| Category | Assignment | Subject | Finance |

|---|---|---|---|

| University | University of Sunderland | Module Title | UGB394 International Financial Reporting |

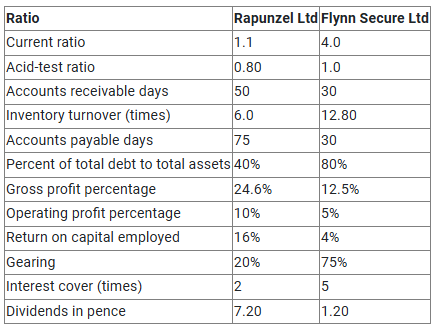

Tangled Plc. is a wholesale distributor of advanced security solutions for large industrial complexes. The company is considering expanding its business and comparing two potential opportunities for investment in either Rapunzel Ltd or Flynn Secure Ltd. You as Finance Director of Tangled Plc. have asked your assistant to prepare a report that summarises the financial aspects of the two potential investees for the last year. Your assistant has presented several financial ratios that can assist in the identification and interpretation of trends for each. The following ratios have been calculated for the year ended 31st December 2024 for each company:

Required:

Prepare a PowerPoint presentation to the Board of Directors of Tangled Plc. that analyses the performance of Rapunzel Ltd and Flynn Secure Ltd and provides recommendations for which of the two investment options offers a better opportunity. Your presentation should include comments on:

Your presentation must be NO MORE than 12 content slides with 2 additional slides: one for welcome and one for any additional questions. Each slide must be copied into Microsoft Word and your verbal presentation you would make must be written In Microsoft Word after each slide. Please note that you will NOT be asked to present the presentation slides, however, you MUST show your speech in your Microsoft Word answer after each slide only. (Word Count 1,800)

Do You Need UGB394 Assignment of This Question

Order Non Plagiarized AssignmentIn your answer, you should:

Question Background:

Week 6 & 7 (Lecture) and Week 6 & 7 (Seminar), Ratios and Interpretation of Accounts, UGB394 International Financial Reporting Canvas 2024/5. University of Sunderland. Mourik/Kirwan, A. (2023) International Financial Reporting and Analysis. Chapters 27 & 28. 9th edition. Cengage Learning.

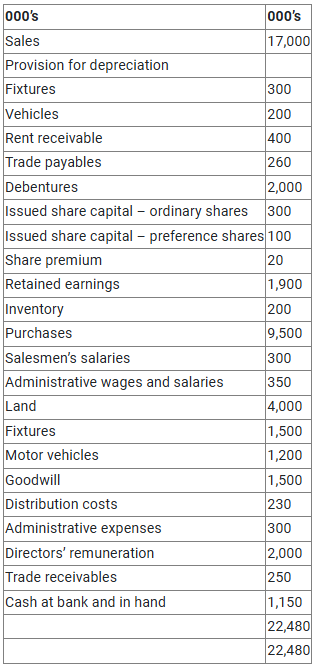

Quantum Systems Ltd. is the European distributor of specialised AI-powered medical diagnostic equipment. The Finance Director has asked you to prepare accounts for the year ended 30 April 2025, ready for publication on Monday. You have obtained the following trial balance from the computerised accounts:

Note all figures are in 000’s.

The following information was not taken into the trial balance data:

For information:

There were no new vehicles were bought during the year. One vehicle costing £10,000 and with depreciation to date of £5,000 was sold. This transaction was completed and is in the above figures. There were no other disposals.

