| Category | Coursework | Subject | Finance |

|---|---|---|---|

| University | University of Huddersfield | Module Title | BMA0092: Quantitative Financial Analysis |

| Word Count | 2500 Words |

|---|---|

| Assessment Type | Individual Assignment (Report) |

| Assessment Title | Coursework |

| Academic Year | 2025-26 |

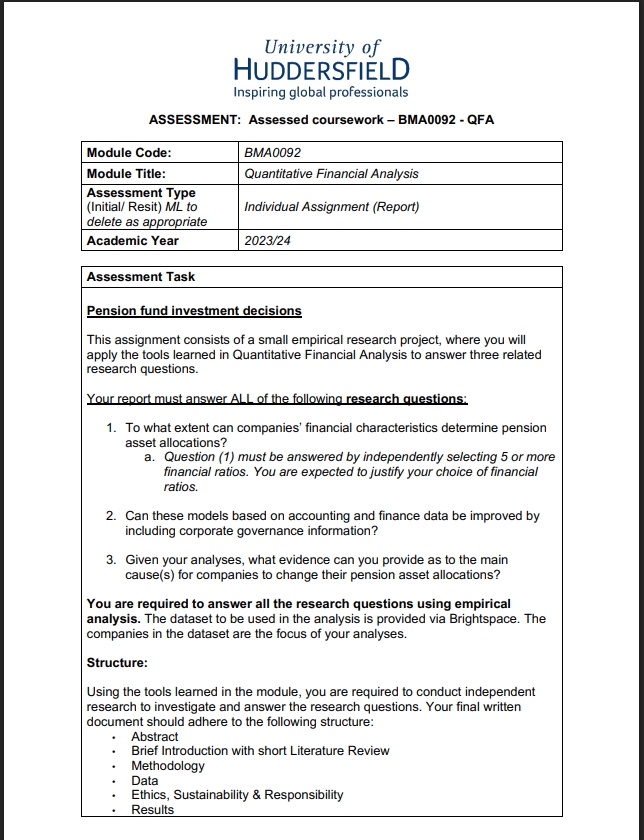

Pension fund investment decisions

This assignment consists of a small empirical research project, where you will apply the tools learned in Quantitative Financial Analysis to answer three related research questions.

Your report must answer ALL of the following research questions:

1. To what extent can companies’ financial characteristics determine pension asset allocations?

a. Question (1) must be answered by independently selecting 5 or more financial ratios. You are expected to justify your choice of financial ratios.

2. Can these models based on accounting and finance data be improved by including corporate governance information?

3. Given your analyses, what evidence can you provide as to the main cause(s) for companies to change their pension asset allocations?

You are required to answer all the research questions using empirical analysis. The dataset to be used in the analysis is provided via Brightspace. The companies in the dataset are the focus of your analyses.

Structure:

Using the tools learned in the module, you are required to conduct independent research to investigate and answer the research questions. Your final written document should adhere to the following structure:

• Abstract

• Brief Introduction with short Literature Review

• Methodology

• Data

• Ethics, Sustainability & Responsibility

• Results

• Conclusion

• References

• Appendices

The report has a similar structure to a research paper. The recommended reading provides a guide of what should be included in each section of the report.

• The Assessment Criteria are shown at the end of this document. Your tutor will discuss how your work will be assessed/marked and will explain how the assessment criteria apply to this piece of work. These criteria have been designed for your level of study.

• These criteria will be used to mark your work and will be used to support the electronic feedback you receive on your marked assignment. Before submission, check that you have tried to meet the requirements of the higher-grade bands to the best of your ability. Please note that the marking process involves academic judgement and interpretation within the marking criteria.

• The Learning Innovation Development Centre can help you to understand and use the assessment criteria. To book an appointment, either visit them on The Street in the Charles Sikes Building or email them at busstudenthub@hud.ac.uk

This section is for information only.

The assessment task outlined above has been designed to address specific validated learning outcomes for this module. It is useful to keep in mind that these are the things you need to show in this piece of work.

On completion of this module, students will need to demonstrate: Learning Outcomes

1. Demonstrate a critical understanding of econometric techniques that can be applied to cross-section, time series and panel data.

2. Critically apply econometric techniques to analyse financial data.

Ability Outcomes

1. Justify the selection of quantitative techniques in financial research.

2. Communicate quantitative data appropriately in writing using academic conventions.

3. Able to utilise the relevant quantitative analysis software.

These criteria are intended to help you understand how your work will be assessed. They describe different levels of performance of a given criteria.

