| Category | Assignment | Subject | Education |

|---|---|---|---|

| University | University of Auckland | Module Title | PROPERTY 211 Property Valuation |

Grafton, a Commercial Lending Manager of Future Bank Limited, 7 Queens Road, Auckland, has requested you to assess the current market value for first mortgage security purposes of 3-9 Westfield Place, Mt Wellington, Auckland.

Please note that there will be no internal inspection of the property. However, an external inspection may be completed from the road side or through google map (if necessary). Under no circumstances are you to enter the property. Whilst this departs from the latest International Valuation Standards whereby it states that all properties must be fully inspected, we have been granted a departure from the above-mentioned valuation standard in this instance.

For internal description and measurement of the property, please rely solely on the photographs and information provided in the improvements report as well as other information you are able to research online. Additionally, you have been provided with the following documentation:

1. Deed of Lease

2. Computer Freehold Register

3. Market Rents and Sales Evidence

Please note that all tenancy information in the deed of lease has been changed for confidentiality reasons, while some of the physical features of the building have been altered for simplicity purposes.

The effective date of valuation is to be July 1, 2025, which is also assumed to be the date of inspection.

Do You Need PROPERTY 211 Assignment of This Question

Order Non Plagiarized AssignmentWorking individually, you are expected to undertake all relevant independent technical analysis to show Mr Grafton that you have a full understanding of the task at hand. This technical analysis must be undertaken on a single Excel file, including the following:

The comparable analysis consists of the Rental and Sales Analysis. You are required to choose five comparables from the market evidence information provided in this assignment and make justifications for the chosen comps.

Rentals Analysis – Read relevant information on all comparable rental lettings provided, prepare a comparable rental table (qualitative and quantitative) of net rents, adjust for time, location, quality, size, etc., and apply adjustments back to the subject building to estimate appropriate market rent.

Sales Analysis – Read relevant information provided on all comparable sales evidence provided and prepare a yield comparison table (qualitative and quantitative), adjusting for time, location, tenant covenant and other adjustments you believe are relevant to derive the appropriate market yield for the subject building.

Valuation Analysis – Apply the two (2) investment valuation approaches detailed below to assess the market value of the subject property. Please ensure you only use the evidence and information supplied within this assignment brief and the improvements report.

Capitalisation Approach – Establish current contract and market rentals for each component of the property based upon the market evidence provided and make appropriate rental surplus/shortfall adjustments between contract and market rentals. Capitalise at an appropriate Capitalisation Rate or Yield (derived from the sales provided and adjusting for relevant factors).

Discounted Cash Flow Approach – Prepare discounted cash flow based on a 10-year investment horizon / holding period. Use annual net contract rental cash flows (beginning of period payments). Ensure that cash flows are adjusted to reflect rent reviews where appropriate.

Internal Rate of Return (IRR) – Please calculate the internal rate of return based on your concluded assessment of market value of the property (being the weighted outcome of the DCF and Direct Capitalisation Approaches).

Please make and state your assumptions with justifications, if not already clearly provided in this brief.

You have been provided with an examplar. Please note that the exemplar provided for your current assignment is intended as a general guide only. It is not a perfect or prescriptive template that must be followed precisely. Base your analysis, adjustments, and calculations primarily on the information, figures, and context provided in your assignment brief. Do not force your work to match the exemplar if your data suggests a different approach. Use the exemplar for inspiration and broad guidance, NOT as a rigid checklist. Your grade depends on how well you apply your understanding of the comparison and investment valuation approaches.

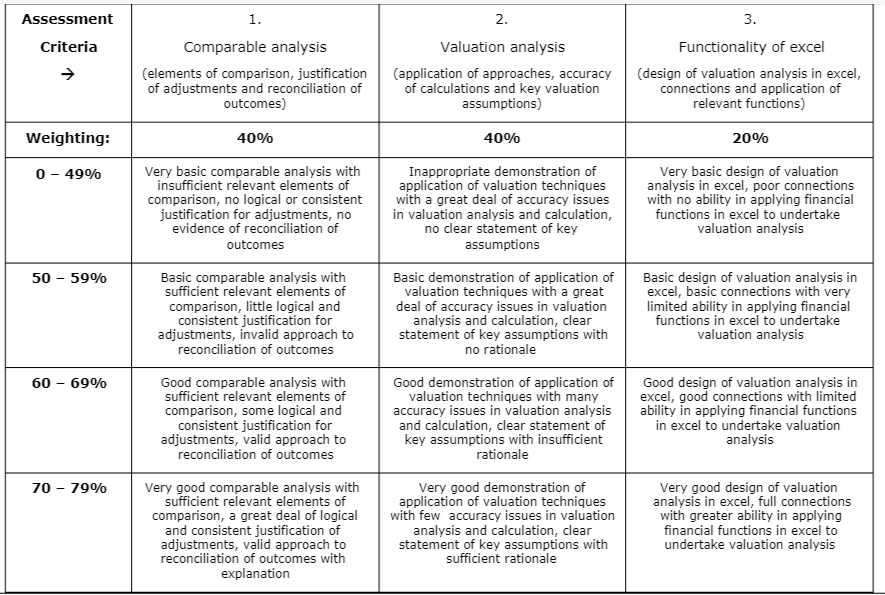

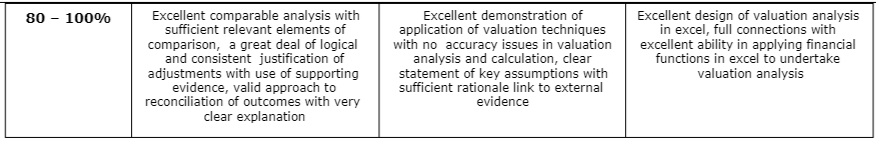

The overall assignment comprises 30% of your Prop 211 grade. The following assessment criteria and associated grading will apply to the assignment:

Struggling with your PROPERTY 211 Assignment

Order Non Plagiarized AssignmentDo you need help on a PROPERTY 211 Property Valuation Assignment? Then no need to worry! Our team of experts provides the best nz assignment help designed for students. We are here to assist you 24/7. We provide the online assignment help And We will deliver your assignment before the deadline with well-researched results. We also provide free assignment samples written by PhD expert writers. Contact us now and boost your academic grades!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content