| Category | Assignment | Subject | Finance |

|---|---|---|---|

| University | Singapore University of Social Science (SUSS) | Module Title | ACC202 Financial and Managerial Accounting |

| Assessment Type | Tutor-Marked Assignment |

|---|---|

| Academic Year | July 2025 |

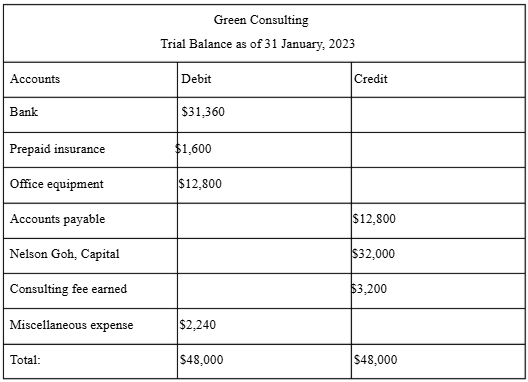

Question 1(a) The trial balance for Green Consulting as at the end of January is as follows

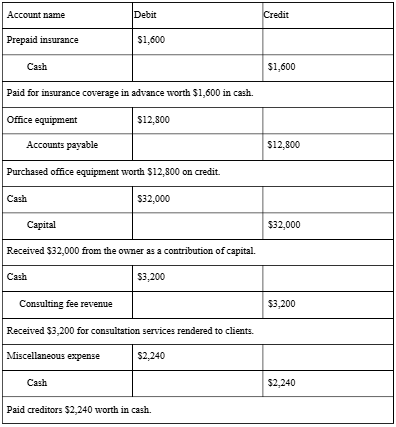

Question 1(b) Based on the individual accounts and their balances, these are the five most likely transactions that occurred in January:

1. The entity purchased insurance coverage costing $1,600 in advance on credit, which is recorded as a prepaid expense until fully utilised.

2. The entity paid $12,800 from its bank account to acquire office equipment essential for business operations, such as computers and printers.

3. Green Consulting received $32,000 from the owner, Nelson Goh as a capital contribution.

4. The entity received $3,200 from clients for the consulting services provided.

5. The entity incurred $2,240 in miscellaneous expenses in relation to the consulting operations.

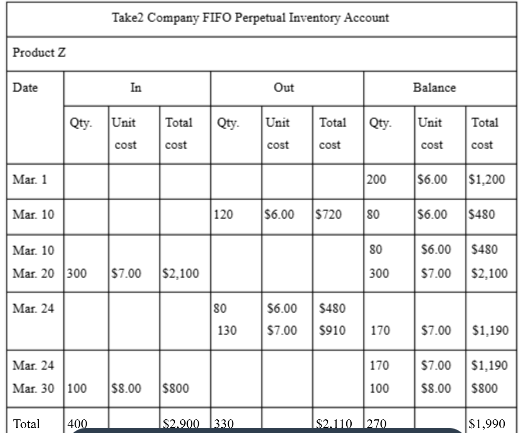

Question 2(a)(i)

Of the 330 units of Product Z sold over two transactions incurred on March 10 and March 24, the first sale on March 10 for 120 units came from the beginning inventory at $6.00. Total cost =120 X $6.00 = $720.

The following sale on March 24 for 210 units came from the balance of 80 units at a $6.00 cost and the earliest purchase on March 20 at $7.00, thus resulting in a balance of 170 units at a $7.00 cost from March 24. Total cost of goods sold = $720 + ((80 X $6.00) + (130 X $7.00))= $2,110.

The ending inventory of 270 units is made up of 170 units from what was left of the March 20purchase after the March 24 sale and 100 units bought at $8.00 per unit on March 30. Total cost of ending inventory = (170 X $7.00) + (100 X $8.00) = $1,990.

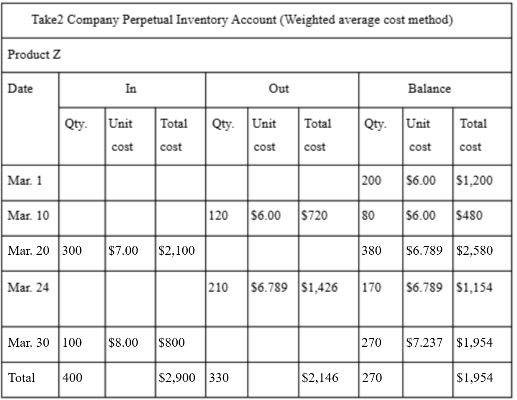

Of the 330 units of Product Z sold over two transactions incurred on March 10 and March 24, the first sale on March 10 for 120 units came from the beginning inventory for $6.00. Total cost = $720.

The following sale on March 24 for 210 units came from the new average unit cost for Product computed with the earliest purchase made on March 20 for 300 units for $7.00, along with the balance of 80 units at a $6.00 cost from March 10. WAC = ($480 + $2,100)/(80 + 300) = $2,580/380 = $6.789 per unit. Total cost of goods sold = $720 + (210 X $6.789) = $2,146.

The ending inventory of 270 units is determined by the new average unit cost of 170 units from what was left of the March 20 purchase after the March 24 sale, and 100 units bought at $8.00 per unit on March 30. WAC = ($1,154 + $800)/(170 + 100) = $1,954/270 = $7.237 per unit. Totalcost of ending inventory = 270 X $7.237 = $1,954.

