| Category | Assignment | Subject | Finance |

|---|---|---|---|

| University | Arden University | Module Title | BUS4012 Introduction to Business Finance |

| Academic Year | 2025\26 |

|---|

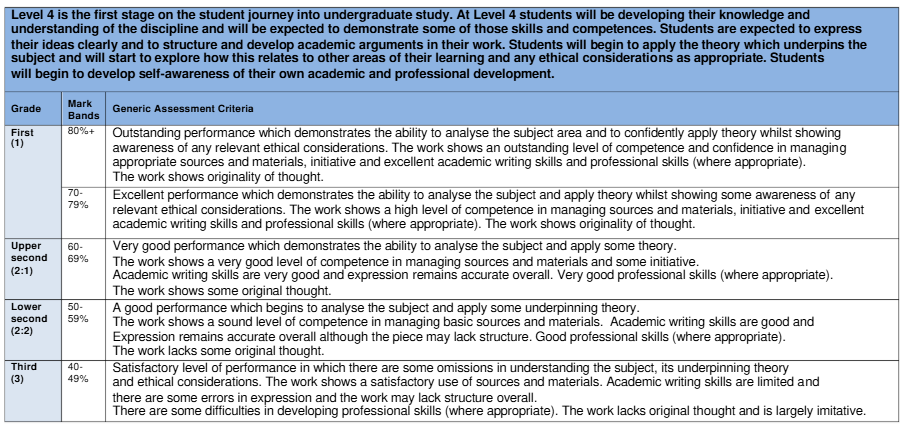

As part of the formal assessment for the programme, you are required to submit an Introduction to Business Finance Time Constrained Assessment (TCA). Please refer to your Student Handbook for full details of the programme assessment scheme and general information on preparing and submitting assignments.

After completing the module, you should be able to:

Your assignment should include: a title page containing your student number, the module name, the submission deadline, and the exact word count of your submitted document; the appendices if relevant; and a reference list in the AU Harvard system(s). You should address all the elements of the assignment task listed below. Please note that tutors will use the assessment criteria set out below in assessing your work.

You must not include your name in your submission because Arden University operates anonymous marking, which means that markers should not be aware of the identity of the student. However, please do not forget to include your STU number.

Instructions:

This assessment should take you no longer than 4 hours and can be completed at any point during the 24-hour window. Please ensure you give yourself adequate time to upload your completed paper to Turnitin.

(a) Explain the need for a regulatory framework for accounting. (8 marks)

(b) Critically discuss the influence of international financial reporting standards on the way that companies prepare and present their financial reports. (17 marks)

(Total: 25 marks)

(LO: 4 and 5)

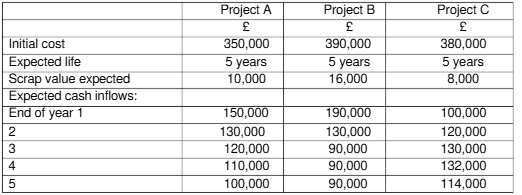

The following information relates to three potential investment projects that are being considered by Convert plc. Due to capital rationing, only one of the three projects can be pursued.

Additional information:

i. Convert PLC estimates its cost of capital to be 10%.

ii. £70,000 depreciation is charged to Project A each year.

iii. £78,000 depreciation is charged to Project B each year.

iv. £76,000 depreciation is charged to Project C each year.

Required:

(a) Calculate the payback period, accounting rate of return, and net present value of each of the potential projects. (15 marks)

(b) Explain which of the three potential investment projects should be undertaken. Your explanation should be based on the results of your calculations in part (a). (3 marks)

(c) Critically discuss the approaches to investment appraisal used in part (a). As part of your critical evaluation, identify what additional information might be used to improve the approach to investment appraisal. (7 marks)

(Total: 25 marks)

(LO: 3, 4 and 5)

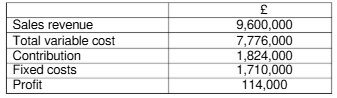

Big Ltd manufactures a single product. The factory’s theoretical maximum production capacity is 36,000 units.

A budget for the year to 31 March 2019 has been prepared based on the production and sale of 24,000 units at a selling price of £400 per unit and a variable cost per unit of £324. The resulting budget is as follows.

Two proposals that may increase the company’s profit are currently under review.

Under the first, £100,040 would be spent on a one-off advertising campaign, and an additional commission of £2 per unit sold would be paid to sales staff. It is believed that these measures would increase the number of units sold at the existing selling price to 26,400.

Under the second proposal, the selling price per unit would be reduced to £380. Market research indicates that 32,000 units would be sold at this price. Improved discounts could then be secured on the purchase of materials, reducing the variable cost per unit by £4 relative to that used in the original budget.

You should consider each of the two proposals independently.

Required:

(a) Calculate the breakeven point (in units) and the margin of safety for each of the two proposals. Express the result of your calculation of the margin of safety as a percentage. (14 marks)

(b) Critically evaluate the two proposals. Your critical evaluation should be supported by the results of your calculations in each of parts (a) and (b). You should also consider any other factors that you consider to be relevant to each of the two proposals. (11 marks)

(Total: 25 marks)

(LO: 4 and 5)

(a) Explain the cash conversion cycle. Your explanation should include an account of each element of this cycle. (6 marks)

(b) Critically discuss the importance of the effective management of trade receivables. Your critical discussion should include an explanation of the measures that might help to manage trade receivables and an explanation of techniques that might help a business to collect money from debtors. (19 marks)

(Total: 25 marks)

(LO: 1, 2, 3, 4 and 5)

Struggling with BUS4012 assignments and feeling stressed?

Order Non-Plagiarized AssignmentDon’t let your BUS4012 Introduction to Business Finance assignment stress you out! We are here for finance assignment help. Our expert writers are here to support you with affordable, AI-free, and plagiarism-free assignment help. Whether it’s Business Management or a complex project, we ensure well-researched, high-quality content. We offer free assignment samples and always deliver your work before the deadline. Reach out today and get the best support for your assignments—quick, easy, and reliable!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content