| Category | Assignment | Subject | Accounting |

|---|---|---|---|

| University | Birmingham City University (BCU) | Module Title | ACC7032 Managerial Finance (RE-SIT) |

| Word Count | 2800 words (10% +/-) |

|---|

Learning outcomes and assessment criteria specific to this assignment:

On completion of this assignment, students should be able to demonstrate their ability to:

LO1 - Evaluate the different competing financial objectives of the firm and the agency problem between shareholders and managers in publicly listed companies.

LO2 - Demonstrate the ability to analyse financial data, conduct cost-benefit analysis and financial planning for effective business decisions using spreadsheet software package.

LO3 - Critically evaluate investment projects using appropriate investment appraisal techniques to assess suitability and viability of the projects consistent with the overall strategy and business model(s) of the firm.

LO4 - Critically appraise the major issues of capital management, relative advantages and disadvantages from the various perspectives of the stakeholders of the firm.

This assessment will assist in development of the following transferable skills:

You will be engaging with independent learning throughout the module in organising your own work/learning schedule. For example, seminar prep., watching online lectures and taking notes, completing online tasks, readings and locating external information relating to the course content. In addition, your assessment requires independently researching, presenting and answering questions on Financial Accounting and Management Accounting and producing clear and well informed reports.

You will learn to think critically with the understanding and application of Managerial Finance in order to make effective management decisions. You will also learn how to think about resolutions to some of the issues identified in the module content, and in turn applied within your assessment.

Late submissions are not permissible for re-sit assessments. Therefore, where a student submits a re-sit attempt after the published deadline, the student will be deemed to have failed the re-sit and the coursework will be returned to the student unmarked unless there is a support statement or valid EC claim.

Please contact your seminar tutor for details on re-sit assessment support as soon as you are notified of the requirement to re-sit.

It is important that you complete your assessment, otherwise it is classed as a failed attempt (unless you have made a successful EC claim relating to Extenuating Circumstances).

If you fail any of your modules you will have to re-take it, although there are limits on the number of times that you can re-take and you may even have to re-study a module you have failed. Having to re-sit or re-study modules means that your workload will be increased and you will be putting yourself under more pressure. You may even be liable to incur more fees if you are required to re-study a module.

The university does appreciate that there are times when you may be unable to take an assessment due to circumstances outside your control such as illness. If this is the case you need to make a formal claim for an extension or deferral, as without this you are expected to submit within the standard guidelines.

No tutor, module leader or course leader can grant any form of extension to the published deadlines - this is done by a separate team within the university to ensure consistency and fairness for all. For full guidance on what constitutes an exceptional circumstance and how to make a claim, please visit the Extenuating Circumstances page on iCity; you can also contact the Student Support Team for help.

The assessment consists of 100% Coursework, with a 500 self reflection, explaining why one was not successful in their first attempt..

To pass this module, you must achieve a final overall mark of at least 500%.

The deadline for submissions is: 7th April 2025, 12pm (Midday).

Work must be submitted online via the link provided in the Assessment area of the module’s Moodle site. Please follow the University policy regarding online submission and submitting assessed material on time (see Page 2).

Please retain a copy of your original assessment material for your own records.

The maximum word count for your assignment is 2800 words (10% +/-).

There are three separate questions included within the assignment and you should attempt all three questions. If any part of the assignment is ignored this reduces the maximum marks which could potentially be awarded. The assignment answer should be carefully checked before submission for the use of appropriate and acceptable grammar. The correct use of English spelling is to be employed throughout.

All the numbers should be reported in 2 decimal points.

All three questions must be attempted and submitted in one document. You are advised to prepare your assignment in Word format and copy and paste contents from Excel where spreadsheets have been used to support your work. Only Microsoft Word file will be allowed for submission.

Your student ID number should be shown on each page of your assignment.

Material should be written in formal business English and structured in a clear way to ensure that ideas are expressed effectively.

ALL facts, concepts and quotations should be referenced as appropriate using the Harvard referencing system.

Specific feedback on individual assessments will only be available via scheduled, face-to-face meetings, not via email. To make the most of these sessions, it is expected that you will have already begun work on your assessment and have a list of questions for your tutor prepared in advance.

