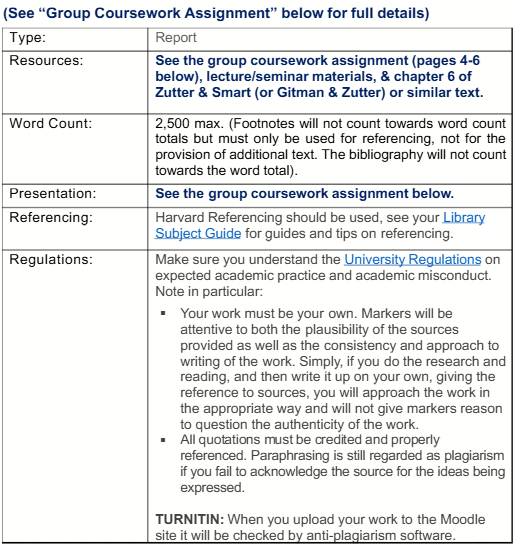

| Category | Assignment | Subject | Finance |

|---|---|---|---|

| University | London South Bank University (LSBU) | Module Title | AFE-5-FDW Finance in a Digital World |

| Word Count | 2500 Words |

|---|---|

| Assessment Type | Report |

| Assessment Title | Group Coursework |

A report showing knowledge and understanding of fundamental concepts in financial asset valuation, demonstrating relevant professional skills in analysing and presenting financial information using basic business software such as Microsoft Word and Excel. The assignment will require students to access relevant information sources, including websites dedicated to providing current or historical financial data. Group work required for the assignment develops teamwork skills - survey reports indicate that employers consider teamwork to be the most important skill that graduate job applicants should possess.

The following are the learning outcomes for this module - the relevant learning outcomes assessed by this assignment are highlighted in green:

The following standard LSBU UG marking criteria will be relevant in the marking of this assignment:

➤Subject Knowledge - understanding and application of subject knowledge; contribution to subject debate.

➤ Critical Analysis: Analysis and interpretation of sources, literature and/or

results.

➤ Practical Competence: Skills to apply theory to practice or to test theory.

► Communication and presentation: Clear intention in communication; audience needs are predicted and met; presentation format is used skilfully; work is well structured.

➤ Academic integrity: Acknowledges and gives credit to the work of others; follows the conventions and practices of the discipline, including appropriate use of referencing standards.

▸ Collaborative working: Demonstration of behaviour appropriate to the discipline, including individual contribution to the team or working with others in

teams.

➤ Data literacy: Competence in working ethically with data, including data access, data extraction, interpretation and representation.

The deadline for submission of this coursework is Friday, 24th March 2023.

This assignment is meant to be done in groups. Please note the following important information:

➤ The coursework relates to the first four weeks of lessons and is meant to be started after students have completed the week 4 topic (Bond Valuation). But meanwhile it is important for the coursework groups to be set up.

‣ Students are required to form their own groups and advise the module leader the names of the group members by 6th February 2023 - the module leader will create the different coursework groups on the module Moodle site, which will also have a forum for intra-group discussion between each group's members (visible only to the members of that group, and to the module teaching team).

➤ To best achieve one of the key learning outcomes of this course (development of team-working skills), each group should ideally have at least 3 and no more than 5 members. Exceptionally 6 members may be permitted, but this is not recommended. Group members can be drawn from any seminar or course, not necessarily from the same seminar group or from the same course.

➤ Students who choose not to join or form groups on their own and are happy to work in a group with random members, must give their names to the module leader by 10th February. These students - and any others who have not yet formed or joined any groups - will be randomly put into groups by the module leader. They will need to complete the coursework by working as a team with the other assigned members of the group.

➤ Students who do not participate in the work of a group should not expect the members of that group to include their name in the group submission - in which case they will not be eligible to share the coursework mark with those members of the group who do participate, and they will have to complete and submit the coursework on their own. Any student whose name is not included in the submission of their group will be deemed to have not submitted the coursework.

The 'Estimate of individual contribution to group report' form (attached) is only required IF the group members have agreed to share the mark for the report unequally - in which case it must be individually signed in confirmation by ALL the group members and a photocopy of the signed form submitted with the report. This form is meant to determine each student's share of the group mark (which is allowed to vary within specified limits) - when the form is not submitted, it will be assumed that the group members have agreed to share the report mark equally.

