| Category | Assignment | Subject | Economics |

|---|---|---|---|

| University | The University of Western Australia (uwa) | Module Title | ECON3300 Agricultural Economics & Marketing |

Assume you are a wheat producer in Western Australia with a crop to be harvested in November. Today is May 3, 2025 and the January 2026 Eastern Australia Wheat (WM) futures contract is trading at 6365/ton on the ASX You expect to sell 6000 tons of wheat, and the size of each futures contract is 20 tons. The forecasted basis for late January 2026 is S45/ton.

What is your expected forward price?

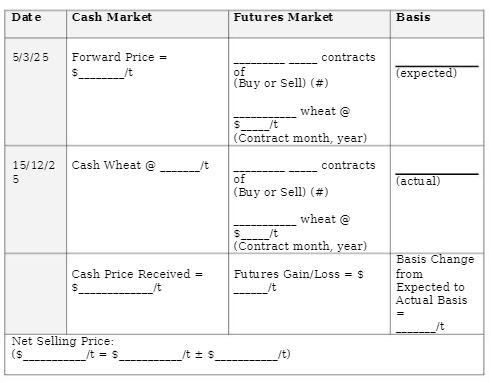

Assume the hedge is lifted (offset) on SJanuary 2026, when the January Eastern Australia Wheat (WM) futures contract is trading at 5340/ton, and the actual basis is S5/ton weaker than expected (under). The brokerage fee is S5 per contract per transaction (equivalent to S0.25 per ton per transaction).

Complete the T-Bar Diagram to compute the Actual Sale Price:

![]()

c)Did the actual sale price equal the expected sale price? Explain why or why not.

Are You Looking for Answer of ECON3300 Assignment 1

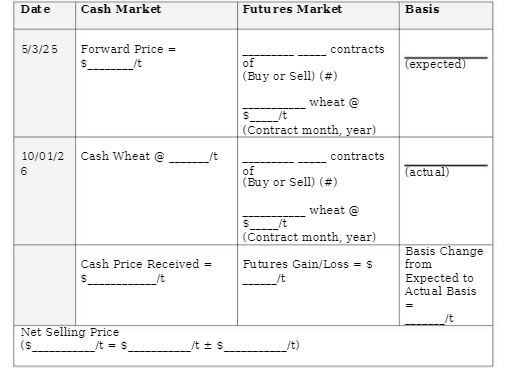

Order Non Plagiarized AssignmentAssume the hedge is lifted (offset) on 15 December 2025, instead of 5 January 2026, when the cash market price for wheat in Geraldton is $470/tonand the actual basis is $20/tonstronger than expected. The brokerage fee is still $5 per contract per transaction (equivalent to $0.25 per ton per transaction).

Complete the T-Bar Diagram to compute the Actual Sale Price:

c) Did the actual sale price equal the expected sale price? Explain why or why not.

Assume the hedge is lifted (offset) on 10 January 2026, instead of 5 January 2026, when the January Eastern Australia Wheat (WK) futures contract is trading at $320/ton, and the actual basis is $15/tonstronger than expected. The brokerage fee is still $5 per contract per transaction (equivalent to $0.25 per ton per transaction).

Complete the T-Bar Diagram to compute the Actual Sale Price:

c) Did the actual sale price equal the expected sale price? Explain why or why not.

Buy Answer of ECON3300 Assignment 1& Raise Your Grades

Request To By AnswerConsider the case of a Flour Milling Company (FMCO) in Western Australia, that is planning to purchase wheat in December 2025 to meet production targets. Today is 3/3/2023 and the January 2026 Eastern Australia Wheat futures contract is trading at 5370 per metric ton. The expected basis is S 10 per metric ton and the brokerage fee is S0.25 per metric ton per transaction.

Use the attached futures and options data from ASX to answer the following questions. Assume the historical expected basis is $30 under per tonand the brokerage fee is $0.25 per metric ton per transaction.

4.1 A short hedger

4.2 A wheat processor in Western Australia (a hedger) purchases a call option with a strike price of $500.

Achieve Higher Grades ECON3300 Assignment 1 Solutions

Order Non Plagiarized AssignmentDo you need ECON3300 Agricultural Economics & Marketing Assignment 2 at The University of Western Australia, look no further! Our economics assignment help is here for you which makes things easy. Now you don't need to worry about your assignment our expert team is providing you all assignment services at an affordable price. Whether you need expert guidance and well researched or free assignment samples we are ready for your need. If you need the best assignment writing help then contact us today and boost your academic grades!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content