Question 2(a)(iii) Applying the specific identification method, understanding that the ending inventory consists of 90 units from the March 30 purchase, 100 units from the March 20 purchase, and the remaining 80 units from the beginning inventory, as computed below:

Take2 Company Perpetual Inventory Account (Specific identification method)Product Z

Ending inventory = 270 units

Mar. 20 100 units X $7.00 = $700

Mar. 30 90 units X $8.00 = $720

Balance from beginning inventory = 270 - (100 + 90) = 80 units

Beginning inventory 200 units X $6.00 = $1,200

Mar. 1 80 units X $6.00 = $480

Total cost of goods sold = (300 X $7.00) + (100 X $8.00) = $800 + $2,100 = $2,900

Total cost of ending inventory = $700 + $720 + $480 = $1,900

It reveals that the total cost of goods sold is $2,900, whereas the total cost of ending inventory is $1,900.

Question 2(b) The gross profit percentage is a profitability measure that estimates how much of every dollar of sales remains after deducting the cost of goods sold (Srivastav, A. K., 2022, September 26). Applying the formula accordingly for all three inventory costing:

FIFO method

($1,200 + $2,900) - $1,990 = $2,110.

Weighted average cost method

($1,200 + $2,900) - $1,954 = $2,146.

Specific identification method

($1,200 + $2,900) - $1,900 = $2,200.

In accordance with the findings, Helen ought to employ the specific identification method to achieve a greater bonus as it would grant her the greatest percentage of gross profit, accounting having the lowest cost of goods sold.

Question 3

Question 3(a) The statement of financial position, also referred to as the balance sheet, is an accounting report that adheres primarily to 3 interconnected components of an accounting equation, with assets on one side, and liabilities plus shareholder equity on the other, balancing out: Assets = Liabilities + Equity (Fernando, J. (2023, January 12).

The formula is the foundation of double-entry bookkeeping, which ensures that all financial transactions are properly recorded and that the balance sheet remains in balance further detailing the reason that a business must pay for all its’ assets by either taking on liabilities or issuing shareholder equity at a given moment whilst serving as the foundation for calculating investor return rates and assessing a business's capital structure to further exemplify the components(Fernando, J. (2022, November 3)):

The assets component of the financial position statement supports creditors and investors who are analyzing the financial records in assessing what resources the business owns, controls, or has invested in and how proficient they are in employing them to provide future economic benefits. It aids in financial analysis by evaluating ratios such as the current ratio, which evaluates whether short-term assets are sufficient to meet short-term commitments. Assets are classified as follows:(Tomasetti, B. (n.d.)):

Current assets: These are cash or cash equivalents that will be transformed into physical currency within a year, such as accounts receivable, inventory, and prepaid expenditures.

Non-current assets: These are a company's long-term assets that signify a longer investment, as they cannot be converted to physical currency as soon as they are often held onto for more than a year. For instance, equipment, land, and property (Jeans, N. (2022, June 2)).

Liabilities are the financial debts and responsibilities that a company incurs throughout the course of its commercial activities. They are categorised as follows.

Current liabilities: These are amounts owing that must be paid within a year. Examples include accounts payable, accrued expenses, and unearned revenue.

Non-current liabilities: These are usually a company's lengthier commitments that are anticipated to be paid beyond a year. These include loan payable and long-term lease obligations.

Equity represents what the company owes its owners. Equity is determined by deducting total liabilities from total assets. As a result, it symbolises the residual claim on the business that belongs to the owners and can be thought of as the company's net worth (Ali, A. (2020, October 5)).

Ultimately, the statement of financial position is a key financial document that presents a view into a company's financial health by disclosing its assets, liabilities, and equity at a certain point in time to aid investors and other stakeholders in understanding a company's financial status and make educated decisions about its prospects.

Question 3(b) The following is an example of each term, along with a justification:

Assets: Accounts receivable are an example of an asset as they signify monies that a business isowed for products or services provided or utilised yet to be paid for by clients. This asset is valuable considering it symbolises future cash receipts and is an indicator of the capacity for earning income. A large accounts receivable balance may suggest that a company is performing well, whereas a low level may imply that the firm is experiencing difficulty collecting payments from clients (Hayes, A. (2023, January 13)).

Liabilities: Bonds payable are an example of a liability as they represent a company's obligation to repay the principal amount of the loaned cash at a future date and pay interest, usually periodically (CliffsNotes. (n.d.). This liability is significant as it reflects the total amount of debt that a business has incurred, as well as its capacity to pay back that debt, not forgetting that the interest rate also plays an important factor, considering it affects a company's overall cost of borrowing.

Equity: Retained earnings are an example of equity because they constitute accumulated net earnings or profits after disbursement of dividend payments to shareholders(Fernando, J. (2023, March 23)). This equity is fundamental since it displays a company's ability to earn profits and reinvest those gains in the firm to fuel future growth. A high amount of retained earnings may imply that a firm is lucrative and in good financial shape, whereas a low level may suggest that the business is struggling to make profits.

All-inclusive, each of the aforementioned examples illustrates a distinct facet of a financial standing, all of which are key indications of financial health. When evaluating a company's financial status, assets, liabilities, and equity must all be examined simultaneously.

Achieve Higher Grades with ACC202 Assignment Solution

Order Non-Plagiarized AssignmentStruggling with your ACC202 Financial and Managerial Accounting assignment? Let us help! Our Finance Assignment Help service is the best for you. We offer professional, affordable assignment writing services that are AI-free, plagiarism-free, and delivered on time. Our team of PhD experts understands what universities expect and creates high-quality content tailored to your needs. We also offer free assignment samples, allowing you to review our quality before booking. We’re available 24/7 to support you with Business Management or any subject. Don’t wait until the last minute—contact us now and make your academic life easier with trusted expert help! We also provide Singapore University of Social Science (SUSS) Assignment Samples that have been written by the phd expert writers. Contact us now!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content