Detailed feedback will not be possible via email and lecturers can only comment in detail on one draft only. Comments on multiple drafts are not possible as there is a danger your work actually becomes your lecturer’s work. However, if you have any specific queries, or need additional support, you can still book a tutorial at any time up to one week prior to the deadline – tutorials and draft reviews will not be provided in the final week prior to the deadline, so it is important that you start work on your draft early and book a meeting as soon as possible.

Please note that tutors are unable to indicate a provisional grade for your work at any point prior to the official release date. As such, it is requested that you do not ask tutors what grade your work is likely to achieve prior to final submission.

Any work you submit must be your own original work.

Any work that is plagiarised - this means submitting any item of assessment which contains work produced by someone else in a way that makes it look as though it is your own work – will be subject to an academic misconduct review. This includes 'self-plagiarism' - you are not allowed to re-use work or significant sections from work, which you have already submitted for an assessment.

You are also not allowed to collude with others to produce work unless your assessment brief specifically outlines group work. Collusion means working with at least one other person to produce a piece of work that you then pass off as your own. You can discuss ideas for the work with other students, but you must not work with them to produce a piece of work together, you must not copy or share another student's work, and you must not lend your work (including drafts) to another student to allow them to copy your work.

If your piece of work is very similar to that of another student, you are likely to be accused of collusion. If you are found to have made your work available for another student to copy all or part of it, you may be referred for disciplinary action even after you have completed your award and are no longer a student of the University. You must not also falsify information, resources or data in any way.

These, and any other types of academic misconduct that are likely to give you an unfair advantage in an assessment, will be referred for investigation. Academic misconduct threatens the standards of awards we make, so we take this matter extremely seriously indeed and any student found guilty of this will have penalties applied and in the most serious of cases students with be withdrawn from the course.

Stuggling Your ACC7032 Assignment? Deadlines Are Near?

Hire Assignment Helper Now!The scenario

Comfort Group (CG) is a flagship name in UK warehousing and property investment spaces. CG’s warehouses serves most of UK’s supermarkets. CG’s property portfolio includes residential, retail and commercial properties including mixed use establishments and was founded on the principles of fairness, integrity and quality. CG is headed by Rosy Zhang its founder and Chief Executive Officer, a renowned businesswoman. CG also has a homebuilding division targeting affordable housing market.

Owing to various macro-economic factors, the UK homebuilding market has an assortment of challenges: the after effects of the COVID-19 pandemic (Hasek, 2021), shockwaves from the Russia-Ukraine war (Neuman & Hurt, 2023), Brexit (Bill & Frank, 2022) etc and opportunities (Hasek, 2021). These and other issues require CG to adopt to enjoy sustainable competitiveness in the competitive market(s) it operates. To achieve this, CG’s Strategic Business Committee resolved to acquire a good fit and are seeking integration with existing brands either in the UK supermarket or UK property development & homebuilding industry. The Strategic Business Committee believes this acquisition will place CG in better stead for strategic competitiveness.

