| Category | Assignment | Subject | Finance |

|---|---|---|---|

| University | Queensland University of Technology (QUT) | Module Title | USB245 Property Investment Analysis |

The ability to critically assess an investment opportunity against stated objectives is an important component in any property investment decision. The role of a property investment analyst requires in-depth market knowledge, the ability to forecast with precision, operate and interpret a discounted cashflow model, and effectively communicate your findings and recommendations to your superiors. This assignment builds on the theoretical knowledge developed during lectures and consolidates the learning task by applying that theory to a real-world example.

This assignment is designed to develop your knowledge of the Australian property investment sector in relation to making a purchase decision. This assignment is focussed on the Brisbane office market sector; however, the decision-making principles also apply to other property sectors and investment opportunities and you should extend your thinking accordingly. Specifically, this assignment is designed to develop and assess the following learning outcomes for this unit:

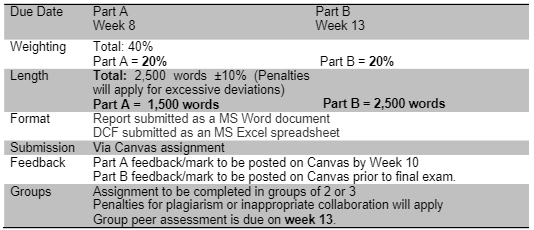

This assignment comprises 40% of your marks for this unit. It is recommended that you read this brief carefully and raise any questions during tutorial time. Additional details on the report format, content and presentation may be given during lectures/tutorials and placed on Canvas. If you miss a lecture or tutorial, it is your responsibility to chase up any assessment information that may have been provided. For further details on Assessment for this unit, please refer to the Introduction to assessments – USB245 Property Investment Analysis on Canvas.

Acting as property analyst for an investor who want to purchase an income producing property, you will need to simulate a real world project, requiring your group to build a discounted cash flow model in MS Excel and provide an associated analytical report based on a provided property investment scenario. You will be required to demonstrate your understanding of discounted cash flow modelling together with investment goals and objectives, analysis of key performance measures and risks, taking into account finance and taxation considerations as they relate to property investments.

Stuck Your USB245 Assignment? Deadlines Are Near?

Hire Assignment Helper Now!

You are an investment analyst with a small publicly listed real estate investment trust. Your AREIT has investment objectives that include:

The property at 310 Ann Street, Brisbane is recently on the market, and you have identified it as potentially fitting your investment objectives. The agent advises the owners are looking for offers over $200 million.

In order to make a recommendation to your supervisor on whether the AREIT should bid for this property, you are required to:

(a) build and analyse a discounted cashflow model using monthly cashflows in order to assess the expected performance of this building against the AREIT’s investment objectives; and

(b) prepare a report which provides evidence and justification for all your DCF assumptions, together with a market analysis to support your recommendations.

A copy of the latest information memorandum and financials for this property is on Canvas. This provides all the property specific information you require for this exercise, as at the date it was prepared. Students are NOT to contact the agent, owners or tenants of the property. Students will be required to carry out their own market and other research in order to assess and justify the necessary inputs and forecasts that will comprise the DCF. Students are not to use any proprietary or off-the-shelf DCF software. You are required to demonstrate your skills in MS Excel and develop your own DCF model. You are required to update all information so that it is inline with your assessment date.

NOTE: This is NOT a valuation exercise. Your output is NOT a valuation report. The required output is a report that will comprise your analysis and recommendations of this investment opportunity, together with your supporting DCF. Your report should present as an investigative report.