Bob Hite is looking to invest some of his savings. A friend has advised him that the current shape of the yield curve suggests it would be advisable to invest in bonds rather than shares. Bob has decided to follow this advice and is trying to decide between a 3-year investment in Vodafone bonds, a 7-year investment in Tesco bonds and a 14-year investment in Aviva bonds. Based on the risk of these companies and the maturities of the debt, Bob's adviser has estimated the relevant opportunity cost of each of these instruments as:

➤ Vodafone three-year debt: 3%

➤ Tesco seven-year debt: 4%

➤ Aviva's fourteen-year debt: 6%

If Bob purchases any of these bonds, the purchase date would be 1 March 2023.

Bob does not understand what a yield curve means and has asked his friend to show him how it is constructed, what it means, and what determines its shape.

A. Go to the website of the London Stock Exchange

Search for each of the above companies in turn and find relevant information on the following securities issued by them:

Vodafone 5.625% bonds maturing 4 December 2025

➤ Tesco 6% bonds maturing 14 December 2029

➤ Aviva 6.125% bonds maturing 14 November 2036

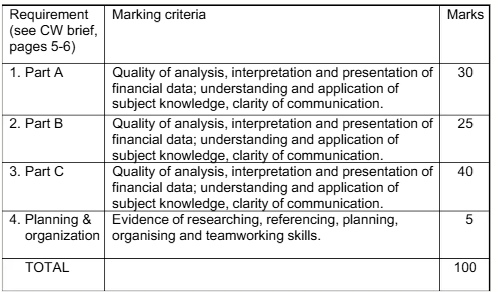

Based on Bob's estimated opportunity cost for each of the above investments, evaluate which (if any) of these bonds would be a worthwhile investment. Perform this evaluation in two different ways:

(i) First, by valuing each bond based on the relevant opportunity cost.

(ii) Then, by estimating the rate of return (yield to maturity) the bond is offering based on the London Stock Exchange's current offer price. (30 marks)

B. How would the values of these three bonds change if Bob's required rate of return (i.e. his opportunity cost):

(i) Increased by 2 percentage points

(ii) Decreased by 2 percentage points

Explain the implications of your answer, both graphically and in words. (25 marks)

C. Go to the UK Government Bonds Page of the Bloomberg website:

(i) Using the latest information relating to 2-year, 5-year, 10-year and 30-year UK Gilts, construct the Yield Curve of UK Government Bonds on Excel.

(ii) Explain the significance of the yield curve to investors.

(iii) Explain the main theories of the term structure of interest rates. (40 marks)

A total of 95 marks, as indicated above, will be awarded for showing knowledge and understanding of the subject, PLUS relevant professional skills such as expertise in producing and writing reports containing financial analysis, using basic business software such as Word/Excel.

A further 5 marks will be awarded for demonstration of planning & organisational skills - evidence of background reading, following the requirements of the assignment, teamworking (evidenced by minutes of meetings, or screenshots of group conversations, or use of the forum provided on Moodle for intra-group discussion), etc.

Please note the following:

Completed assignments should be submitted at the Coursework Submission point on the module Moodle site.

Demonstration of appropriate Excel skills is expected, so feel free to upload Excel file(s) in addition to the main report on Word.

The main report must be word-processed and word-counted, and the number of words clearly indicated on the cover sheet.

The maximum permissible word limit is 2,500 - reports that exceed this limit will be penalised. (Undershooting by 10-15% is acceptable, as concise and pithy reports can often be excellent; what is more important than the sheer number of words is the quality and clarity of understanding that is demonstrated.)

Since the coursework groups will be set up on Moodle it is not necessary for each group member to separately submit the assignment - it is enough if any one member of the group uploads the finished work (however, the person submitting should please make sure that it is the correct final version, and that the other group members have agreed it may be submitted!)

When you take market information from any website, please reference it suitably, including the date on which you took the information.

Struggle With AFE-5-FDW assignments and feeling stressed?

Order Non-Plagiarized AssignmentAre you having trouble completing your AFE-5-FDW Finance in a Digital World? Our Finance Assignment Help service is the best for you. You can even check our free assignment samples before placing your order. We promise on-time delivery and 24/7 support, no matter your academic needs. From Business Management to technical subjects, we cover it all.

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content