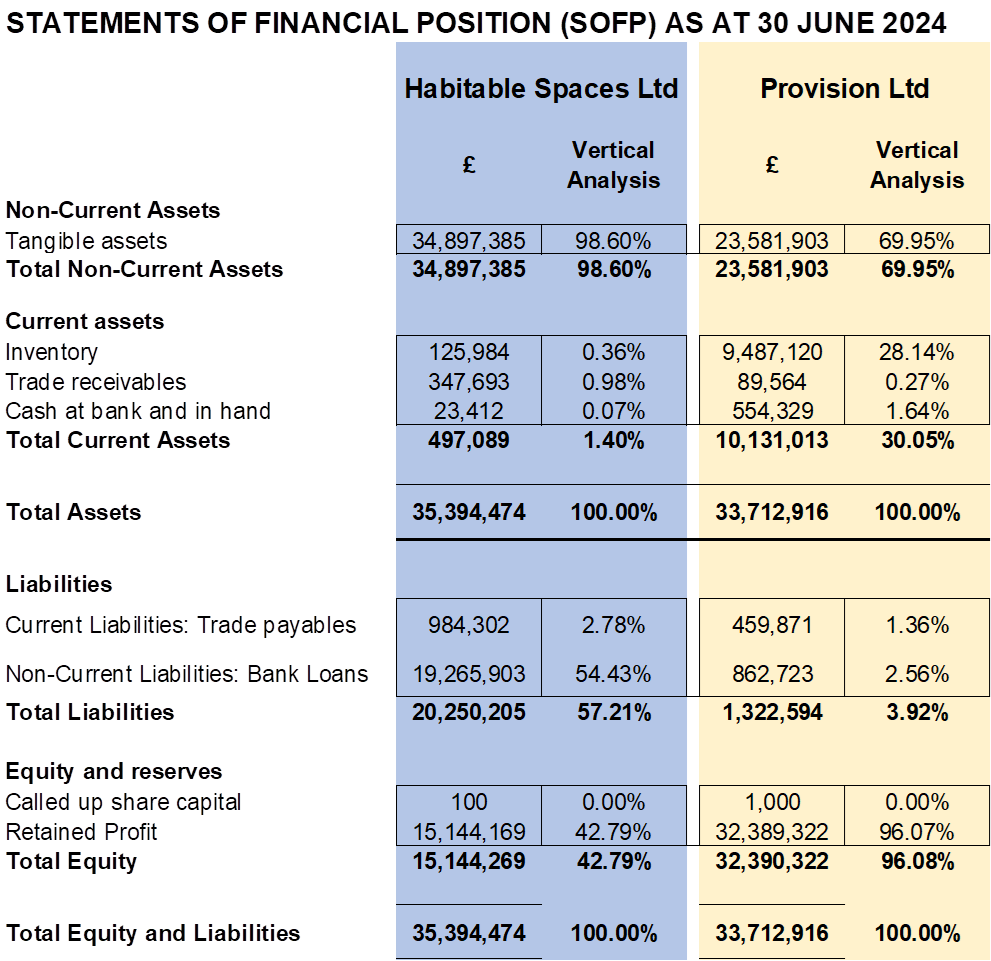

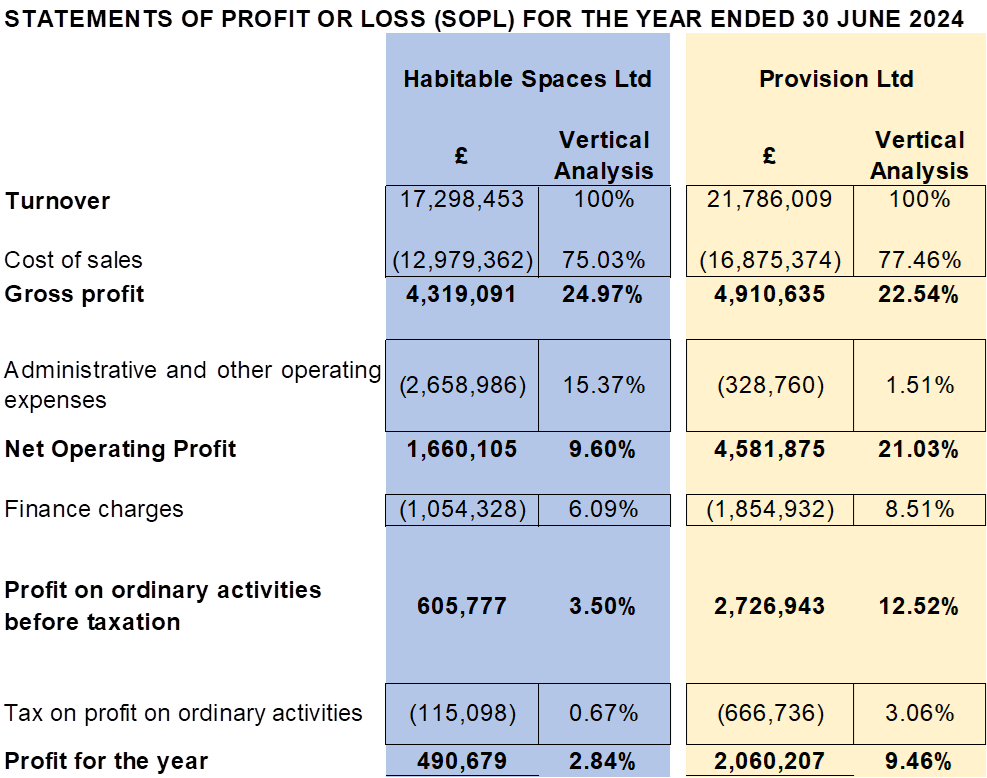

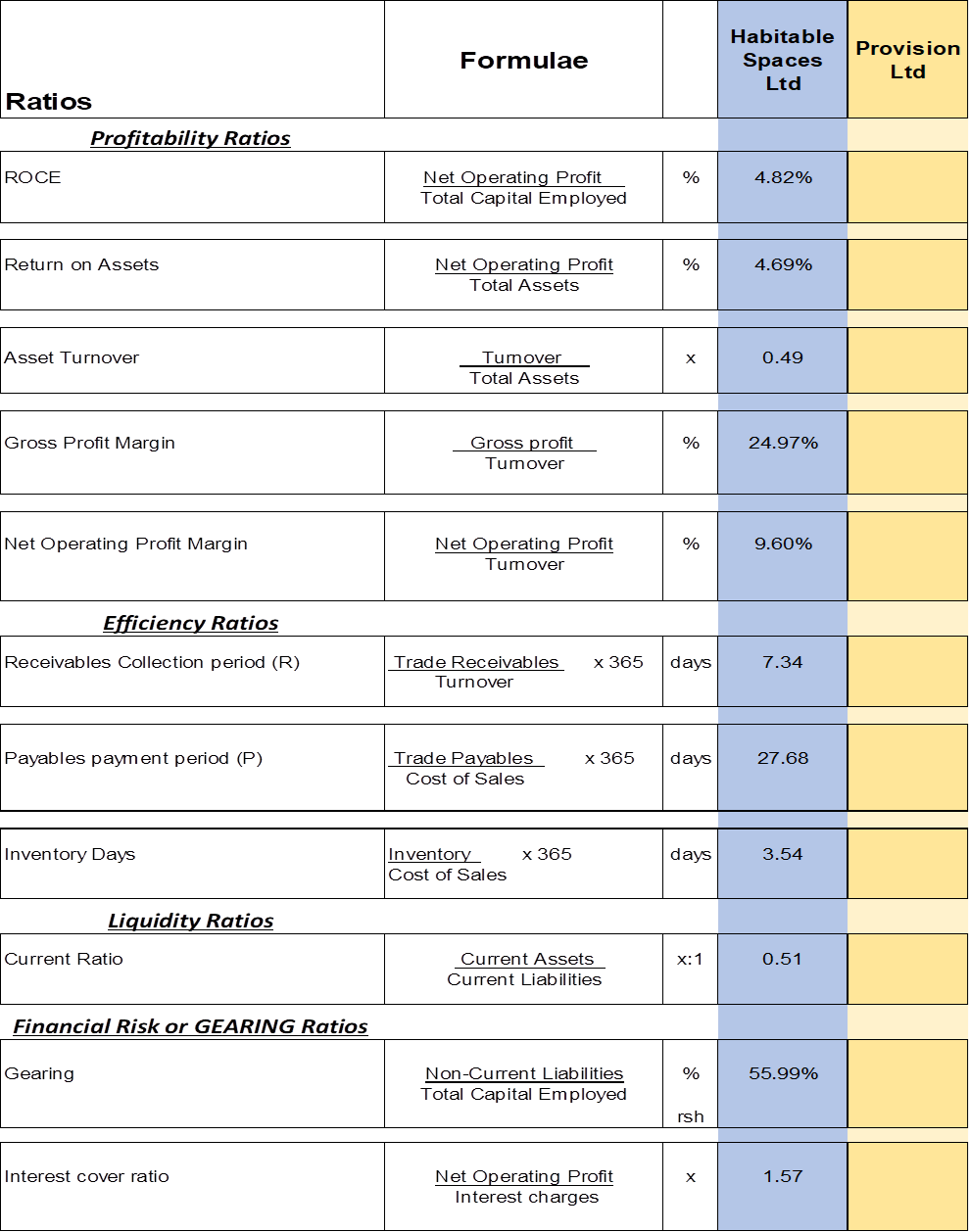

The Strategic Business Committee has identified two possible acquisition targets and would want you to perform some ratio analysis, evaluate the findings and advise the committee on which one they should acquire and why.

The target companies are below:

Habitable Spaces Ltd: A force in the property development and homebuilding industry. Habitable Spaces competes against Barrat Developments, Taylor Wimpey, Persimmon, Bellway and Vistry Group to name but a few. It is listed on UK’s London stock exchange with huge capital raising capacity. A myriad of challenges and opportunities characterise the building industry including labour shortages (Hasek, 2021).

