| Category | Assignment | Subject | Finance |

|---|---|---|---|

| University | Singapore University of Social Science (SUSS) | Module Title | BPM303 Project Development and Finance |

This assignment is worth 10% of the final mark for BPM303 Project Development and Finance.

The cut-off date for this assignment is 21 September 2025, 2355 hrs.

S’pore, Malaysia sign agreement on Johor-S’pore Special Economic Zone; 20,000 jobs to be created

The Straits Times dated 8 January 2025.

A U.S. private real estate fund is keen to invest in this newly set up economic zone in Johor Baru, Malaysia. They have engaged your consultancy firm to carry out a feasibility study to support an Industrial real estate’s investment in this zone.

Your feasibility report must include the following analyses to support their investment:

A Design Brief is created to outline the developer’s requirements and define the objectives of a project. However, it is not a fixed document and may evolve over time as the project progresses.

Demonstrate your understanding of Design Brief and provide an explanation of the statement above.

Do You Need BPM303 TMA01 Assignment Of This Question

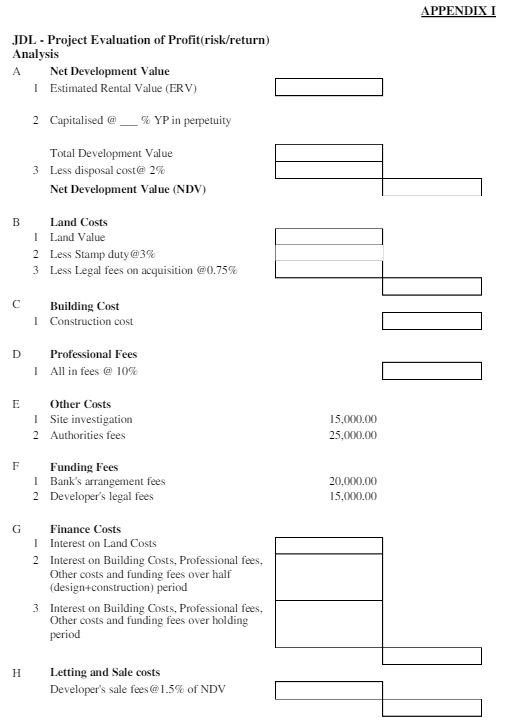

Order Non Plagiarized AssignmentJC Development Ltd is exploring the opportunity to acquire a 50,000 m² industrial site at Kallang Industrial Estate. The land has a plot ratio of 2.5, allowing for the development of a ramp-up, multi-tenanted logistics facility. JC development will use the bank loan to fund the land cost over the whole development period.

Market research forecasts that logistics gross rent and maintenance cost will be S$ 50/m² and S$ 5/ m² per month upon project completion respectively.

The project team has estimated the construction cost for the logistics facility at S$1,300/m², with a net lettable area equivalent to 90% of the GFA. The development timeline for the project includes 3 months for design, 12 months for construction, and a 12-month holding period. A bank has agreed to provide short-term financing at an annual interest rate of 7%.

JC Development Ltd is planning to sell the completed building with tenancy to REIT with a capitalization rate of 6.0%.

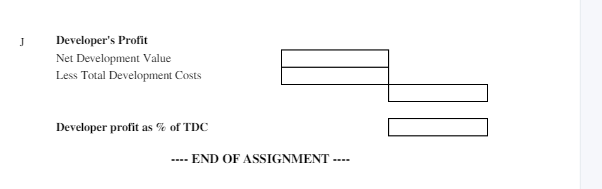

(a) Apply Profit Evaluation Analysis (risk/return) to assess the project's profit margin, considering that the developer is bidding for the land at S$10,000 per square meter of land area

(You are to use Appendix 1 for the computation and submit it together with the assignment.)

(b) Show your understanding of the potential concerns related to the accuracy of profit calculations when using this method and describe any additional sources of income that may not have been considered during the holding period, which could enhance overall profitability.

Buy Custom Answer Of This Assessment & Raise Your Grades

Get A Free QuoteAre you struggling with Singapore Digital BPM303 Project Development and Finance TMA01 Presentation? You are at the right place. Our platform provides the Assignment Help in Singapore. We have talented writers who can provide assignments without any plagiarism and 100% original content. You are confident that our online assignment help will make you productive and help you achieve high grades in your academic year. No doubt about it! We also provide free sample assignments for your guidance. Contact us now.

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content