| Category | Assignment | Subject | Accounting |

|---|---|---|---|

| University | University College Dublin | Module Title | Depositary Functions |

| Word Count | 1,200 words (plus or minus 10%) |

|---|---|

| Assessment Title | Assignment 1 |

| Academic Year | 2024-25 |

Holden plc is a large UK bank holding company with its headquarters in London. Its main bank, Holden Bank plc, operates the group’s global custody business in London. Holden Bank’s Irish subsidiary, Holden Trustee Services (Ireland) Ltd. (“HTS”), acts as depositary for Ireland-domiciled investment funds.

You work in the depositary oversight department of HTS.

Burton Investment Advisors, Ltd. (“Burton”) is a large London-based asset manager with global reach. Burton is an important client of the wider Holden group. Burton is the investment advisor appointed by the Management Company of Burton Fund Unit Trust (“Burton Fund”), an Irish UCITS umbrella fund.

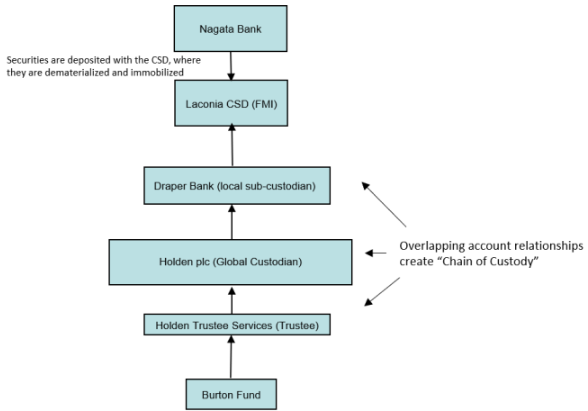

Nagata Bank is a large systemically important bank whose headquarters are in the country of Laconia. Its shares in issue are traded on the Laconian stock exchange and are therefore maintained in custody via Holden plc’s Laconian sub-custodian, Draper Bank, which is a participant in the Laconian Central Securities Depository (CSD).

Burton wishes to invest in shares (equity securities) of Nagata Bank on behalf of Burton Fund.

Until now, the Burton Fund has not invested in any securities in Laconia, and Holden plc will need to appoint a new sub-custodian to provide access to securities held at the Laconian CSD.

The structure of the custody holding would be depicted as follows:

Nagata Bank – in which Burton Fund has by now invested – is in trouble.

Nagata Bank has been told by the Lanconian Central Bank that it must recapitalise by a certain date or face takeover by the state.

Under the Laconian “Act of Intervention“, the Laconian Ministry of Finance is empowered to expropriate (effectively seize) a financial institution in case of danger to “the stability of the financial system”. Expropriation would mean seizure by the state, not just the assets of Nagata Bank, but also all shares that have been issued (equity securities issued and outstanding) and subordinated debt, meaning that investors in such securities would be wiped out.

The developing situation is reported widely in the media.

The Depositary is nervous about Burton Fund’s holding of Nagata Bank shares and has raised the situation with Burton, the manager of the fund. Burton believes the long-term investment potential of the bank warrants holding onto the position and that recapitalisation will occur.

Under the UCITS Directive, depositaries are liable for “loss” of the fund’s securities unless they can prove the loss is due to “external events” beyond the depositary’s “reasonable control” and which could not have been prevented “despite all reasonable efforts”.

To complete this assignment, please provide a written response in respect of the following questions:

a. What is the depositary’s role regarding the proposed custody of shares of Nagata Bank? What steps should HTS, as depositary, undertake on behalf of the Burton Fund?

b. What is the depositary’s role regarding whether Burton complies with the Burton Fund’s investment restrictions in the first place?

c. If the investment in Nagata Bank is deemed not to comply with the fund’s investment restrictions, what steps should the depositary take?

a. Assuming the investment complies with Burton Fund’s investment restrictions, what considerations should the depositary take into account to ensure that the interests of the fund’s investors are adequately protected under the developing circumstances?

b. If the depositary can’t get comfortable that investor interests are adequately protected given the developing situation, what should the depositary consider and do, given the risk of restitution liability?

Please ensure that your responses are well-presented and written in a way that will clearly and concisely identify the relevant issues and recommended course of action for your manager at HTS.

Buy Answer of This Assignment & Raise Your Grades

Request to Buy AnswerLooking for expert guidance in FIN1085B1 Depositary Functions Assignment? Worry, no need! We are here to help you with assignments. Whether you need accounting assignment help or well-structured solutions, we will provide everything. You will get free assignment examples that will make your study material stronger. our expert team are providing all assignment services, you will get accurate, clear, and original content. Now stop worrying about marks and complete your assignments hassle-free with expert support. So what's the delay? Get connected with us now and make your academic journey easy!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content