| Category | Assignment | Subject | Accounting |

|---|---|---|---|

| University | Universiti Teknologi MARA (UiTM) | Module Title | FAR460 Accounting Financial & Reporting 2 |

| Assessment Type | Group Assignment |

|---|---|

| Academic Year | 2025 |

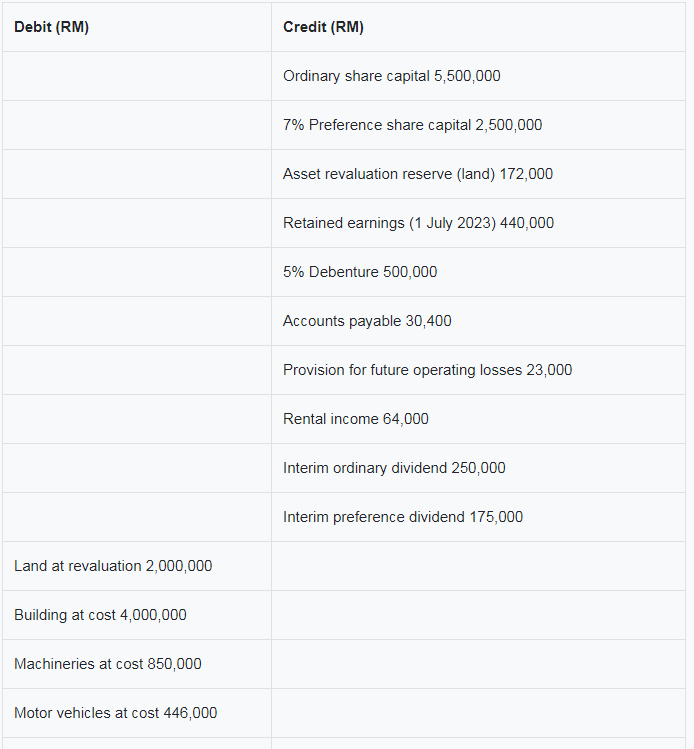

Ladang Segar Bhd (LSB or the Company) has been involved in the manufacture of various dairy products since 2016. The company gets its milk supply from various cattle farming areas in Sarawak. On 1 July 2023, the Company ventured into agriculture, breeding dairy cattle for its milk production. The following is the trial balance of LSB as at 30 June 2024. The financial statement is authorised for issue on 30 September 2024.

Are You Looking for Answer of FAR460 Assignment

Order Non Plagiarized AssignmentBuildings and machineries are depreciated using straight line method on a yearly basis. While motor vehicles are depreciated using reducing balance method on a yearly basis. As at 1 July 2023, the remaining useful life for the building, machineries and motor vehicles are 30 years, 8 years and 5 years. Depreciation for machineries is treated as part of cost of sales, whereas the depreciations for building and motor vehicles are treated as administrative expenses. Land is not depreciated. The company adopted the revaluation model for its property, plant and equipment.The building was revalued on 1 July 2023 at RM3,300,000. While the land was subsequently revalued on 30 June 2024 at a deficit of RM250,000.On 2 July 2023, the production facility of the company experiences some problems with the machinery. The machinery was previously purchased for RM450,000. Upon inspection, it was discovered that a component of the machinery was broken and was replaced immediately. The cost of the old component was RM150,000 (carrying amount of RM100,000) and was sold for RM75,000, while the new component cost RM200,000. The Company expected with this replacement an improvement in the machinery’s operating capability with a new remaining useful life of 10 years.

The company has amortised all intangible assets on a straight-line basis within 10 years of their useful lives and charged per year basis in the statement of profit or loss. On 1 July 2023, the company had disposed one of its licenses (classified as an intangible asset) for a RM80,000 by cheque. The license was acquired on July 2020 for RM90,000.

The investment property was a 3-storey building acquired by the company. On 30 June 2024, the company occupied one floor as a showroom for product display, and for the sale and distribution of the company’s products. The rest of the building were rented out as office space under operating lease. Each of the floors can be sold separately. The cost for each floor was RM500,000 and was revalued at RM600,000 each as at 30 June 2024. The company adopts the fair value model for its investment property. The building has an estimated useful life of 40 years.

The company’s biological assets consist of 200 cattle (3-year-old) and 100 calves (6-month-old) which was purchased on 1 July 2023.On 30 June 2024, the fair value less cost to sell of a 4-year-old cattle, and a 1.5-year-old calf are RM4,500, and RM2,100 respectively.

On 1 April 2024, the company was confronted with a legal suit of RM500,000 from one of its distributors for supplying defective goods. As at 30 June 2024, the case was still ongoing and the next hearing of the case will take place in August 2024. The company’s legal advisor indicated that there is a 75% probability that the distributor will win the case with a maximum claim of RM400,000.One of LSB’s operations has suffered net losses for three consecutive years. The Company expects the operation to suffer another financial operating loss in 2025 and had provided for the loss in the current year.

On 3 September 2023, a payment to a supplier for a credit purchase of RM20,000 for the year ended 30 June 2023 was made. However, while finalizing the financial statements for the year ended 30 June 2024, it was discovered that the payment was accidentally recorded as a current year cash purchase.

The Company increased its allowance for accounts receivable to RM15,000 by the end of the financial year.

On 25 July 2024, the directors of LSB declared a final ordinary dividend of RM124,000 in respect of profits earned for the financial year ended on 30 June 2024. The dividend will be paid on 5 October 2024.The net realizable value of the closing inventory was RM160,000.

Tax charged for the year ended 30 June 2024 is estimated at RM98,700.

The following requirements relate to the additional information above. Relate your answers to the relevant MFRSs.

(50 marks)

Prepare the following financial statements for LSB in accordance with the requirements of the Companies Act 2016 and MFRS101 Presentation of Financial Statements and other Malaysian Financial Reporting Standards:

(50 marks)

Total: 100 Marks

Achieve Higher Grades FAR460 Assignment

Order Non Plagiarized AssignmentStruggling with your FAR460 Accounting Financial & Reporting 2? Let us help! We offer professional, affordable assignment writing services that are AI-free, plagiarism-free, and delivered on time. Our team of PhD experts understands what universities expect and creates high-quality content tailored to your needs. We also offer free assignment samples so you can check our quality before booking. Our expert team provides Accounting Assignment Help that has been designed for the students. We’re available 24/7 to support you. Don’t wait until the last minute—contact us now and make your academic life easier with trusted expert Assignment Helper Malaysia!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content