Provision Ltd: A no frills supermarket chain with roots in Germany but operates in major markets including USA and UK. Provision Ltd’s journey in the UK began with a single store four decades ago and now has a strong supply chain focusing on low cost, quality products. The layout in its supermarkets resembles simplicity and convenience and fosters numerous cost-saving initiatives in all it does including product displays, shop size and the checkout process. Over the past decades of serving the UK, Provision Ltd has and is still gaining market share. It overtook a number of traditional supermarkets.

The ratio analysis below is in 4 categories (Profitability, Liquidity, Management Efficiency, a

1.1. You are required to calculate ratios for Provision Ltd.

1.2. Prepare a business report (using a proper report format) to Comfort Group’s Strategic Business Committee based on ratio analysis and relevant qualitative issues to be considered.

You are required to critically evaluate the financial statements, making a convincing argument for investment in one of the two target companies. Please consider qualitative factors in your critical evaluation.

You are also required to critically evaluate the working capital management (WCM) of both companies and draw conclusions on which is stronger. In conjunction with quantitative measures, provide some qualitative aspects (for example: Industry related characteristics) for a more comprehensive understanding of working capital management of the companies.

Financing decision is an important one for Comfort Group’s strategic Business Committee when considering the acquisition of either Habitable Spaces Ltd or Provision Ltd.

Identify and critically evaluate three sources of finance that Comfort Group’s Strategic Business Committee should consider in the acquisition process of either Habitable Spaces Ltd or Provision Ltd.

You should recommend one or two of the sources you deem best suited. Your explanation of possible sources of funding must be accompanied by a critical, well-reasoned, well-referenced conclusion and recommendation(s).

1.3. Your analysis, conclusions and recommendations should be supported by credible academic references (in Harvard Referencing format per Birmingham City University policy) using proper academic/ business English presented using an appropriate business format.

You are a Junior Management Accountant at Horizon Holdings Plc. The Finance Director wants your calculations and recommendations regarding an expansion plan being considered by the Board is considering, which includes a chain of factory outlet stores.

Company policy dictates that any decision should be based on the results of calculating Net Present Value (NPV) of 3 years of cash flows using a cost of capital of 11%, Payback Period (PBP) and discounted Payback Periods (DPBP) must be less than 3 years, and the Internal Rate of Return (IRR) of the project should provide a 7% cushion in case of increases in inflation or interest rates.

Below are the figures for the first one that is planned for a central Leeds location next year.

The investment consists of £120,000 for the land, building costs of £201,300, and £96,200 for fittings and equipment.

The new Leeds location will produce products Alpha and Beta once commissioned.

The cash flows in year 1 are expected to be:

total sales revenue £780,530

the cost of Alpha stock sold £256,490

cost of Beta stock sold £127,281

staff costs £102,906

lighting & heating costs £12,486

other overheads £98,562.

All sales are cash sales and Horizon Holdings Plc will pay for all its costs and expenses each year. The cash flow patterns for years 2 and 3 are the same with those in year 1 however, they are expected to increase by 3% inflation each year.

2.1. Using the information above and in accord with the above stated company policy you are required to calculate:a) Net cash flows over the three years of the project

b) Net Present Value (NPV)

c) Payback period (PBP)

d) Discounted Payback Period (DPBP)

2.2. Based on your calculations and other considerations, critically evaluate the proposed investment’s viability and recommend whether Horizon Holdings Plc should proceed with the investment.

2.3. In addition to the investment appraisal techniques calculated in 2.1, recommend two alternative investment appraisal techniques Horizon Holdings Plc could use and justify why you think they are effective.

Flexi Sportswear Ltd manufactures and distributes sportswear & accessories and is a major supplier to Olympics participants.

Below are three of the products Flexi Sportswear produces and are accessing their viability:

1. Golf ball

2. Tennis ball

3. Foot ball

Each ball must pass through a pressure testing machine and there is currently only one testing machine which cannot be replaced. For this reason, Flexi Sportswear Ltd cannot expand its operations unless a costly and time-consuming production process re-engineering project is done. The maximum available testing machine hours for Flexi Sportswear Ltd in 2024 is expected to be 3452 hours due to the ageing state of the testing machine.

