and you will have to interact with the information provided in StockTrak (acts as the central exchange/Market Maker). The live trading sessions will help us understand the interaction between Central Exchange and Price takers. You will learn about how the Central Exchange provide liquidity to the market, whilst understanding how Price Takers are able to hedge and risk manage their FX exposure.Additionally, you will also observe the formation of market conditions during the live trading sessions examining how FX prices are determined by market conditions. Keep in mind that there will be one account per group 2. The arrangements for the live trading sessions are as follows:

-In Week 5, you will have a practice trading session where you will be able to accustom yourselves to the dealing environment. Note that this practice week will not count to your overall mark for Assessment 2, but attendance is strongly encouraged as the knowledge acquired during this session can prove vital towards your success during the actual trading session.

-At the end of the class on week 5, your tutorial lecturer will provide you the actual scenario for your trading session. Coming to the class on Week 5 is the only way you will receive the actual scenario. If you and/or your team do not come to receive the scenario and later request the scenario, you will need to email the Course Coordinator to schedule a meeting on campus. The Course Coordinator will provide the actual scenario with 10% penalty applied to your group in Assignment 2.

-Your actual trading session starts after your class on Week 5 and lasts for 1 week until the end of the class on Week 6.

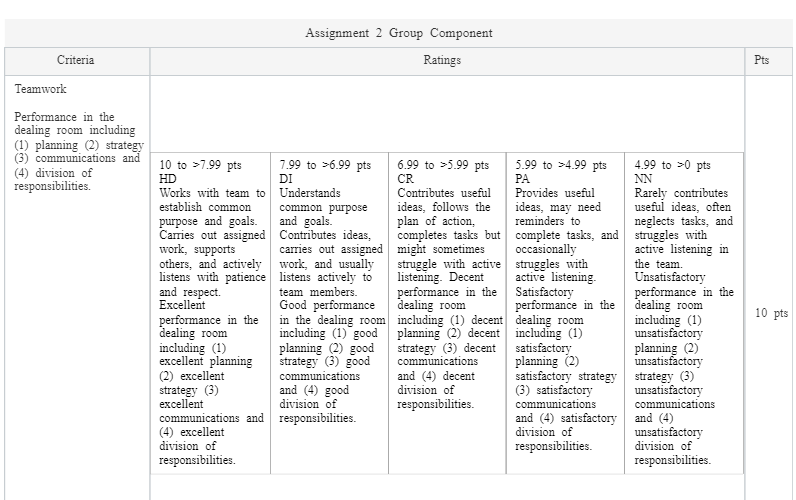

-In Week 6, when you return to the class, you will continue and complete your actual trading session. You will be marked for your actions during this trading session (see Additional Information page at the end for detail). You will be assessed in terms of team planning, strategy, communication, and division of responsibilities. You willalso have to download and submit your transaction history file and trading notes.

In Week 7, you will submit a report on the dealing session including a detailed discussion ofthe following points:

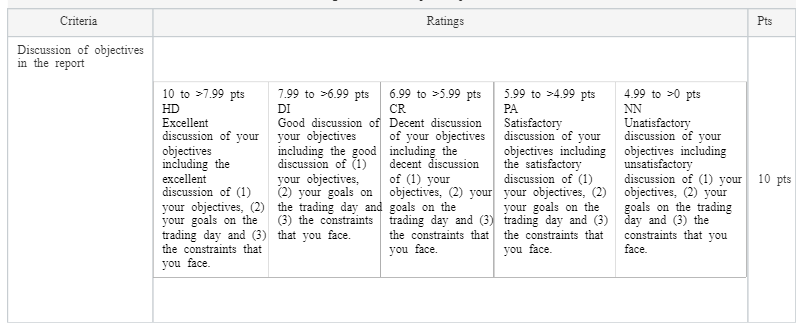

-Discuss your objectives in the dealing session. Where applicable, describe specificsignificant transactions that are to be carried out in the dealing session.

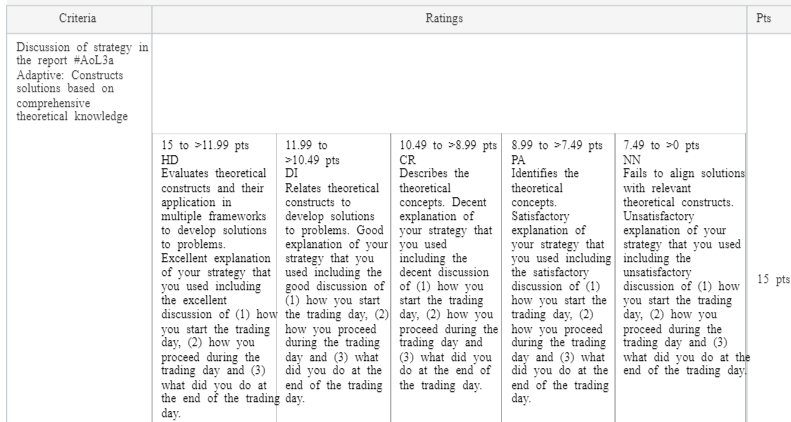

-Outline your strategy to achieve your objectives.

