| Category | Assignment | Subject | Management |

|---|---|---|---|

| University | RMIT University | Module Title | BAFI3192 Derivatives and Risk Management |

| Word Count | 3000 Words |

|---|---|

| Assessment Type | Individual Assessment |

| Assessment Title | Assessment 3 |

| Academic Year | Semester 2, 2025 |

The goal of this individual assessment is to gain a better understanding of the equity portfolio investment (in the US stock market) and risk management processes. Below are the tasks to be completed in this assessment:

1) Create an account (with your student ID, e.g., sXXXXXXX) on MarketWatch. comand join the following trading game:

2) Your goal is:

a. to set up and manage an equity portfolio.

b. to make a profit by trading from the beginning of Week 8, Monday, 18 August 20251, until Tuesday, 2 September 2025.

c. to identify and manage the portfolio risk, and

d. to communicate your investment and risk management process using a professional report.

3) There should be two elements to your portfolio:

i) an initial portfolio that must remain fixed for the trading period, and

ii) an additional portfolio that you can use to actively trade over the trading period.

The initial equity portfolio should consist of at least 5 different stocks and should be created on the first trading day (18 August 2025). The stocks for the initial portfolio should belong to a single American index, for example, the S&P 500, Dow Jones, or NASDAQ.

The additional portfolio can be created once you have chosen your 5 stocks and have decided on how much to spend. Any leftover funds after the purchase of the initial portfolio can then be used to actively trade with the objective of maximising profit. The stocks in the active element of your portfolio can be traded across American indexes.

Note that you will be trading American equities and as such, the market timing is9.30am – 4 pm EDT (or 8.30 pm – 3 am the next day in Vietnam time). You can place your trades after hours during the day, Vietnamese time, and they will be executed once the market opens in America.

4) Calculate the one-day 99%-Value at Risk of your initial portfolio (portfolio created on the first trading day) using the historical approach. Use daily stock prices since 1 January 2020 for the calculation of the VaR

5) Additionally, undertake the following on the initial portfolio:

a) Calculate the Beta of your initial equity portfolio.

b) Hedge your initial portfolio against share price declines with Futures contracts. The futures index value should be recorded on the first and last day of trading,i.e., Monday, 18 August 2025 and Tuesday, 2 September 2025, respectively. It is recommended that you record the index price when you purchased and sold the final share in your initial portfolio.

c) Select one stock from the initial portfolio and hedge its position against potential losses with an Options contract. The option premium should be recorded on the first day of trading, i.e., Monday, 18 August 2025.

6) For the active portfolio, you can engage in additional transactions (either buying or selling) of stocks during the trading period to maximise your portfolio’s return. You can purchase additional shares of the companies in your initial portfolio to actively trade in your active portfolio, but note that you cannot trade the shares in your initial portfolio, e.g., if you have 1000 Tesla shares in your initial portfolio, and then decide to trade an additional 500 Tesla shares, only the additional 500 can be actively managed. The initial 1000 shares cannot be touched. A copy of your initial and additional portfolio, including the list of stocks and balances, is required in the report as part of your analysis. Whether you engage in additional trades, please keep in mind that you must maintain the 5 initial stocks in your portfolio for the whole trading period, so you can perform the required hedging activities at the end of the trading period. You are allowed to use AI Generative tools (e.g., the free trial version of Incite AI, TICKERON, Rockflow or others) to help you in the process of finding an asset (stock) to support your decision in your active portfolio. Please provide evidence (e.g., a screenshot or the transcript of the conversation with the AIGenerative tools), and you need to present your counterargument and evaluate the advice (pros and cons) from the AI tools.

Portfolio investment strategy

Since the trading game is only for a few weeks, the investment strategy is to generate high short-term growth in the value of the portfolio over the trading period. You may use both fundamental(EPS / PE ratio / ROE) and technical analysis to construct your equity portfolio.

