| Category | Assignment | Subject | Statistics |

|---|---|---|---|

| University | Stockholm University | Module Title | SPSS-Assignment 1-case of Cyprus |

The firm-specific characteristics impact firms’ performance under COVID-19 Regression coefficients

As the table 1, the firm-specific characteristics impact firms’ performance under COVID-19 positively are gender of a top manager, own website, an auditor and sales costs; conversely, the rest of those characteristics have a negative impact.

Table 1: Coefficient

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

|

|

B |

Std. Error |

Beta |

|||

|

(Constant) |

83.724 |

404.73 |

|

0.207 |

0.837 |

|

sector |

-2.68 |

10.475 |

-0.039 |

-0.256 |

0.799 |

|

size |

-0.001 |

0.063 |

-0.002 |

-0.023 |

0.982 |

|

multiindustry |

-2.574 |

9.373 |

-0.027 |

-0.275 |

0.784 |

|

legalstatus |

-0.486 |

4.225 |

-0.012 |

-0.115 |

0.909 |

|

boarddirectors |

-6.074 |

7.422 |

-0.089 |

-0.818 |

0.415 |

|

yearestablishment |

-0.059 |

0.205 |

-0.029 |

-0.288 |

0.774 |

|

gendermanager |

5.681 |

12.647 |

0.044 |

0.449 |

0.654 |

|

qualitycertificate |

-3.169 |

7.707 |

-0.045 |

-0.411 |

0.682 |

|

ownwebsite |

2.933 |

7.746 |

0.037 |

0.379 |

0.706 |

|

auditor |

2.526 |

7.402 |

0.034 |

0.341 |

0.734 |

|

profitability |

5.567 |

14.78 |

0.053 |

0.377 |

0.707 |

|

environment |

-4.713 |

10.221 |

-0.05 |

-0.461 |

0.646 |

|

energyconsumption |

-1.787 |

7.306 |

-0.026 |

-0.245 |

0.807 |

|

receivedsupport |

-11.716 |

6.85 |

-0.167 |

-1.71 |

0.09 |

As the “Sig” stands for significance level or the p-value (according to the table 1), we can find that the value of those predictors is more than 5 % (0.05); this implies that they are not statistically significant, thus we fail to reject the null hypothesis while declining the alternative hypothesis. That is, there is no strong evidence to prove that those independent variables have a relationship with the change in sales.

However, a statistically significant outcome cannot prove that this is 100% certainly correct. As a result of the failure of declining the null hypothesis, maybe it is because of type II error—failing to reject the null hypothesis when we do not know whether the null hypothesis is true, and we probably make wrong decision (Penn State Eberly College of Science, n.d.). I assume that the model is not statistically significant because of too fewer number of sample size comparing with the number of predictors. As it is difficult to specify a rule of thumb for number of the observation. Some sources presents that it is probably 15-20 samples per predictor.

Table 2: Model Summaryb

R Square = 0.051 ( if 1 or 100% mean that the data fit linear regression)

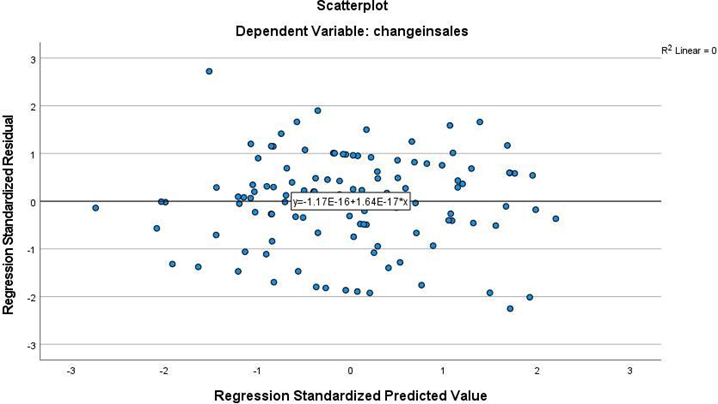

Due to only 5% of R2, this implies that the data does not fit the linear regression well, and there is no linear relationship as shown on the scatterplot; therefore, there is no enough evidence of the strength of the relationship between the model and the dependent variable (the change of sales).

Adjusted R2 is a measurement of a corrected good fit for linear regression. The adjusted R2 is a modified value of R2. Normally the R2 value will increase when adding another independent variable in the model regardless of the corrected goodness-of-fit after adding the new predictor parameter. On the contrary, the adjusted R2 value will even decrease if the additional predictor is less important or unnecessary in the model, but it will increase if the additional predictor fit the model. (Corporate Finance Institute, n.d.).

In this case, R2 is equal to 0.051 while the adjusted R2 is -0.074 which is 0.125 in difference. From these values, we cannot apparently see and compare between variation of models unless we need to investigate further.

However, as the analysis of p-value together with the R Square and the adjusted R2, I would conclude that we may not be able to reject the null hypothesis because they are not statistically significant; there is inadequate evidence to prove that those predictors have impact on the sales or the firm’s performance as the statistical p-value is less than 5% and the discrepancy between the R2 and the adjusted R2. The result may be caused by the inappropriate sample size and the number of independent variables of the model.

Looking for online assignment help by UK writers? Our expert team is here to assist you with your SPSS assignment help and much more. Whether you need someone to do my assignment for me or are looking for free assignment samples to guide you, we’ve got you covered. We understand the challenges of completing tasks like the SPSS assignment 1-case of Cyprus, and our experienced writers provide comprehensive, 100% plagiarism-free content tailored to your needs. With years of expertise in this field, we offer unlimited assignment help to UK students, ensuring you get top-quality work every time. Don’t worry about academic stress; let our writers help you succeed!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content

dfs

dfs