| Category | Assignment | Subject | Finance |

|---|---|---|---|

| University | University of Northampton | Module Title | FINM089 Investment Analysis |

| Word Count | 1500 Words |

|---|---|

| Assessment Type | Portfolio |

| Assessment Title | AS1 |

| Academic Year | 2024-25 |

| Submission | 8th August 2025 |

On successful completion of this assessment, you will be able to:

a) Synthesise knowledge of asset classes, investment strategies and finance theories in the analysis of individual securities and investment portfolios.

b)Apply both qualitative and quantitative analytical skills in assessing and evaluating investment opportunities.

c)Propose and justify an appropriate investment strategy from a range of options.

d)Critically evaluate the selected approaches and solutions to the problem and justify a refined solution with consideration of interrelated impacts.

This assignment offers students an opportunity to apply core concepts in investment analysis through three key components: the identification of investment objectives and development of a relevant investment strategy; the construction of an investment portfolio; and an evaluation of the portfolio's performance. Students will demonstrate the application of theoretical and practical knowledge in security analysis, portfolio strategy, and performance measurement.

The task simulates a real-world analyst scenario where investment recommendations and strategies must be based on data-driven reasoning and sound financial principles. Students are expected to apply appropriate models, assess risk and return, and articulate a logical investment rationale in a clear and professional format.

Task 1: Investment Objectives and Strategy

Begin by defining the investment objectives for your portfolio, considering various factors such as return expectations, risk tolerance, time horizon, and liquidity needs. Propose an appropriate investment strategy aligned with these objectives. Justify your strategic approach using relevant financial theories and applicable models. This part carries 20% of the weight of the assignment and must be submitted by 07th July 2025 through the module Nile site.

Task 2: Equity Research and Portfolio Construction

Develop an investment portfolio consisting of a selection of 10-15 securities of your choice. The portfolio can be composed of equities only or a blend of financial instruments, but you are not required to include multiple asset classes.

You should justify your security selection, for example, choosing either a top-down (macroeconomic and sector-based) or bottom-up(firm-level fundamentals) approach. Use appropriate relative valuation techniques—comparing multiples like P/E, P/B, EV/EBITDA — to support your stock selections. Provide a table comparing key stock fundamentals (e.g., earnings growth, ROE, valuation ratios) to justify your choices.

For portfolio construction, you are expected to clarify the weighting decisions, drawing on relevant investment theories and market analysis. Explain how the portfolio addresses risk and return trade-offs and demonstrate a clear rationale behind the portfolio design.

Task 2 carries 50% of the weight of the assignment and must be submitted by 25th July 2025 through the module Nile site.

Task 3: Portfolio Performance Evaluation

Finally, evaluate your constructed portfolio by estimating its expected performance using appropriate financial metrics. This may include calculations such as expected return, standard deviation, and Sharpe ratio. You should analyse the effectiveness of your portfolio in meeting its investment objectives and assess its expected risk-adjusted return. Discuss the assumptions and limitations of your analysis and critically reflect on the robustness of your strategy.

This part carries 20% of the weight of the assignment and must be submitted by 8th August 2025 through the module Nile site. 10% will be given for the academic and professional quality of the portfolio.

To complete Tasks 2 and 3 - portfolio construction and evaluation, please follow the given steps:

Step 1: Stock Selection

Please submit a list of selected stocks by 4th July 2025 to the module leader by email/Nile submission. Examples of selection strategies include but are NOT LIMITED to the following:

Step 2: Download Data

Download closing price data of the selected stocks for at least 5 years (at weekly frequency). You can download the data using Excel's built-in functions, Bloomberg, Yahoo Finance, Refinitiv Datastream, or other sources.

Step 3: Construct Portfolios

Create an investment portfolio with well-justified weights, making use of financial tools/softwares (i.e Excel, Bloomberg, ft.com, Trading View)

Step 4: Write your Analysis and Findings

Using academic literature on asset allocation, provide a detailed explanation and rationale for: (a) Stock selection, and (b) Portfolio strategies. Analyse the risk and return profile of your selected stocks and

portfolios by calculating their average returns and standard deviations. Reflect on how your asset selection and allocation strategies incorporate behavioural factors and address the investment needs of different types of investors. Identify key insights and lessons for your readers.

a)To provide evidence of your work, create an appendix with screenshots from your sources (i.e. Bloomberg Terminal, Orbis database, and/or reference publicly available information on websites like Seeking Alpha, The Motley Fool, Market Watch, Trading View, Yahoo Finance, etc).

b)The raw price data must be shown in a separate Excel sheet. All calculations must be shown in another Excel sheet with Excel formulas in working order. Students opting to use R or Python must submit the raw data in Excel and the output in Word/PDF format, along with the code used to perform the calculations.

