| Category | Assignment | Subject | Accounting |

|---|---|---|---|

| University | Monash University (MU) | Module Title | ACF2100 Financial Accounting |

| Due date: | 10 June (Wednesday) by 4pm |

| Assignment No.: | Individual Assignment 2 |

On 1 July 2017, London Ltd acquired all of the shares off Whale Ltd, oniEn-div. basis, for $2,700,000. At this date, the equity and liability sections off Whale Ltd.'s statement off financial position showed the following balances:

At 1 July 2017, Whale Ltd.'s asserts included $46,000 off recorded goodwill. The dividend payable at acquisition date was sub sequently paid in Auguest 2017.

The inventory on hand in Whale Ltd art 1 July 2017 was sold in November 2017. The plant was estimated to have a further 5-year life with zero residual value. On 1 January 2019, the plant was sold to Bruno Ltd for 5230,000. On 30 June 2018, goodwill was impaired by $4 500. The company applies the partial goodwill method. Tax rate is 30%.

Are You Looking for Answer of ACF2100 Assignment 2

Pay & Buy Non Plagiarized AssignmentDuring the period 1 July 2017 to 30 June 2019, the following intragroup transactions have occurred between London Ltd and Whale Ltd:

(T1) On 1 October 2018, London Lt-td provided a 5500,000 loan to Whale Ltd. The interest rate on this loan is 10% p.a., and interest is paid each year on 30 March. On 30 June 2019, no principal repayments have been made on the loan.

(T2) In April 2018, London Ltd sold inventory to Whale Lttd for 51,300. The inventory had previously cost London Ltd $800. By 30 June 2018, 80% off this invenacrod was sold t-to Scarf Ltd for $1,500. The remainder off the inventory was sold to Fluffy Jacket Ltd in August 2018 for $1,600.

(T3) On 3 June 2019, Whale Ltd sold inventory to London Ltd for $42,000. The transfer price included a mark-up off 20% on cost. On 30 June 2019, one-half off this inventory was still on hand.

(T4) On 1 March 2019, Whale Ltd sold equipment to London Ltd for $55 000, this asset having a carrying amount at the tme of sale of $46,000. Whale Ltd had treated the asset as a depreciable non-current asset, being depreciated at 15% on cost, whereas London Ltd records the equipment as inventory. London Ltd sold this asset to Beanie Ltd on 15 June 2019 for $61,500.

(T5) On 1 January 2018, London Ltd sold machinery to Whale Ltd for $66,000. The machinery had a writen down value at the tme of sale of $45,000. For this type of machinery, both enties charge depreciation at a rate of 20% p.a. straight-line.

Q1 Show the acquisition analysis on 1 July 2017.

Q2 Prepare the BCVR entries on 30 June 2019. If BCVR entries are not necessary for a certain BCVR asset, please indicate it clearly and explain why BCVR entries are not necessary (You need to discuss more than simply saying "as it was sold in the previous year").

Q3 Prepare the pre-acquisition entries on 30 June 2019.

Q4 Prepare the intragroup transaction adjustment entries on 30 June 2019.

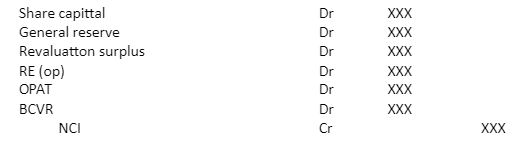

Q5 Now assume that the parent acquired 75% (rather than 100%) of the shares of the subsidiary and paid $2,000,000 (rather than $2,700,000). Solve the following two questons under this new assumpton. a.Provide the acquisiton analysis on 1 July 2017. b.Suppose that the BCVR land is stll on hand of the subsidiary on 30 June 2020.The following NCI journal entries are made for the calculaton of the NCI share of equity on 30 June 2020.The amounts for each account are not provided for the sake of simplicity.

Now, if the BCVR land is sold during the fscal year ended on 30 June 2020 (rather than stll on hand), what changes will need to be made to the NCI journal entries shown above? Explain the changes and provide reasons for them.

Get the Solution of ACF2100 Assignment 2 Hire Experts to solve this assignment Before your Deadline

Order Non Plagiarized AssignmentSeeking help with your ACF2100 Financial Accounting Assignment 2? Now to be stress-free and get Professional Accounting Assignment Help from our expert team. We also provide free assignment samples that have been written by PhD expert writers. We are available 24/7 to assist you. Now, be tension-free and focus on studying and give your assignment to our expert team. We will deliver your assignment before the deadline with well-researched results. Contact us today and boost your academic grades!

If you want to see the related solution of this brief then click here: ACC7043 Assignment Examples

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content