| Category | Assignment | Subject | Accounting |

|---|---|---|---|

| University | London Metropolitan University | Module Title | AC4052QA Financial Accounting |

| Word Count | 1500 Words |

|---|---|

| Assessment Type | Written Report |

| Assessment Title | Coursework 1 |

This assignment requires each student to work on the published financial statements of ASOS PLC for two years from 2021 to 2022(edited). A summary of some of the ratios is provided below.

You are required to: Given the ratios provided above, write a brief report on the performance of ASOS over the financial periods 2021 to 2022. Use any other information relevant to ASOS PLC for your comments (especially for the introduction). Information can be accessed from the annual report and accounts and any other source of evidence that you believe helps to explanation. (Note the report must follow the criteria provided below.

The figures have been edited, interpret them as given here.)

Are You Looking Solution of AC4052QA Assignment

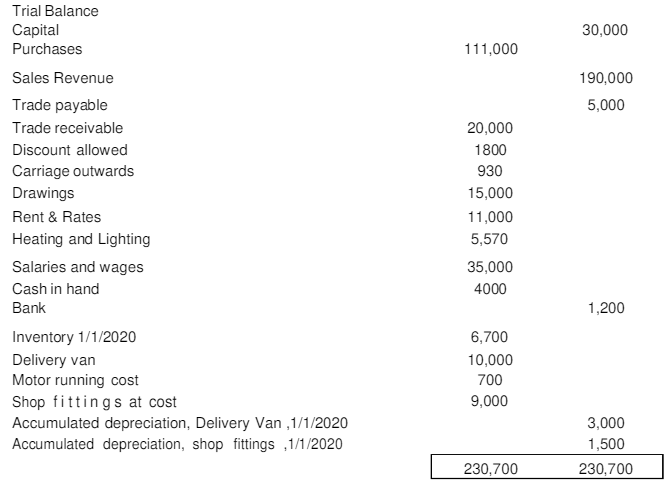

Order Non Plagiarized AssignmentElwira Ventures The following trial balance was extracted from the books of Elwira Ventures, a spare parts merchant, at the close of business on 31 December 2020.

1. Inventory on 31 December 2020 was £3,400.

2. Elwira took out spare parts costing £500 for the repair of her private car. No payment was made for these goods. 3. Rent prepaid on 31 December 2020 was £1,200.

4. Motor running expenses owing on 31 December 2020 was £90. 5. Provide for depreciation on 31 Dec 2020 as follows: Delivery Van 45% on the reducing balance basis and Shop fittings 35% on the straight-line basis.

a) Draw up Elwira Ventures income statement for the year ended 31December2020 [25 marks]

b) Draw up Elwira statement of financial position as at 31 December 2020 [25 marks]

c) In one sentence, state the effect of the following on income statement and statement of financial position.

i. Prepaid income. [2 mark]

ii. Prepaid expense. [2 mark]

iii. Accrued income. [2 mark]

iv. Accrued expense. [2 mark]

Hristo Ventures, a new business, starts trading in sports shoes on 1st January 2021 and expects to make the following transactions for the 6 months ending 30th June20 21:

(i) Sales are expected to be 500 units (sports shoes) per month for the 3 months from January to March and then 700 units per month from April to June.

(ii) The selling price will be £48 per unit.

(iii) All sales will be cash sales with cash received in the same month the sale takes place.

(iv ) Payment for Purchases of inventory (sports shoes) will take place on the month after receiving the inventory. Each unit of inventory will cost £30.

(v ) Wages are expected to be £2000 per month and will be paid in the month in which they are incurred.

(v i) Rent will be £3000 per month to be paid quarterly in advance.

(v ii) General overheads are expected to cost £5000 per month and will be paid in the month in which they are incurred.

(v iii) Bought a laptop for the business in April for £2000

a) Prepare a cash budget for the 6 months from January to June 2021. Show the cash receipts and cash payments the business expects to have each month and the cash balance at the end of each month. (7marks)

b) Prepare a profit budget for the 6 months ending 30th June 2021. (5marks)

Buy Custom Answer Of AC4052QA Assignment & Raise Your Grades

Get A Free QuoteIf you are worried about the AC4052QA Financial Accounting Assignment? no need to worry anymore! Our experts provide Accounting Assignment Help that has been designed for the students. You will get expert guidance and help on assignments that will strengthen your concepts. We also provide you with free assignment samples that will help you understand. And the best part? All the content is 100% original, written by PhD expert writers, and well-researched, so that you get the best quality. So don’t delay now; boost your grades with our help!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content