| Category | Assignment | Subject | Finance |

|---|---|---|---|

| University | RMIT University | Module Title | BAFI3184 / BAFI3231 Corporate Finance |

| Word Count | 2300 Words |

|---|---|

| Academic Year | Semester 1, 2025 | |

You are required to complete this assignment individully and it accounts for 40% of the course’s final grade. All questions are compulsory.

You may submit the individual report via Turnitin by Week 12, Friday, 23 May 2025, 11:59 pm. A penalty of 10% of the total possible mark (of the task) per day will apply to a late submission. It means that a penalty of 0.42% of the total possible mark (of the task) per hour will apply to a late submission. The unit for calculating late penalties is 'hour'. Any late submission received after the designated deadline, whether by 1 second or up to one hour, will be treated as a complete one-hour late submission, resulting in a penalty of 0.42% of the total possible mark. Weekend days (Saturday and Sunday) are considered when counting total late days for electronic submissions.

The assignment should be typed. Any graphs should be drawn using MS Office tools. All calculations must be done using MS Excel.

You have only THREE attempts to submit your assignment. Check your documents carefully before submission. For every extra submission, your assignment will have 30% of the marks awarded.

Attachments submitted via "Assignment Comments", Email, RMIT SharePoint, or any other channels will NOT be accepted.

You are required to submit a report in a Word file. Please include Excel worksheets showing all your calculations in your submission (use the + Add another file function).

The document should be formatted following the guidelines below and the RMIT presentation guidelines:

This assessment provides an opportunity for the students to work on a real valuation project in an investment firm. This individual report requires students to apply the business finance principles, concepts and techniques they have acquired throughout the semester to provide an investment recommendation to their company.

In this assignment, students will explore the financials of DHG Pharmaceutical Joint Stock Company (HOSE: DHG). DHG Pharmaceutical Joint Stock Company specialises in the production and distribution of pharmaceutical products in Vietnam. Its product portfolio includes antibiotics, pain relievers and fever reducers, respiratory treatments, nutritional supplements, musculoskeletal medications, gastrointestinal and hepatobiliary drugs, as well as products for the nervous system, ophthalmology, cardiovascular health, diabetes care, dermatology, and beauty. The company manufactures and sells dietary supplements and pharmaceutical cosmetics. DHG exports its products to around 20 countries. Established in 1974, the company is headquartered in Can Tho, Vietnam, and operates as a subsidiary of Taisho Pharmaceutical Co., Ltd.

The analysis should be structured as a professional report. Based on the provided material “Case RMITVN Corporate Finance S1 2025 (DHG)”, answer the following questions:

1. Based on the information, forecast DHG’s revenue, COGS, SG&A, and Net Income for the next 5 years. Provide assumptions and explanation for your projections (10 marks)

2. Calculate the Weighted Average Cost of Capital ("WACC") to be used as the discount rate for DHG. Justify and explain your selection of the variables that go into your WACC calculation. (10 marks)

3. Provide a valuation of DHG based on the two valuation methodologies: Comparable Company Analysis (Comps) and DDM. The results should include Enterprise Value, Equity Value, and Share Price, as appropriate. - Select 6 public companies comparable to DHG for the relative valuation approach of comps. (5 marks) - Value DHG based on DDM for the intrinsic valuation approach. (10 marks)

4. Prepare a risk-return analysis of an investment into DHG. Would you invest in DHG based on your analysis? (15 marks)

5. What strategic direction and business initiatives should DHG’s Board and senior management focus on in the next 5 years, considering an increasingly challenging macro environment, increased industry competition, and the proliferation of digitalisation and powerful analytics tools such as AI? (20 marks)

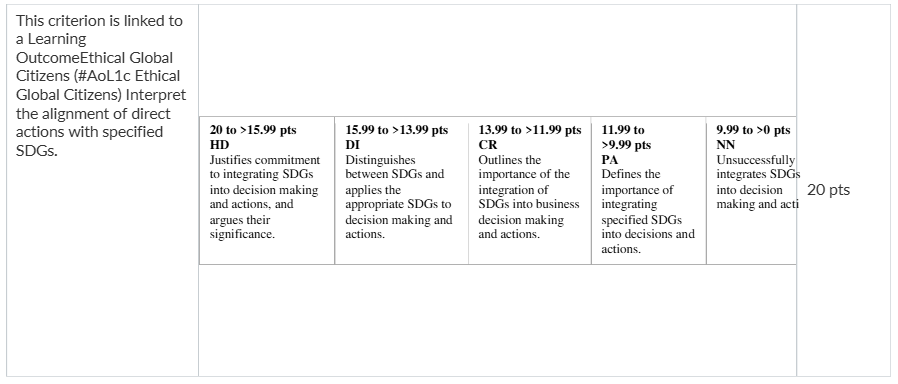

6. Provide an assessment of DHG’s environmental, social, and governance (“ESG”) efforts. (20 marks). You are required to use Val GenAI Chatbot (a RMIT generative artificial intelligence tool) to support your answers to this question and write a 300-word reflection on (1) how Generative AI supports your answers and (2) critically evaluate the use of AI with examples (10 marks)

Submit Your BAFI3184 / BAFI3231 Assignment Questions & Get Plagiarism Free Answers

Order Non-Plagiarized AssignmentAre you looking for help with your BAFI3184 / BAFI3231 Corporate Finance? Don’t stress anymore! We offer expert Finance assignment help at affordable prices. Our team of PhD writers provides well-researched, AI-free, and plagiarism-free work. We deliver before deadlines and are available 24/7 to support you. Whether it’s Business Management or any other topic, we’re here for you. You can also get free assignment samples to check our quality. Improve your grades and reduce your stress—contact us today for reliable and professional assignment help that you can trust!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content