| Category | Assignment | Subject | Finance |

|---|---|---|---|

| University | Swinburne University of Technology | Module Title | FNSACC421 Prepare Financial Reports |

| Assignment Title | Prepare and maintain asset register |

| Academic Year | 2025 |

This assessment is designed to gather evidence of your ability to apply the knowledge and skills required to record the acquisition, depreciation and subsequent disposal of fixed assets.

Students are required to complete this assignment after finishing the recommended reading and exercises in Chapter 5 of the textbook, and the Week 2 course content in Canvas.

To complete this task, students can use the learning materials as a reference.

Students may use a computer to complete this assignment.

Generative artificial intelligence (GenAI) tools are not permitted to be used to complete this assignment.

Using the templates and information provided as per the Task Instructions in Canvas, students are required to:

Time: Students are expected to complete the assessment by the due date specified in the unit outline and in Canvas.

Location: Students will complete this assessment as a self-directed task and submit it to Canvas.

If you have any queries regarding this assessment task or you feel that the assessment method is not suitable for you, before commencing, seek clarification from your teacher.

To assist in completing this assessment, students will need to obtain the following items:

To assist in completing this assessment, your teacher has provided the following items:

To successfully achieve a Satisfactory (S) outcome for this assessment, you are required to complete all requirements and submit all evidence to be assessed against the marking criteria outlined in the Product-Based Marking Guide.

An Unsatisfactory (US) will be applied where you have been unable to demonstrate the required evidence to meet parts or all of the criteria.

The outcome of this assessment will contribute to the evidence used in the final decision to achieve competency for this unit/s.

Submit Your Assignment Questions & Get Plagiarism-Free Answers

Order Non-Plagiarised AssignmentStudents are required to submit the following documents via Canvas to the teacher:

As part of her aim to grow her business, Eastwood Furnishings, Emma has decided to expand her market and has started producing and wholesaling her range of natural timber cleaning products.

To do this, she has had to purchase various pieces of equipment, one of which is a Packaging Machine.

The transactions for this piece of equipment are included below.

From the information you are required to:

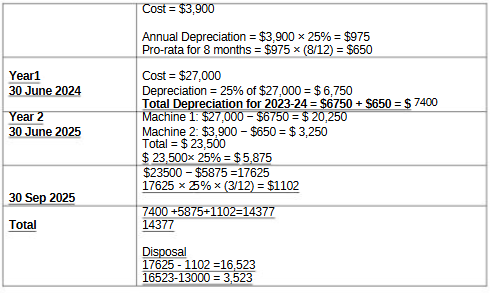

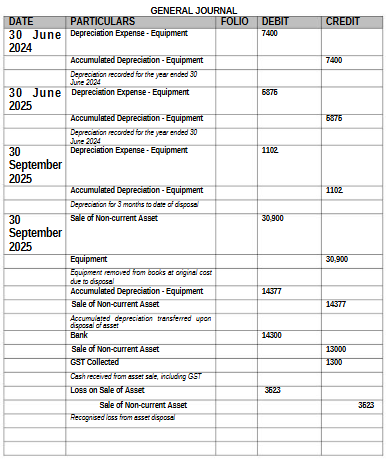

Purchase of the Packaging Machine, Model TRZ 90, Serial number PAL586349, from Comco Industries came with a 5-year warranty.

Invoice #CC127 for the total amount of $30,745 (incl. GST) is due 31st July. The itemised invoice includes:

Paid Comco Industries for the first service and recalibration to ensure the machine was running correctly. $550 (including GST).

Emma decided to purchase an automatic labelling component from Comco Industries to be fitted to the Packaging machine to speed up the overall process. (Note that the labelling machine is part of the packaging machine)

Invoice #CC150 for the total amount of $4,290 (incl. GST) is due 30th November. The itemised invoice includes:

Maintenance call out to the machine to repair damage caused by incorrect use. $715 (including GST) paid to Repairs on the Run.

Depreciation is charged on equipment as per the policies and procedures for Eastwood Furnishings.

Annual Service by Comco Industries $1,650 (including GST)

Depreciation is charged on equipment as per the policies and procedures for Eastwood Furnishings.

Emma has decided to get out of the timber cleaning products operations and sold the Packaging and Labelling machine (as a single unit) for $14,300 (including GST) cash.

Record depreciation and the entries for the disposal of the packaging machine on 30th September 2025, according to accounting requirements and organisational policies and procedures for Eastwood Furnishings.

Hire Experts to solve this assignment before your Deadline

Buy Today Contact Us

Are you trying to find someone who can help with my FNSACC421 Prepare Financial Reports? Well! You're in the right place, our podium, Workingment provides Finance Assignment Help. Our well-researched and talented professors can also provide you with odd assignments. Suppose you're judging whether to Write My Assignment with our professors. No doubt! Our team can help with your assignment. We also provide Free Sample assignments for your guidance. Get in touch right now!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content