| Category | Assignment | Subject | Finance |

|---|---|---|---|

| University | Universiti Teknologi MARA (UiTM) | Module Title | FIN435 Financial Market and Banking Services |

Struggle with assignments and feeling stressed

Order Non-Plagiarised Assignmenti. Calculate the amount payable in MYR if the company does not hedge and pays at the future spot rate of 5.15. (2 marks)

ii. If the company enters a forward contract at 5.10, how much will it save or lose compared to paying at the future spot rate? (3 marks)

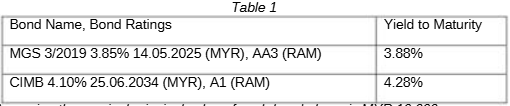

Assuming the nominal principal value of each bond above is MYR 10,000.

i. Based on Table 2, determine each bond's yearly coupon rate, coupon payment, maturity date, type of issuer, and currency used for issuance. (5 marks)

ii. Briefly describe the meaning of the above rating given for each bond. Which bond is more stable in fulfilling its debt obligations? Justify your selection. (5 marks)

8 An investor buys a call option on ABC stock with an exercise price of RM 5.55. The option premium is RM 0.30, and the stock price at expiration is RM 5.70.

Looking for expert guidance in FIN435 Financial Market and Banking Services? Worry, no need! We are here to help you with assignments. Whether you need finance assignment help or well-structured solutions, we will provide everything. You will get free assignment examples that will make your study material stronger. our expert team are providing all assignment services, you will get accurate, clear, and original content. Now stop worrying about marks and complete your assignments hassle-free with expert support. So what's the delay? Get connected with us now and make your academic journey easy!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content