Note: The assessment presentation will be assessed, and a poor presentation will affect the assessment outcomes.

AS1 -Investment Analysis -Portfolio Construction and Evaluation

Title page

Table of contents

Task 1: Investment Objectives and Strategy (350 words)

1.1 Investment Objectives 1.2 Investment Strategies

Task 2: Stock Selection and Portfolio Construction (800 words) 2.1 Equity Research

2.2 Portfolio Construction

Task 3: Portfolio Performance Evaluation (350 words) 3.1Exploratory Data Analysis (of portfolio risk and return),

3.2 Reflective note on Portfolio Management Strategies Reference List

Appendix (if any)

To submit your work electronically, please go to the 'Assessment and submission' area on the NILE site and use the relevant submission point to upload the assignment deliverable. The deadline for this is 11.59 pm (UK local time) on the date of submission. Please note that Essays and text-based reports should be submitted as Microsoft Word documents (.doc or .docx), or as guided within the assignment. Please access the following guide to submitting assessments.

Written work submitted to Turnitin will be subject to anti-plagiarism detection software. Turnitin checks student work for possible textual matches against internet available resources and its proprietary database. Please access the University of Northampton's Plagiarism Avoidance Course (UNPAC) to learn more.

When you upload your work correctly to Turnitin you will receive a receipt, which is your record and proof of submission. If your assessment is not submitted to Turnitin, rather than a receipt, you will see a green banner at the top of the screen that denotes successful submission.

N.B. Work emailed directly to your tutor will not be marked.

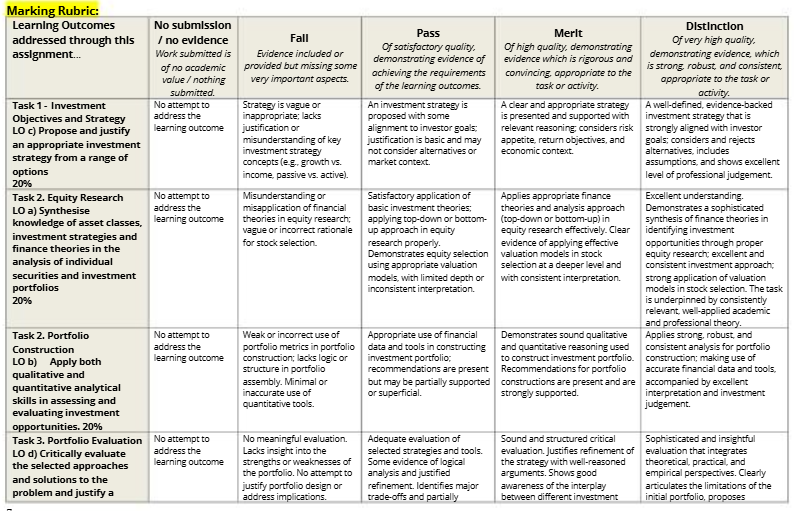

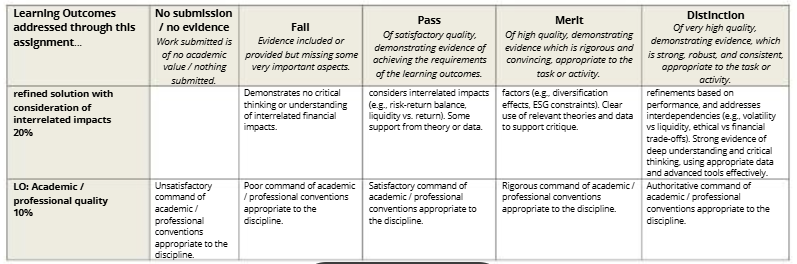

Your mark will depend on the extent to which you meet the learning outcomes in a way relevant to this assessment.

The marking criteria is included in a table called the rubric that has different statements for how well each learning outcome has been met. This table is used by anyone marking the module to ensure consistency in the marking of the assignment. Please see the marking criteria/rubric on NILE or see the final page of this document for further details of the marking criteria for this assessment.

Please access the following document for more general information about the assessment process, including anonymous marking, submissions, and where to find feedback and grades. UON Standard Assessment Guidance.

Get the Solution to this Assessment

Order Non-Plagiarised AssignmentSeeking with your FINM089 Investment Analysis, to now stress-free and get Professional Help With Investment Assignment from our expert team. we also provide free assignment samples that have been written by PhD expert writers. We are available 24/7 to assist you. Now, be tension-free and focus on studying and give your assignment to our expert team. We will deliver your assignment before the deadline with well-researched results. Contact us today and boost your academic grades!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content