Criteria are not weighted equally, and the marking process involves academic judgement and interpretation within the marking criteria.

The grades between Pass and Merit should be considered as different levels of performance within the normal bounds of the module. The higher-level categories allow for students who, in addition to fulfilling the basic requirement, perform at a superior level beyond the normal boundaries of the module and demonstrate intellectual creativity, originality and innovation.

|

|

Unacceptable |

Unsatisfactory |

Pass |

Merit |

Distinction |

||||

|

0 – 9 |

10-19 |

20-34 |

35-49 |

50-59 |

60-69 |

70-79 |

80-89 |

90-100 |

|

|

Fulfilment of relevant learning outcomes |

Not met or minimal |

Not met or minimal |

Not met or partially met |

Not met or partially met |

Pass |

Pass |

Pass |

Pass |

Pass |

|

Response to the question /task |

No response |

Little response |

Insufficient response |

Adequate response, but with limitations |

Adequate response |

Secure response to assessment task |

Very good response to topic; elements of sophistication |

Clear command of assessment task; sophisticated approach |

Full command of assessment task; imaginative approach demonstrating flair and creativity |

|

|

Unacceptable A superficial answer with only peripheral knowledge of core material and very little critical ability |

Unsatisfactory Some knowledge of core material but limited. |

Pass A coherent and logical answer which shows understanding of the basic principles |

Merit A coherent answer that demonstrate s critical evaluation |

Distinction An exceptional answer that reflects outstanding knowledge of material and critical ability |