Maximum market demand and testing hours requirements for each of these ball for year ending 31 December 2025 are shown below:

Budgeted data year ending 31 December 2025

|

|

Golf ball |

Tennis ball |

Football |

|

Maximum demand |

5,376 |

1,296 |

3,695 |

|

Testing machine hours |

0.3 hours |

0.9 hours |

0.2 hours |

|

Total testing machine hours |

1,613 |

1,166 |

739 |

Flexi Sportswear Ltd uses a pull production system in the quest to eliminate inventory holding costs.

Flexi Sportswear Ltd’s Sales Director, Judy Tyde has reported to the Planning Committee that she has already signed a once off 1,210 Tennis ball contract with Universe Players Club a new club started in 2024. This will be the first order to deliver to Universe Players Club by Flexi Sportswear Ltd. If this contract is not fulfilled, Flexi Sportswear Ltd would incur a financial penalty of £7,840. This order is not included in the Tennis ball maximum market demand figure. This implies Flexi Sportswear Ltd should prioritise fulfilment of the Tennis ball contract ahead of normal annual demand requirements. The agreed contract selling price per Tennis ball is the same as normal Tennis ball.

Flexi Sportswear Ltd’s directors need to know whether they should go ahead and satisfy (honour) the contract and then prioritise production in the normal way or whether they should consider breaching (dishonouring) the Universe Players Club Tennis ball contract.

You have been provided with the following actual results for years ended 31 December 2023 and 31 December 2024 below.

3.1. Considering the scenario above, rank these three sports ball variants (Golf ball, Tennis ball and Football) in the order in which they must be produced by Flexi Sportswear Ltd – Rank 1 being the one to be prioritised. Clearly show your workings.

3.2. Prepare a Budgeted Production Schedule and a Marginal Costing Income Statement (analysed by product) the year ending 31 December 2025 assuming that the Tennis ball contract is honoured. [3 marks for the Production Plan, 5 marks for the Marginal Costing Income Statement]

3.3. Prepare a Budgeted Production Schedule and a Marginal Costing Income Statement (analysed by product) the year ending 31 December 2025 assuming that the Tennis ball contract is not honoured. [3 marks for the Production Plan, 5 marks for the Marginal Costing Income Statement].

3.4. Considering quantitative and qualitative issues, critically evaluate then advise Flexi Sportswear Ltd Directors whether to satisfy (honour) or breach (dishonour) the Tennis ball contract. Also consider other practical options Flexi Sportswear Ltd can consider so that demand is met including implications of such options.

3.5. Discuss and critically examine the usefulness of budgeting to Flexi Sportswear Ltd.

NB: In your analysis, please cite credible sources using Harvard reverencing style per Birmingham City University (BCU) requirements. Support and guidance can be sought from The Centre for Academic Success and the Library).

|

Fail (0%-49%) |

Pass (50%-59%) |

Merit (60%-69%) |

Distinction (70%-100%) |

Marks available |

Marks awarded |

|

0 – 14 marks |

15 – 18 marks |

19 – 21 marks |

21+ marks |

|

|

|

A lack of breadth and depth of financial analysis techniques accompanied by incorrect formulae or calculation without appropriate explanation. |

Evidence of some financial analysis techniques but with errors of formulae and calculation with insufficient explanation and adequate presentation.

|

Wide range of financial analysis techniques evident and supported by full disclosure of formulae and accurate calculation in a clear format.

|

An excellent range of financial analysis techniques which are supported by full disclosure of formulae and accurate calculation in a clear format. |

30 |

|

|

0 – 29 marks |

30 – 35 marks |

36 – 41 marks |

42+ marks |

|

|

|

No evidence of research and application into industry benchmarks. |

Limited evidence of research and application into industry benchmarks.

|

Good evidence of research and application into industry benchmarks.

|

Very good evidence of research and application into industry benchmarks. |

60 |

|

|

0 – 4 marks |

5 marks |

6 marks |

7+ marks |

|

|

|

Poor layout or presentation in anything other than business report style. Inadequate grammar and lacking in overall knowledgeable synthesis. |

Attempt at a business report format with some supportive appendices. Mainly descriptive with some attempt at synthesis. Grammar and structure being adequate. |

Presented in business report format and coherently structured. Supported by referenced appendices. Effective and well-reasoned narrative discussion. |

Excellent business report format and well structured. Supported by fully referenced appendices. Excellent analytical and justified explanations showing synthesis and application. |

