| Category |

Assignment |

Subject |

Finance |

| University |

- |

Module Title |

FIN702 Corporate Financial Management |

Questions

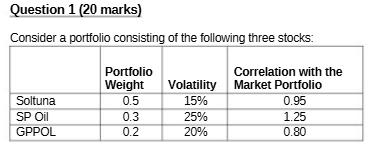

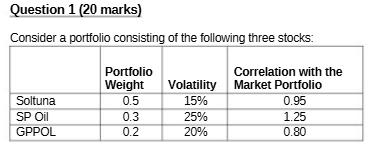

The volatility of the market portfolio is 22%, and it has an expected return of 14%. The risk-free rate is 8%.

- Compute the beta and expected return of each stock. (6 marks)

- Using your answer from part a, calculate the expected return of the portfolio. (6 marks)

- What is the beta of the portfolio? (4 marks)

- Using your answer from part c, calculate the expected return of the portfolio. (4 marks)

Question 2 (20 Marks)

Your company operates a steel plant. On average, revenues from the plant are $300 million per year. All of the plant's costs are variable costs and are consistently 80% of revenues, including energy costs associated with powering the plant, which represent one quarter of the plant's costs, or an average of $60 million per year. Suppose the plant has an asset beta of 1.25, the risk-free rate is 4%, and the market risk premium is 5%. The tax rate is 40%, and there are no other costs.

- Estimate the value of the plant today, assuming no growth. (6 marks)

- Suppose you enter a long-term contract that will supply all of the plant's energy needs for a fixed cost of $30 million per year (before tax). What is the value of the plant if you take this contract? (8 marks)

- How would taking the contract in (b) change the plant's cost of capital? Explain. (6 marks)

Question 3 (20 marks)

The information below pertains to Hollyford Corporation:

- Hollyford Corporation expects to have earnings this coming year of $50 per share. Hollyford plans to retain all of its earnings for the next two years.

- For the subsequent two years, the firm will retain 50% of its earnings. It will then retain 20% of its earnings from that point onward.

- Each year, retained earnings will be invested in new projects with an expected return of 25% per year. Any earnings that are not retained will be paid out as dividends.

- Assume Hollyford's share count remains constant and all earnings growth comes from the investment of retained earnings. If Hollyford's equity cost of capital is 10%, what price would you estimate for Hollyford stock?

Question 4 (20 marks)

In the recent annual general meeting of Umi Technology Limited, the board of directors declared an annual dividend of $20 per share, and the shareholders agreed to a rights issue of shares in order to raise funds to expand the business to the provinces.

Required:

- Some shareholders expect the dividend rate of $20 per share to decline at a rate of 2.5% in the next three years and thereafter grow at a constant rate of 15% indefinitely as the business expands to and establishes itself in all provinces. Suppose these shareholders hold a required rate of return of 20%. What is the expected price per share? (10 marks)

- Some shareholders hold the belief that for the business to expand, it must return 60% of its annual earnings and reinvest the retained earnings to earn a 25% rate of return. If they demand a required rate of return of 20%, what is the expected price per share? (7 marks)

- The Board of directors expect a required rate of return of 10% and no decline or growth in the dividend per share. What is the expected price per share? (3 marks)

Question 5 (20 marks)

The SIG recently issued a 5-year bond with a face value of $150 million at an annual coupon rate of 10% p.a. in order to borrow funds to pay the promised economic stimulus assistance to local farmers. The bond is currently selling for $145 million.

- What will be the price of the bond if the market interest rate changes to 12% p.a? What is the effect on the investor? (6 marks)

- What will be the price of the bond if the market interest rate changes to 10% p.a? What is the effect on the investor? (6 marks)

- What will be the price of the bond if the market interest rate changes to 17% p.a? What is the effect on the investor? (6 marks)

- Explain the relative price movements in response to interest rate changes. (2 marks)

Question 6

They have received two bids:

- The first bid, Satsol, will require a $120 million upfront investment and will generate $100 million in savings for Telekom each year for the next five years.

- The second bid, from Solfish, requires a $200 million upfront investment and will generate $150 million in savings each year for the next five years.

a. What is the IRR for Telekom associated with each bid? (6 marks)

b. If the cost of capital for this investment is 10%, what is the NPV for Telekom of each bid? (6 marks)

Suppose Solfish modifies its bid by offering a lease contract instead. Under the terms of the lease, Telekom will pay $50 million upfront and $40 million per year for the next five years. Telekom's savings will be the same as with Solfish's original bid.

c. Including its savings, what are Telekom's net cash flows under the lease contract? What is the IRR of the Solfish bid now? (5 marks)

d. Is this new bid a better deal for Telekom than Solfish's original bid? Explain.(3 marks)

Question 7 (30 Marks)

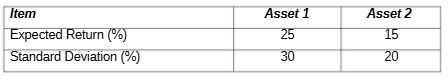

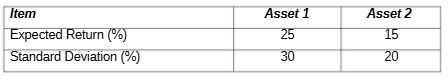

Kerry is considering investing his funds in two assets. His assessment of each investment is as shown in the table below: (30 Marks)

Required:

- If the correlation coefficient is +1.0, and Kerry decides to put 70% of his funds in Asset 1, what are the expected return and the standard deviation of return of Kerry's Portfolio? Is Kerry better or worse off as a result of investing in two assets (Asset 1 and Asset 2) rather than just in one asset? (7 marks)

- If the correlation coefficient is +1.0, and Kerry decides to put 30% of his funds in Asset 1, what are the expected return and the standard deviation of return of Kerry's Portfolio? Is Kerry better or worse off as a result of investing in two assets (Asset 1 and Asset 2) rather than just in one asset? (7 marks)

- If the correlation coefficient is 0.0, and Kerry decides to put 50% of his funds in Asset 1, what are the expected return and the standard deviation of return of Kerry's Portfolio? Is Kerry better or worse off as a result of investing in two assets (Asset 1 and Asset 2) rather than just in one asset? (7 marks)

- If the correlation coefficient is -1.0, and Kerry decides to put 70% of his funds in Asset 1, what is the standard deviation of return of Kerry's Portfolio? Is Kerry better or worse off if he splits his funds in this way? (4.5 marks)

- If the correlation coefficient is -1.0, and Kerry decides to put 30% of his funds in Asset 1, what is the standard deviation of return of Kerry's Portfolio? Is Kerry better or worse off if he splits his funds in this way? (4.5 marks)