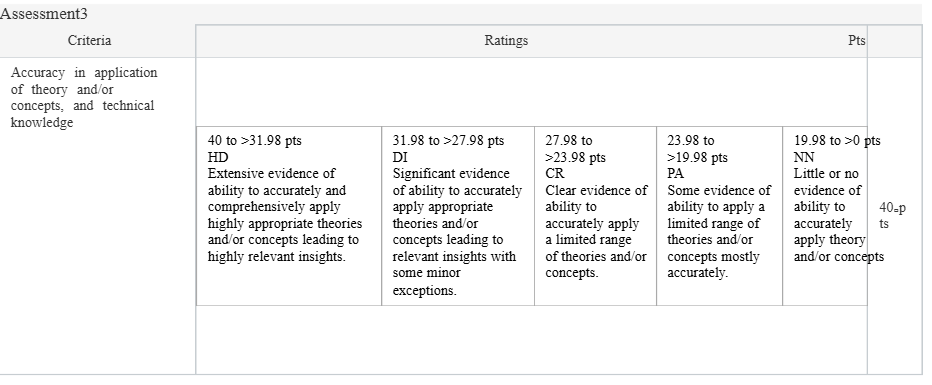

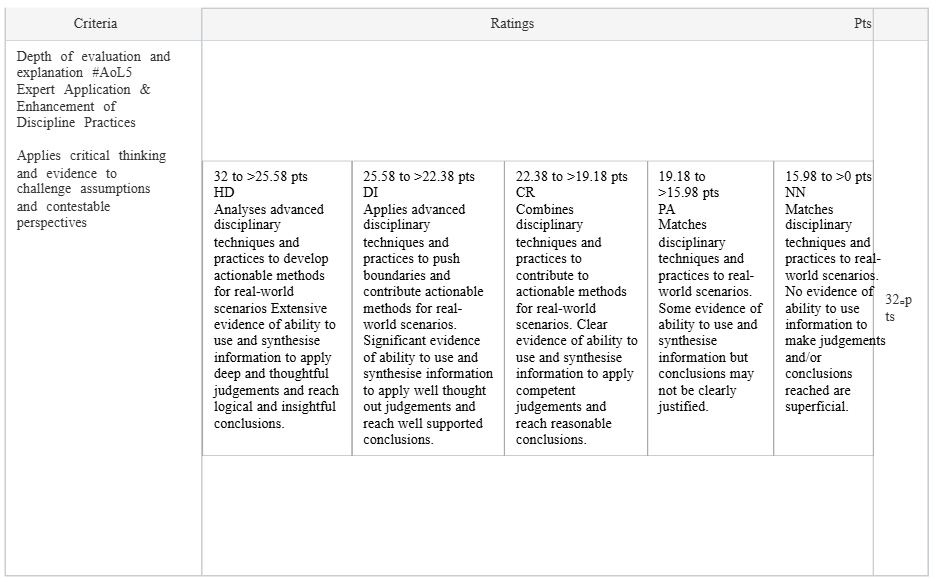

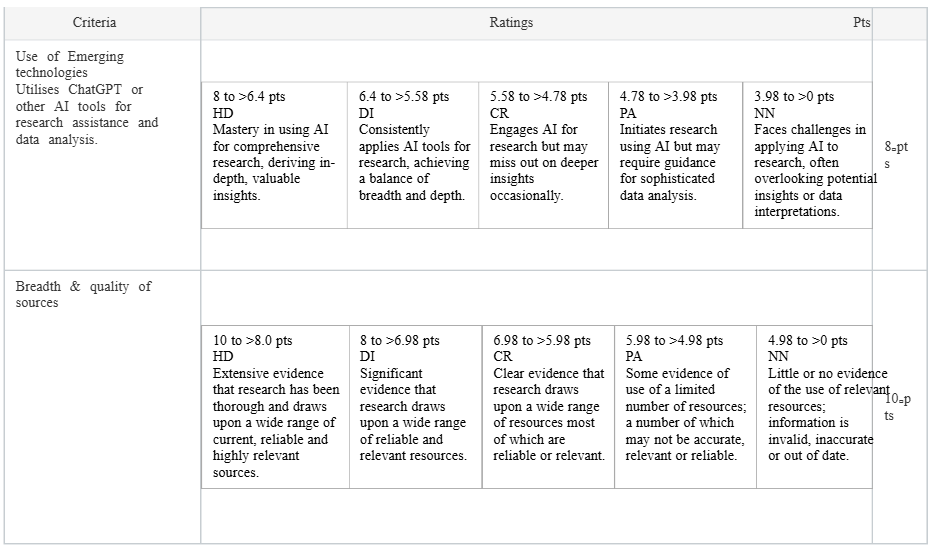

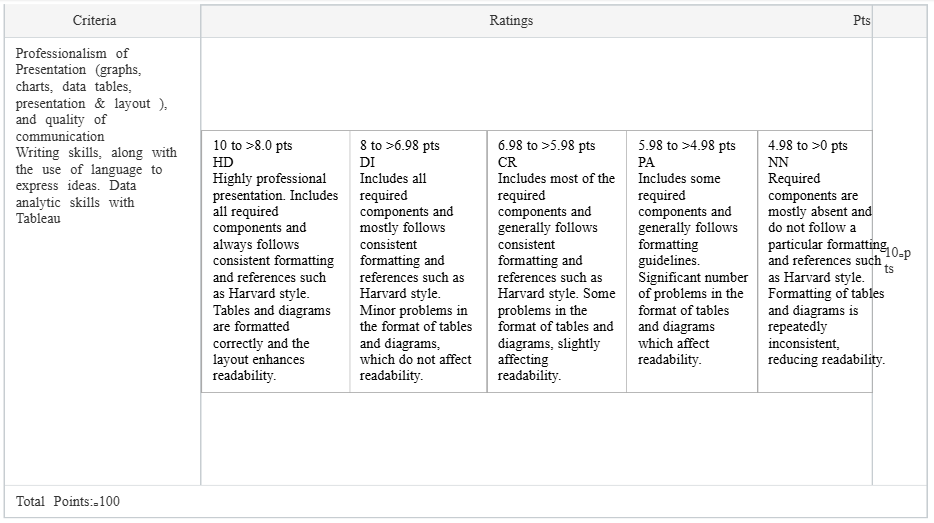

Your report should include the following sections (*note: this marking guide gives you an indication of the weight awarded to each report element, but the final scores will be based on the marking rubric):

