| Category | Assignment | Subject | Education |

|---|---|---|---|

| University | The Career Academy | Module Title | ABKA694 Certificate in Xero Payroll |

Read through the requirements below, complete all parts of the assessment, and then save your work as a PDF file. Once you have saved your work, click on the Assessment Submission link within this course and upload your completed payslips to your tutor for marking.

You are required to complete the following assessment in the Xero Demo Company. To access the Demo Company, please login to Xero > Go to “My Xero” > Click on “Try the Demo Company” at the bottom of the screen.

Note: The Demo Company contains its own data and is reset every 28 days, which means you will lose any data you have entered after this period.

Before you start this assessment, if you have already accessed the Demo Company, please reset it by clicking the ‘Reset’ link on the ‘My Xero’ Home Page. Then, ensure you complete all assessment requirements before the Demo Company resets in 28 days.

Your employer has decided to switch from the current payroll provider to Xero Payroll. You have been assigned to oversee the transition, and all relevant information for each employee is provided on the following pages.

You will need to set up Xero Payroll and then add each employee. Once all details have been entered, process the first pay in Xero for the week ending last Friday, and submit the payslips for each employee for marking.

Navigate to Payroll tab> Payroll settings and make the following changes:

Organisation

Pay Frequencies (New staff are all paid weekly on a Wednesday.)

Pay Items

Struggling With Your ABKA694 Certificate in Xero Payroll Assessment? Deadlines Are Near?

Hire Assignment Helper Now!Refer to the table on the following pages for the details of the three employees. Navigate to Payroll > Employees > New Employee and add three new employees into Xero Payroll:

1.John Petric

2.Abby Rose

3.Wendy Miller

|

Employee Details Employee #1 Employee #2 Employee #3 Personal Details Tab (or Details) |

|

|||

|

First Name |

John |

Abby |

Wendy |

|

|

Last Name |

Petric |

Rose |

Miller |

|

|

Date of Birth |

12 April 1955 |

4 July 2000 |

2 November |

|

|

Gender |

Male |

Female |

Female |

|

|

Address (click “Enter |

24 Vender |

45 Bypass |

89 Queens |

|

|

address manually” |

Lane |

Drive |

Parade |

|

|

Suburb |

Melbourne |

Melbourne |

Melbourne |

|

|

State |

Victoria |

Victoria |

Victoria |

|

|

Postcode |

1234 |

1234 |

1234 |

|

|

Employment Information Employment) |

||||

|

Employment Type |

Employee |

Employee |

Employee |

|

|

Income Type |

Salary and |

Salary and |

Salary and |

|

|

Employment Basis |

Full-time Employment |

Full-time Employment |

Full-time Employment |

|

|

Start Date |

5/06/2017 |

4/06/2020 |

9/04/2020 |

|

|

Payroll Calendar |

Weekly - |

Weekly - |

Weekly - |

|

|

Ordinary Earnings |

Ordinary |

Ordinary |

Ordinary |

|

|

Authorised to Approve Leave/Timesheets? |

No/No |

No/No |

Yes/Yes |

|

|

Tax Details Tab (or Taxes) Tax File Number (TFN) 862793498 999999507 999999574 Residency Status Australian Australian Australian Tax Scale Type Regular Regular Regular Tax Offset and Claim the tax- Claim the tax- Claim the tax- Variations free threshold, free threshold, free threshold, eligible for eligible for eligible for |

||||

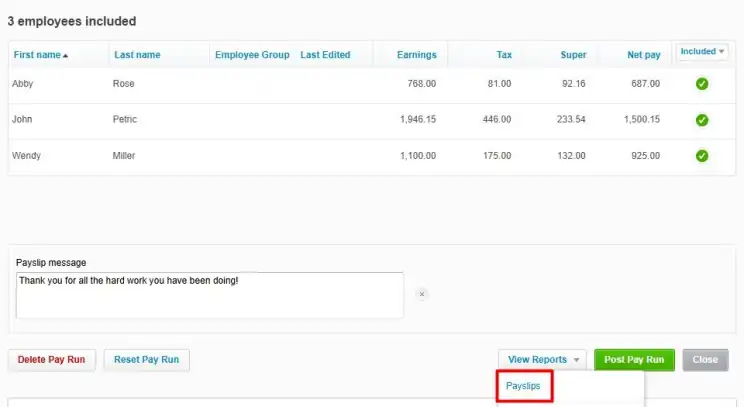

Now that the employees are set up, process the first Weekly – Wednesday pay run for these employees. Navigate to Payroll > Pay employees and + Add Pay Run

Don’t post the pay run. Navigate to View Reports, then Payslips.

Submit the PDF file containing the payslips for the three employees for grading.

Get Answer of ABKA694 Certificate in Xero Payroll Assessment before Deadline

Pay & Buy Non Plagiarized AssignmentLooking for assignment help in New Zealand for your ABKA694 Certificate in Xero Payroll Assignment at The Career Academy? We provide expert guidance to help you excel in your assignments and exams. Our team of experts delivers 100% plagiarism-free, AI-free, and high-quality solutions tailored to your academic needs. Improve your grades and secure your academic future with our reliable services. Contact us today for exceptional service!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content