| Category | Assignment | Subject | Accounting |

|---|---|---|---|

| University | Monash University (MU) | Module Title | ACC2100 Financial Accounting |

| Due Date: | 14 May 2025 by 11.55 pm | Semester: | Semester 1 |

| Word Limit: | 1,800 words | Assessment: | Individual Assignment Report to a Potential Investor |

On May 16, 2024, the Australian Securities & Investments Commission (ASIC) Commissioner Kate O'Rourke highlighted in her Financial Reporting and Audit Surveillance Speech that impairment of assets, especially goodwill impairment, is a top area for ASIC surveillance of financial report (see more details by accessing the Speech using this link). Impairment of assets has been a contentious issue for some time. This was previously highlighted by ASIC in their reviews of financial reports and by audit firms (e.g., BDO Australia) as well.

A potential investor has been reviewing the annual reports for the year ending 2020 and 2021 of ASX listed companies and identified a list of companies that recorded a goodwill (the list of companies is provided with this document on Moodle). The investor is particularly interested in the year 2020 and 2021 because stock markets were significantly affected by COVID-19 around that time. The investor is perplexed that some companies (from the company list he accumulated) recorded a goodwill impairment (GI > 0) while other companies did not impair their assets (GI = 0). To understand managers' choice of goodwill impairment, the investor browsed through the disclosures relating to goodwill and impairment of assets for two companies, one with GI > 0 and the other with GI = 0. This further confused the investor as he/she is unable to understand why both companies did not impair their goodwill.

Are You Looking for Answer of ACC2100 Assignment

Order Non Plagiarized AssignmentThe potential investor was browsing through the consolidated financial statement of a listed company (fictitious name: Parent Ltd) and was unable to understand certain reported amounts.

The investor approached the Chief Financial Officer of Parent Ltd who has provided them the following information and selected consolidation worksheet entries at 30 June 2021. However, the investor is unable to understand the consolidation worksheet entries for the intragroup transactions and has approached you for consultation. Brief information about Parent Ltd and its subsidiary (Son Ltd) is provided below.

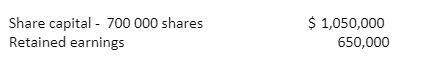

On 1 July 2019, Parent Ltd acquired all the shares of Son Ltd, on a cum-div. basis, for $1,100,000. At this date, the equity of Son Ltd consisted of:

Son Ltd also reported a dividend payable of $100,000 and a recorded goodwill of $150,000 at the acquisition date. The dividend payable was subsequently paid in September 2019.

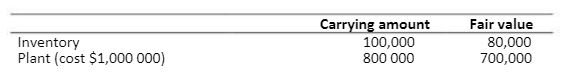

At the acquisition date, all the identifiable assets and liabilities of Son Ltd were recorded at amounts equal to fair value except for the following:

Of the inventory on hand in Son Ltd at 1 July 2019, 60 percent was sold in December 2019 and the remainder was sold in August 2020. The remaining useful life of the plant at the date of acquisition was 5 years.

The plant on hand at the acquisition date was sold on 1 January 2021 for $500,000.

The company applies the partial goodwill method. The income tax rate is 30%.

During the period 1 July 2019 to 30 June 2021, the following intragroup transactions have occurred between Parent Ltd and Son Ltd:

(T1) On 1 January 2020, Parent Ltd acquired furniture for $200,000 from Son Ltd. The furniture had originally cost Son Ltd $200,000 and had a carrying amount at the time of sale of $160,000. The sale was made on credit. At 30 June 2020, $120,000 was outstanding. At 30 June 2021, $40,000 was still not paid and outstanding. Both entities apply depreciation on a straight-line basis. At 1 January 2020, the furniture had a further five years of useful life, with zero residual value.

(T2) On 1 March 2020, Son Ltd sold inventory costing $120,000 to Parent Ltd for $100,000. On 1 October 2020, Parent Ltd sold half of these inventory items back to Son Ltd for $60,000. Of the remaining inventory kept by Parent Ltd, half was sold in March 2021 to Dingo Ltd at a profit of $10,000.

Buy Answer of ACC2100 Assignment & Raise Your Grades

Order Non Plagiarized AssignmentLooking for help with your ACC2100 Financial Accounting Assignment then be stress free now and get professional Accounting Assignment Help from our expert team. We also provide free assignment samples written by PhD expert writers. We are available 24/7 to assist you. Now, be stress free and focus on studying and give your assignment to our expert team. We will deliver your assignment with well-researched results before the deadline. Contact us today and increase your academic grades!

See the solution related of Accounting click here: AC4006T Assignment Examples

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content