10 |

|

|

Total |

100 |

|

|||

|

Weighting |

40% |

40% |

|||

|

Total for question 1 |

40% |

|

|||

|

Fail (0%-49%) |

Pass (50%-59%) |

Merit (60%-69%) |

Distinction (70%-100%) |

Marks available |

Marks awarded |

|

2.1 Investment appraisal calculations |

|

||||

|

Marks available for each calculation as indicated |

40 |

|

|||

|

0 – 14 marks |

15 – 17 marks |

18 – 20 marks |

21+ marks |

|

|

|

Unable to make any recommendations based on the data calculated or Only able to comment on the outcome of the calculations

|

Only basic recommendations are made |

Good recommendations made which are based on some relevant academic literature

|

Full and clear recommendations made which are based on relevant and current academic literature

|

30 |

|

|

0 – 14 marks |

15 – 17 marks |

18 – 20 marks |

21+ marks |

|

|

|

Able to provide basic definitions of alternative investment appraisal techniques without any substantiated justification

|

Identified relevant alternatives, basic discussion provided without reference to academic literature to support points raised |

Identified relevant alternatives, good discussion of the justification for their use |

Clear critical justification of alternative investment appraisal techniques provided, including reference to academic literature

|

30 |

|

|

Total |

100 |

|

|||

|

Weighting |

30% |

30% |

|||

|

Total for question 2 |

30% |

|

|||

|

Fail (0%-49%) |

Pass (50%-59%) |

Merit (60%-69%) |

Distinction (70%-100%) |

Marks available |

Marks awarded |

|

0 – 19 marks |

20 – 23 marks |

24 – 27 marks |

28+ marks |

|

|

|

3.1 Product ranking |

|

||||

|

Marks available for each calculation as indicated |

15 |

|

|||

|

3.2 Production budget with contract |

|

||||

|

Marks available for each calculation as indicated |

25 |

|

|||

|

3.3 Production budget without contract |

|

||||

|

Marks available for each calculation as indicated |

20 |

|

|||

|

3.4 Discussion of advice |

|

||||

|

A lack of understanding of the topic and the related literature. Limited or no narrative discussion or recommendations and conclusions. Poor academic writing and referencing.

|

Ability to research and apply theory to a reasonable degree. Demonstrates the ability to critically evaluate and make the appropriate conclusions. Reasonable attempt at analysis and discussion of findings, though of limited depth. |

A good understanding of the topic. Demonstrates a good understanding of the principles and techniques involved. Good analysis and discussion with good use of academic references which support clear and well explained conclusions. |

Excellent understanding of the topic. Thorough and detailed critical discussion with excellent use of a range of academic references which support clear, practical, and well explained recommendations and conclusions. |

20 |

|

|

3.5 Discussion of usefulness of budgets |

|

||||

|

A lack of understanding of the topic and the related literature. Limited or no narrative discussion or recommendations and conclusions. Poor academic writing and referencing.

|

Ability to research and apply theory to a reasonable degree. Demonstrates the ability to critically evaluate and make the appropriate conclusions. Reasonable attempt at analysis and discussion of findings, though of limited depth. |

A good understanding of the topic. Demonstrates a good understanding of the principles and techniques involved. Good analysis and discussion with good use of academic references which support clear and well explained conclusions. |

Excellent understanding of the topic. Thorough and detailed critical discussion with excellent use of a range of academic references which support clear, practical, and well explained recommendations and conclusions. |

20 |

|

|

Total |

100 |

|

|||

|

Weighting |

30% |

30% |

|||

|

Total for question 2 |

30% |

|

|||

Buy Answer of ACC7032 Assignment & Raise Your Grades

Pay & Buy Non Plagiarized AssignmentAre you facing trouble in working on your ACC7032 Managerial Finance Assignment? Our online assignment help Services is always there to provide excellent support to UK students on every step of the coursework. If you're struggling with financial analysis, budgeting, or decision-making models, we are serving human-made, well-structured and well-researched Accounting Assignment Help In UK. Looking for guidance? You can get Birmingham City University Assignment Samples for your guidance to understand complex topics and improve your understanding of finance management. Let our professionals help you complete your assignments on time and achieve the best possible grades.

Let's Book Your Work with Our Expert and Get High-Quality Content