| Category | Assignment | Subject | Management |

|---|---|---|---|

| University | RMIT University | Module Title | BAFI1026: Derivatives and Risk Management |

This is an individual task. In this assessment, students are required to form one equity portfolio, evaluate their risks and provide solutions to manage the risk. The goal of this individual assignment is to gain a better understanding of the portfolio investment (in the US stock market) and risk management process.

● to build one equity investment portfolio and justify stock selection

● to hold the portfolio from Monday, 12 May 2025 (beginning of Week 10) to Friday, 23 May 2025 and observe its value changes

● to identify the portfolio risk by reporting portfolio's VaR

● to provide suggestions for managing the risk

● to communicate your investment and risk management process using a professional report

Please follow the following steps to build one portfolio.

1. Create an account (with your real first & surname) on Market

2. Create a watchlist of one Portfolio based on the close price as of Monday, 12 May 2025

3. This watchlist of Portfolio ($1 million) consists of Four stocks from the S&P500

4. Take screenshots of your portfolio and the necessary information in all sections. Make sure you attach them in the Appendixof your submitted report.

5. Suppose this is a Buy-and-Hold strategy, therefore, do not change your portfolio setting during your holding period Monday, 12 May 2025 to Friday, 23 May 2025.

Are You Looking for Answer of BAFI1026 Assessment 3 - Report

Order Non Plagiarized AssignmentGive an overview of your philosophy to form the portfolio. You should identify yourself as a value or growth investor or a mixture of both. Provide brief definitions for value/growth investing.

Present your initial portfolio, including information on why you have invested in the stocks in your initial portfolio (three stock selection for Portfolio).

In this part, you should discuss the risk profile of your portfolio. On Monday, 12 May 2025, calculate the VaR of your Portfolio using 2-year daily historical stock price between 11 May 2023(exclusive) and 12 May 2025 (exclusive). The discussion should include the following points and show key steps of workings:

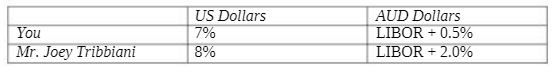

As an Australian-based investor, you want to borrow 1 million U.S. dollars at a fixed interest rate to match your investment cash flows. To achieve this, you enter into a two-year currency swap agreement with Mr. Joey Tribbiani, who wishes to borrow Australian dollars at a floating interest rate. The amounts required by both parties are roughly the same at the current exchange rate. You and Mr. Joey Tribbiani have been quoted the following interest rates, which have been adjusted for the impact of taxes:

Design a swap that will net a bank (Bank A), acting as an intermediary, 20 basis points per annum. Unlike a swap equally attractive to both parties, this task requires you to design a swap that allocates 40% of the advantage (i.e., gain) to you and 60% of the advantage (i.e., gain) to Mr. Joey Tribbiani. Determine the rates of interest that you and Mr. Joey Tribbiani will end up paying. Provide an explanation, list your calculation process, and use a diagram to illustrate the swap structure.

(e.g., Usage of professional Figures and Tables, with numbering and captions.)

Note:

Buy Answer of BAFI1026 Assessment 3 & Raise Your Grades

Request to Buy AnswerAre you searching the solution of the BAFI1026 Derivatives and Risk Management Assessment 3 - Individual Risk Management Report? Then worry no need. There are specialized professionals for all categories of assignments who offer you plagiarism-free and superior content. You are assured that our report writing service will make you productive and help you achieve high grades in your academic year. A free list of assignment samples written by PhD experts is also provided here that can help you boost your study power and check the quality of the report. So contact us today and get your top-notch report!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content