| Category | Assignment | Subject | Accounting |

|---|---|---|---|

| University | Monash University (MU) | Module Title | ACF2100 Financial Accounting |

| Due Date: | 14 May 2025 by 11.55 pm | Assessment: | Individual Assignment Report to a Potential Investor |

| Words count: | 600 words | Semester: | 1 |

The potential investor was browsing through the consolidated financial statement of a listed company (fictitious name: Parent Ltd) and was unable to understand certain reported amounts. The investor approached the Chief Financial Officer of Parent Ltd who has provided them the following information and selected consolidation worksheet entries at 30 June 2021.

However, the investor is unable to understand the consolidation worksheet entries for the intragroup transactions and has approached you for consultation. Brief information about Parent Ltd and its subsidiary (Son Ltd) is provided below.

On 1 July 2019, Parent Ltd acquired all the shares of Son Ltd, on a cum-div. basis, for $1,100,000. At this date, the equity of Son Ltd consisted of:

![]()

Son Ltd also reported a dividend payable of $100,000 and a recorded goodwill of $150,000 at the acquisition date. The dividend payable was subsequently paid in September 2019.

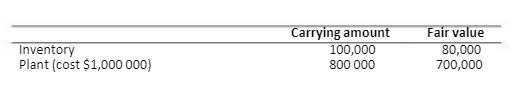

At the acquisition date, all the identifiable assets and liabilities of Son Ltd were recorded at amounts equal to fair value except for the following:

Need Help With ACF2100 Assignment of This Question

Order Non Plagiarized AssignmentOf the inventory on hand in Son Ltd at 1 July 2019, 60 percent was sold in December 2019 and the remainder was sold in August 2020.

The remaining useful life of the plant at the date of acquisition was 5 years. The plant on hand at the acquisition date was sold on 1 January 2021 for $500,000.

The company applies the partial goodwill method. The income tax rate is 30%.

During the period 1 July 2019 to 30 June 2021, the following intragroup transactions have occurred between Parent Ltd and Son Ltd:

(T1) On 1 January 2020, Parent Ltd acquired furniture for $200,000 from Son Ltd. The furniture had originally cost Son Ltd $200,000 and had a carrying amount at the time of sale of $160,000. The sale was made on credit. At 30 June 2020, $120,000 was outstanding. At 30 June 2021, $40,000 was still not paid and outstanding. Both entities apply depreciation on a straight-line basis. At 1 January 2020, the furniture had a further five years of useful life, with zero residual value.

(T2) On 1 March 2020, Son Ltd sold inventory costing $120,000 to Parent Ltd for $100,000. On 1 October 2020, Parent Ltd sold half of these inventory items back to Son Ltd for $60,000. Of the remaining inventory kept by Parent Ltd, half was sold in March 2021 to Dingo Ltd at a profit of $10,000.

Achieve Higher Grades ACF2100 Assignment

Order Non Plagiarized AssignmentIf you are looking for ACF2100 Financial Accounting individual report task 2 assignment solutions? Then don’t worry! Our accounting assignment help service is the best solution for you. Our expert writers provide you high-quality assignment writing services that match your academic standards. If you are looking for the best assignment help, then you can improve your grades with our professional assistance. Also, you can take free assignment samples so that you get an idea of writing the perfect assignment. Contact now for the best material and timely delivery!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content