Trading philosophy: Provide an overview of your trading philosophy, i.e., how stocks were selected, and the strategy to outperform the market. You should identify yourself as a value or growth investor or a mixture of both and provide justifications. (10 marks)

Portfolio construction: Present your initial portfolio, including information on why you have invested in the stocks in your initial portfolio. (10 marks)

Recommended (but not mandatory) research information of this part could include:

a. the fundamentals of each stock

b. the technical analysis of each stock

c. news and the overall market and macroeconomic conditions

d. the initial weightings of the portfolio and the rationale for that composition

Additionally, you should also provide a calculation of the expected return of your portfolio using the CAPM (Beta, risk-free rate, expected market return)

Risk identification (10 marks)

In this section, you could discuss the risk profile of your portfolio. The discussion should include the following points:

a. The systematic risk of your initial portfolio

b. The unsystematic risk of your initial portfolio

c. Calculation and discussion of the one-day 99%-Value at Risk of your portfolio using the historical approach

Hedging (10 marks)

This section should include an explanation of how the portfolio was hedged. This comprises:

a. How you used the Futures contract to hedge your initial equity portfolio position against a possible market decline. Provide calculations as necessary.

b. How you used the Options contract to hedge your individual stock position. Provide calculations as necessary.

Reflection on the trading process

An important goal of this assessment is to provide students with a (costless)insight into trading behaviour, risk appetite, and risk management process. As such, you should provide a robust and comprehensive critical reflection of the trading and hedging process. Your reflection should include:

a) Your risk appetite. Hint: Are you risk-seeking or risk-averse? How did this influence your selection of stocks in your trading and hedging activities? Has your appetite remained the same, or has it changed over the course of the trading period? Explain. (8 marks)

b) A comparison of the expected return on the portfolio (i.e., using the CAPM model) and the actual returns achieved (based on stock price movement). Discuss the difference and implications this has in relation to the potential risk in stock portfolio investment. This discussion may require a demonstration of a good understanding of the CAPM model, how it is used, and what it often shows. (8 marks)

c) A calculation of the net portfolio return taking into account the hedging transactions, and a calculation of the net return of the particular stock that you have hedged using option contracts. (8 marks)

d) A comparison of the hedging transactions from which you should conclude i) the effect of hedging on your investment portfolio, e.g., how it helped you manage the risks that you have identified above, and ii)the preferable derivative contracts (among the two) that you would prefer to use in hedging an investment portfolio. (8 marks)

e) Digitally Adept-Emerging technologies #AoL4 Digitally Adept: Using appropriate AI Generative tools (e.g., Incite AI, TICKERON, Rockflow), provide analysis/opinion/recommendation (buy/sell) of one aspect of a stock that you select to be added to your active portfolio. In addition, you need to present your counterargument and evaluate the advice (pros and cons) from the AI tool using one of the relevant frameworks we learned in the course (You need to state which frameworks you are referring to in your report, e.g., foreign exchange risk, interest rate risk, business risk, etc.). (8 marks)

Notes:

The report requires VAR calculations that should be undertaken in Excel. Therefore, you should submit a separate Excel file on Canvas detailing your calculations.

The report requires Tableau data visualisation output that should be undertaken in Tableau. Therefore, you should submit a separate Tableau output file on Canvas.

Remember that one of the focuses of this report is risk management. As such, please be balanced in how you approach your discussions. In other words, it is easy to get carried away with the technical and fundamental analysis, so please be mindful of this. You are encouraged to be selective in the portfolio construction discussions and only include relevant information. Please refrain from including excessive information (e.g., economic factors) without clear evidence of how it helps in selecting the stocks.

The listed items in the guidelines above are only recommendations and are not exhaustive. You can be very brief about one or more of these elements if it does not pertain to you. -

Bonus marks will be awarded to the top 3 traders.

Do You Need BAFI3192 Assignment for This Question

Order Non-Plagiarised AssignmentAre you looking for help with your BAFI3192 Derivatives and Risk Management? Don’t stress anymore! We offer expert Risk Management assignment help at affordable prices. Our team of PhD writers provides well-researched, AI-free, and plagiarism-free work. We deliver before deadlines and are available 24/7 to support you. Whether it’s Business Management or any other topic, we’re here for you. You can also get free assignment samples to check our quality. Improve your grades and reduce your stress—contact us today for reliable and professional assignment help that you can trust! We also provide Ulster University Assignment Samples that have been written by the phd expert writers. Contact us now!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content