||||

|

|

0-9 |

10-19 |

20-34 |

35-49 |

50-59 |

60-69 |

70-79 |

80-89 |

90-100 |

|

Conceptual |

Entirely lacking |

Typically, only |

Knowledge of |

Marginally |

A systematic |

Approachin |

Excellent. |

Insightful. |

Striking and |

|

and critical |

in evidence of |

able to deal |

concepts falls |

insufficient. |

understanding |

g excellence |

Displays (for |

Displays (for |

insightful. |

|

understanding |

knowledge and |

with |

short of |

Adequate |

of knowledge; |

in some |

example): |

example): |

Displays (for |

|

of |

understanding |

terminology, |

prescribed |

knowledge of |

critical |

areas with |

high levels of |

excellent |

example): |

|

contemporary |

|

basic facts |

range |

concepts within |

awareness of |

evidence of |

accuracy; |

research |

publishable |

|

/ seminal |

|

and concepts |

Typically only |

prescribed |

current |

the potential |

evidence of |

potential; |

quality; |

|

knowledge in |

|

|

able to deal |

range but fails |

problems |

to undertake |

the potential |

flexibility of |

outstanding |

|

the subject |

|

|

with |

to adequately |

and/or new |

Research. |

to undertake |

thought; |

research |

|

|

|

|

terminology, |

solve problems |

insights; can |

Well- |

research; the |

possibly of |

potential; |

|

|

|

|

basic facts |

posed by |

evaluate |

developed |

ability to |

publishable |

originality and |

|

|

|

|

and concepts |

assessment |

critically |

relevant |

analyse |

quality. |

independent |

|

|

|

|

|

|

current |

argument, |

primary |

|

thought; |

|

|

|

|

|

|

research and |

good |

sources |

|

ability to |

|

|

|

|

|

|

can evaluate |

degree of |

critically. |

|

make |

|

|

|

|

|

|

methodologies |

accuracy |

|

|

informed |

|

|

|

|

|

|

|

and |

|

|

judgements. |

|

|

|

|

|

|

|

technical |

|

|

|

|

|

|

|

|

|

|

competence |

|

|

|

|

Presentation |

Length |

Length |

Length |

Length |

Length |

Good |

Very good |

Professional |

Highest |

|

|

requirements |

requirements |

requirements |

requirement met |

requirement |

standard of |

standards of |

standards of |

professional |

|

|

may not be |

may not be |

may not be |

and academic |

met and |

presentation |

presentation |

presentation |

standards of |

|

|

observed; does |

observed; |

observed; |

conventions |

academic |

; length |

|

|

presentation |

|

|

not follow |

does not |

does not |

mostly followed. |

conventions |

requirement |

|

|

|

|

|

academic |

follow |

follow |

Minor errors in |

mostly |

met, and |

|

|

|

|

|

conventions; |

academic |

academic |

language |

followed. |

academic |

|

|

|

|

|

language |

conventions; |

conventions; |

|

Possibly very |

conventions |

|

|

|

|

|

errors impact |

language |

language |

|

minor errors in |

followed |

|

|

|

|

|

on intelligibility |

errors impact |

errors impact |

|

language |

|

|

|

|

|

|

|

on |

on |

|

|

|

|

|

|

|

|

|

intelligibility |

intelligibility |

|

|

|

|

|

|

|

Understanding |

Limited insight into the problem or topic |

Limited insight into the problem or topic |

Limited insight into the problem or topic |

Some insight into the problem or topic |

Practical understanding of how established techniques of research and enquiry are used to create and interpret knowledge in the discipline |

Independent , critical evaluation of full range of theories with some evidence of originality |

Authoritative, full understanding of all the issues with originality in analysis |

Authoritative, full understanding of all the issues with originality in analysis |

Authoritative, full understanding of all the issues with originality in analysis |

|

Use of evidence and sources to support task |

Some irrelevant and/or out of date Sources |

Some irrelevant and/or out of date Sources |

Some irrelevant and/or out of date Sources |

Limited sources |

Comprehensiv e understanding of techniques applicable to own research or advanced scholarship |

Complex work and concepts presented, key texts used effectively |

Full range of sources used selectively to support argument |

Full range of sources used selectively to support argument |

Full range of sources used selectively to support argument |

|

Development of ideas |

Argument not developed and may be confused and incoherent |

Argument not developed and may be confused and incoherent |

Argument not developed and may be confused and incoherent |

Argument not fully developed and may lack structure |

The argument is developed but may lack fluency |

Argument concise and explicit |

Coherent and compelling argument well presented |

Coherent and compelling argument well presented |

Coherent and compelling argument well presented |

|

Depth of Reflection |

Response demonstrates a lack of reflection on, or personalization of, the theories, concepts, and/or strategies presented in the course materials to date. Viewpoints and interpretations are missing, inappropriate, and/or unsupported. Examples, when |

Response demonstrates a lack of reflection on, or personalizatio n of, the theories, concepts, and/or strategies presented in the course materials to date. Viewpoints and interpretations are missing, inappropriate, and/or |

Response demonstrates a lack of reflection on, or personalizatio n of, the theories, concepts, and/or strategies presented in the course materials to date. Viewpoints and interpretations are missing, inappropriate, and/or |

Response demonstrates a minimal reflection on, and personalization of, the theories, concepts, and/or strategies presented in the course materials to date. Viewpoints and interpretations are unsupported or supported with flawed arguments. Examples, |

Response demonstrates reflection on, and personalizatio n of, the theories, concepts, and/or strategies presented in the course materials to date. Viewpoints and interpretations are generally supported. Some relevant examples, |

Response demonstrate s a general reflection on, and personalizat ion of, the theories, concepts, and/or strategies presented in the course materials to date. Viewpoints and interpretatio ns are supported. Appropriate |

In-depth reflection on, and personalizatio n of, the theories, concepts, and/or strategies presented.

Extensive evidence of analysis through questioning and challenging of assumptions leading to transformatio |

In-depth reflection on, and personalizatio n of, the theories, concepts, and/or strategies presented.

Extensive evidence of analysis through questioning and challenging of assumptions leading to transformatio |

In-depth reflection on, and personalizatio n of, the theories, concepts, and/or strategies presented.

Extensive evidence of analysis through questioning and challenging of assumptions leading to transformatio |

|

|

applicable, are not provided. |

unsupported. Examples, when applicable, are not provided. |

unsupported. Examples, when applicable, are not provided. |

when applicable, are not provided or are irrelevant to the assignment. |

when applicable, are provided. |

examples are provided, as applicable |

n of personal insight. Some evidence of reflexivity and self- development.

Well supported by clear, detailed examples as applicable. |

n of personal insight. Evidence of reflexivity and self- development.

Well supported by clear, detailed examples as applicable. |

n of personal insight. Substantial evidence of reflexivity and self- development.

Well supported by clear, detailed examples as applicable. |

Do You Need BMA0092 Assignment of This Question

Order Non-Plagiarized AssignmentHave you been finding it tough to complete the BMA0092 course, Quantitative Financial Analysis? With us, expert guidance and quality solutions for finance assignment help. We provide online assignment help to students in the UK in risk analysis, financial modelling, statistical methods, and market trends. Free samples are also available from us. Get in touch with us right now to boost your grades!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content