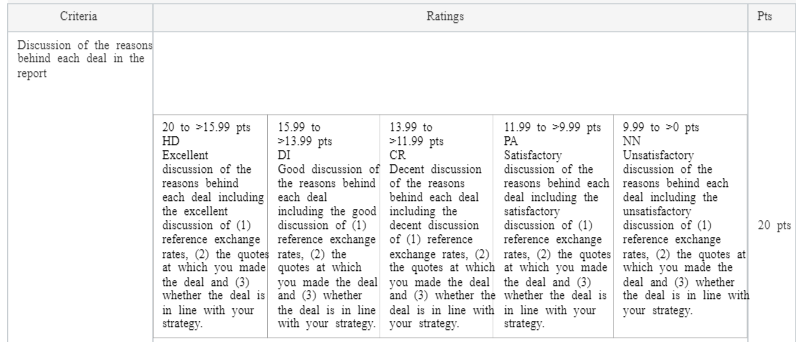

-Explain the reasons behind each deal that you have made including discussion of theassociated prices/quotes.

-Explain whether you have been able to achieve your objectives. If you were unableto achieve your objectives, provide an explanation. Provide a calculation of theaverage price that you have purchased or sold each particular pair of currency andprofits that you have made in the trading session.

-Student teams will also have to complete a peer review statement. This peer reviewstatement will have to be submitted with the group report. As part of the peer review,all students in a group will be assigned the same marks provided all team membersindicate a 100%contribution within the peer review form. In the event that anystudent receives less than a 100% contribution rating from any of their peers, his/hermark will be lower. See peer review statement for an example calculation.

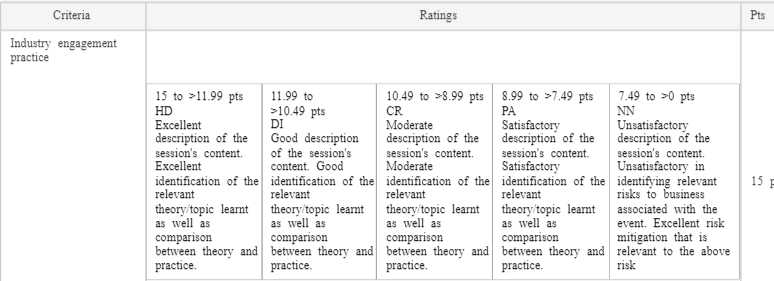

Task A2 (15 marks)(200 words +/- 10%)

As part of this course, you are required to attend an industry engagement guest lecture. Youwill have to critically reflect on the content of the guest lecture paying close attention to thecontent raised by the industry specialist, along with comments and questions raised during thesession. Within your critical reflection you should provide the following:

i. a brief summary of the content of the guest lecture

ii. a discussion of links between the guest lecture content and the topics that youhave studied on this course highlighting any similarities between practice andacademia.

Total word limit for Part A- Group report: 1,300 words +/- 10%

-Your attendance is required for Week 6 trading session, and you will be evaluated during theclass with your lecturer.

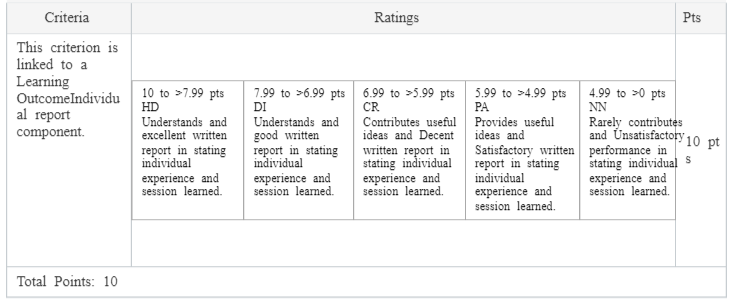

-In addition, you need to provide a critical reflection of what have you learnt from the dealingsession in terms of what you did, and the difficulties you have encountered in achieving yourobjectives. Select 1 deal/transaction and discuss about it.

Total word limit for Part B- Individual report: 200 words limit, no variation.

Are You Looking The Solution of BAFI3192 Assignment 2

Order Non Plagiarized AssignmentFor the trading session:In order to excel in this assessment, you need to understand the differences between bid andoffer (ask) quotes, i.e. at which rate does the Market Maker buy/sell the commodity or termscurrency. Since you will trade using Cash Spots and Forex, you also need to know the differences between those two types of contracts. Please refer and review both Topic 2 and 4prior to the live trading sessions. Additionally, you are encouraged to undertake furtherresearch into the motivations of Price Takers in FX markets. Please review the “BAFI3192 Assessment 2 preparation” slides to familiarise yourself withthe rules of the live trading sessions.

For the industry engagement:

Make sure you are able to attend the guest lecture. Contribute and ask questions during theindustry engagement session. You are encouraged to take or make notes during or after thesession to help with your understanding of the content.

Buy Answer of BAFI3192 Assignment 2 & Raise Your Grades

Pay & Buy Non Plagiarized AssignmentIf you are struggling with your BAFI3192 Derivatives and Risk Management Assignment 2 ? Be stress-free! AI-free Finance Assignment Help is here for you. We assure you that our online assignment help will make you productive and help you achieve high grades in your academic year. A free list of assignment samples written by PhD experts is also provided here that can help you boost your study power and check the quality of the research paper. So contact us today and get your high-quality assignment!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content