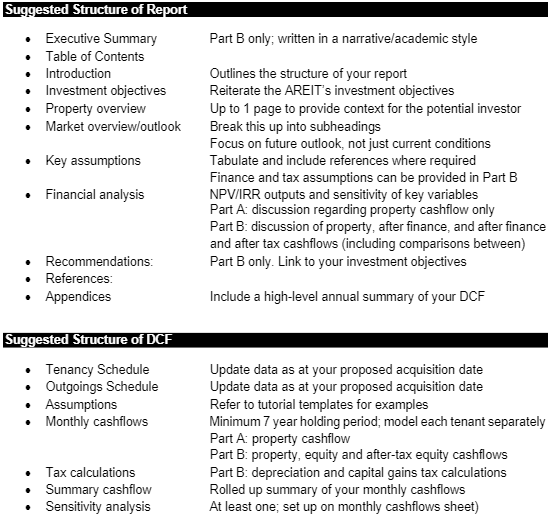

Part A comprises your draft report and monthly DCF completed to the property cashflow stage (excluding finance and tax). The report should include an introduction, brief investment objectives, brief property overview, market overview and forecast, key assumptions with justification, and financial analysis of your DCF findings for the property cashflow (before finance and tax). You are required to submit both a MS Word report and the supporting MS Excel DCF (do not paste as values or include links to external files).

A maximum of 1,500 words for Part A is recommended, excluding the DCF spreadsheet or appendices.

Part B comprises your final report updated with feedback from Part A and will also include your Executive Summary, financial analysis of your after finance and equity after tax cashflows, and recommendations. You are required to submit both a MS Word report and the supporting MS Excel DCF (do not paste as values or include links to external files).

The word limit is 2,500 words excluding the DCF spreadsheet and appendices.

In order to complete the after tax DCF, you will require additional information about the building that is not included in the Information Memorandum. Adopt the following assumptions:

Please state clearly any other assumptions you make in this regard, including depreciation assumptions for future capital upgrades (if any).

Your assignment should provide a fully referenced analysis of the specified Task. Your assignment should employ a logical and coherent structure using headings and subheadings to delineate the individual components of your work. You may opt to include figures, graphs, charts, and other diagrams in your paper. While such components are an efficient way of summarising information, it is important to refer to each table, chart or other diagram in the accompanying text to identify the significant points the item illustrates.

Your submitted assignment should reference appropriate literature - peer-reviewed journal articles, technical texts, government reports, and other professional-level documents. Please do not submit work based upon unreviewed web-based sources such as Wikipedia.

Following QUT policy, you should refer to QUT Cite|Write (www.citewrite.qut.edu.au) should you have any questions about what constitutes a report, how to appropriately credit/reference others’ work, or for general advice on writing style.

Unless otherwise specified you should follow these guidelines:

These guidelines are not intended to reduce the presentation quality of your assignment. On the contrary, you are encouraged to present your report in a professional manner. You will note from the Rubrics that 5% of the total marks are allocated for report formatting and presentation.

Ensure your DCF is formatted in a print-friendly layout with appropriate page margins and sizing. You are required to submit a soft copy of your DCF in MS Excel via Canvas assignment.

The assessment criteria defined in each assignment (known as Rubrics) reflect the unit learning outcomes and what you are expected to learn from this unit. These Rubrics are used to assess your work using pre-determined criteria against a set of standards (or performance indicators) for each of the assessment criteria.

You will be marked against the following Rubrics. It is recommended you review the Rubrics prior to submitting your assignment to ensure you aware how marks will be allocated. You are therefore encouraged to familiarise yourself with it to assess your own work prior to submission and thus develop your self-directed learning and critical thinking skills. It is also an important cross-checking step to ensure that you have fulfilled all the requirements of the assessment, thus ensuring you have the highest possibility of obtaining maximum possible marks.

You DON'T need to include a copy of this rubrics with your assignments for this unit. This is the primary method of summative feedback for this item of assessment.

Buy Answer of USB245 Assignment & Raise Your Grades

Request to Buy AnswerAre you trying to find a solution for the USB245 Property Investment Analysis Assignment? You are at the right place. Our platform provides the Australia Assignment Help. We have talented writers who can provide assignments without any plagiarism and 100% original content. You are confident that our Finance assignment help services will make you productive and help you achieve high grades in your academic year. No doubt about it! We also provide free sample assignments for your guidance. Contact us now.

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content