Buy Answer of This UGB394 Assignment & Raise Your Grades

Request to Buy AnswerRequired:

Produce for publication:

In your answer you should:

Question Background:

Week 1-3 (Lecture) and Week 1-3 (Seminar), Financial Statements Presentation, UGB394 International Financial Reporting Canvas 2024/5. University of Sunderland. Week 5 – 10 (Lecture) and Week 5 – 10 (Seminar), Non-Current Assets, Intangible Assets, Inventories & Provisions, Contingent Assets & Liabilities UGB394 International Financial Reporting Canvas 2024/5. University of Sunderland. Mourik/Kirwan, A. (2023) International Financial Reporting and Analysis, 9th edition. Cengage Learning:

This question is in 2 parts A) and B) and all must be answered to gain full marks. After graduating, you secure a position at a small accounting firm. A key part of your role involves guiding customers through less common issues, and helping them make informed decisions when they are unsure of how to proceed. Over the past week, you received the following calls from clients seeking your expertise and advice.

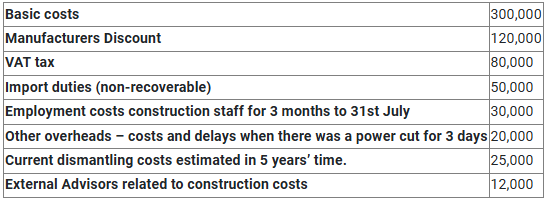

A) Your biggest client, who is VAT registered, has decided to expand their operations and has bought a new state-of-the-art machine for improved productivity on its production line. The machine started production on 1st July. You have identified costs as follows:

You will need to write a report (approx. 750 words) to the client stating in each line:

B) Espresso Plc was incorporated in 1998 in Singapore and has grown into a national brand in the coffee roasting business. They now have several large contracts with globally recognised hotel and leisure businesses. This growth has however been at reduced margins to enable successful bids for the contacts. Espresso Plc has been researching a new technique to cut down the time for producing their main product, the “Golden Tropic Roast.” They have sent the following to you via e mail.

Dear Accountant

We are looking to gain advice in the strictest of confidence. As you know we have been developing a new technique for roasting of beans. This has been under research now for 3 years and all costs during the first 2 years as per your advice were written off.

However, this year we have spent a considerable amount of additional funds and we need to know if again this cost must be written off. We are concerned that this will result in a loss in our Statement of Profit or Loss and may send the wrong signals to our shareholder and potential investors.

We estimate that the new technique will take 2 more years to develop but to date we feel that we can continue on with the project and that we will be successful in the endeavour. It has been estimated that the process will increase output of beans by 25% and that there will be no increase in other costs for the process except for needing increased amounts of beans for the increased productivity.

Development work has commenced and we are committed that this will continue so long as the project looks viable. There are no definite certain outcomes as yet but independent experts are hopeful for success of this project. The investment this year was £2,800 000. It is estimated we will need another £1,000,000 to continue the development and bring this to a market. We intend to use the system exclusively and start operating the new process as soon as possible.

If you require further information, please contact me.

Mr Mocha

Espresso Plc has requested guidance on whether their recent development costs should be capitalized or expensed under IAS 38. Write a concise email (maximum 450 words) to Mr. Mocha, explaining the key criteria for capitalization under IAS 38. Use the information provided to assess whether the £2,800,000 investment should be treated as an expense or capitalized. Your response should be clear, professional, and well-structured.

Please reference your written answers.

Are You Looking for an Answer of This UGB394 Assignment

Buy Non Plagiarized AssignmentIn your answer you should:

A) Report on machine purchase:

B) Intangible Assets:

Please reference your written answers.

Question Background:

Week 5 – 7 (Lecture) and Week 5 – 7 (Seminar), Non-Current Assets, Intangible Assets, UGB394 International Financial Reporting Canvas 2024/5. University of Sunderland. Mourik/Kirwan, A. (2023) International Financial Reporting and Analysis. Chapter 9 & 10. 9th edition. Cengage Learning.

Are you worried about your UGB394 International Financial Reporting? If yes, you have come to the right place. Workingment assignment help in the UK is here to provide the best finance assignment help from UK-based writers. We have a team of professionals who can provide the best coursework help, and in this team, we have writers, proofreaders and editors who have a deep knowledge of the subject and have provided 100% unique and AI-free work for years. Here, we also provide a report-writing service.

If you want to see the related solution of this brief then click here:-International Financial

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content