| Category | Coursework | Subject | Accounting |

|---|---|---|---|

| University | King's College London | Module Title | 5QQMN531 Audit and Assurance Lecture 1 |

Auditing is the accumulation and evaluation of evidence about information to determine and report on the degree of correspondence between the information and established criteria.

Performed by a competent, independent person.

The definition of auditing includes the following key words and phrases:

In the context of an audit, "information" refers to the financial statements, records, or any data that is subject to examination.

"Established criteria" are the benchmarks, standards or norms against which the auditor evaluates the information.

These criteria could include generally accepted accounting principles (GAAP), specific legal requirements, industry standards, or any other relevant standards that are considered appropriate for the specific audit engagement.

The audit process involves comparing the provided information with the established criteria to assess the accuracy, completeness, and compliance of information.

In the audit context, accumulating and evaluating evidence are integral processes. Auditors gather diverse evidence, ensuring sufficient quality and quantity.

Struggling with coursework and feeling stressed?

Order Non Plagiarized CourseworkA "competent and independent person" is an auditor who possesses professional expertise, education, and experience in auditing, demonstrating a thorough understanding of accounting principles and adherence to ethical standards.

Competence involves the ability to navigate complex information and apply professional judgement in line with established standards.

Independence requires maintaining an objective and unbiased perspective, avoiding conflicts of interest, and adhering to ethical guidelines.

Reporting

Reporting in an audit involves the formal communication of an auditor's findings, conclusions, and opinions regarding the examined financial information or other audit subjects.

Overall, reporting plays a crucial role in influencing stakeholder confidence in the reliability of financial information.

Accounting is the ongoing process of recording, classifying and summarising financial transactions to generate accurate financial information for internal and external decision-making. It is an integral part of daily business operations and is carried out by internal accounting departments.

On the other hand, auditing is an independent and periodic examination of financial statements and records to verify their accuracy and reliability. Auditors, external to the organisation, provide an unbiased opinion on the fairness of the financial statements. Auditing occurs after the accounting period, serving as a retrospective assessment.

An assurance service is a professional service provided by auditors and other qualified professionals to enhance the reliability and credibility of information for decision-makers.

The primary goal of assurance services is to provide an independent and objective assessment of various aspects, such as financial statements, processes, or controls, to instil confidence in the accuracy and completeness of the information.

These services go beyond traditional financial audits and may include reviews and may include reviews, compilations, and other engagements that assure the reliability of information without necessarily expressing an opinion.

An attestation engagement - a practitioner assesses and reports on "subject matter or an assertion about the subject matter that is the responsibility of another party."

Some financial attestation engagements (other than audits):

This regulation requires:

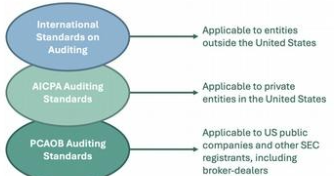

International Standards on Auditing (ISAs) are issued by the International Auditing and Assurance Standards Board (IAASB) of the International Federation of Accountants (IFAC).

The IAASB works to improve the uniformity of auditing practices & related services throughout the world.

The IAASB's medium-term strategy addresses the following three main themes in the public interest:

In response to several accounting-related corporate scandals, Congress passed the Sarbanes-Oxley Act.

The provisions changed the relationship between publicly held companies and their audit firms.

The Act's major provisions include:

PCAOB

The Sarbanes-Oxley Act established the PCAOB to:

Membership in the AICPA is voluntary and restricted to certified public accountants (CPAs).

Not all CPAs join, and not all members are practising as independent auditors. The AICPA:

The AICPA sets standards and rules that all members and other practising CPAs must follow:

AICPA Audit Standards:

PCAOB Audit Standards:

Profession effectively regulates itself with some laws. Financial Reporting Council: assess the quality of the audit.

UK has lots of institutes, e.g. ACCA, ICAEW, ICAS. All are characterised by:

The Audit principles underlying an audit provide a framework to help auditors fulfil the two objectives:

The principles do not carry authority, but they provide structure for the Codification. The structure is organized around the following principles:

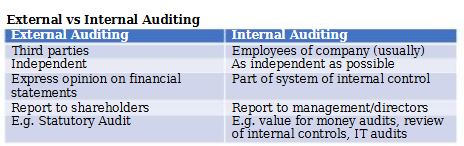

The role of internal audit is to provide independent assurance that an organisation's risk management, governance and internal control processes are operating effectively.

Internal auditors have professional duty to provide an unbiased and objective view. They must be independent from the operations we evaluate and report to the highest level in an organisation: senior managers and governors.

Except for certain governmental organisations, the audits of most FSs in the US are done by CPA firms.

Three size categories are used to describe CPA firms:

Hire Experts to solve this assignment before your Deadline

Buy Today, Contact UsCPA firms provide audit services as well as other attestation and assurance services. Additional services commonly provided by CPA firms include:

CPA firms vary in the nature and range of services offered, which affects the organisation and structure of the firms. Three main factors influence the organisational structure for all firms:

There are six organisational structures available to CPA firms:

If you are stressed about the coursework on 5QQMN531 Audit and Assurance Lecture 1, then there is no need to worry now! Whether you need Accounting Assignment Help or Finance Assignment Help, you will get expert guidance and help on report writing services, which will make your concepts strong. We also provide you with free coursework solutions that will help you understand. And the best part? All the content is 100% original, written by PhD expert writers, and is well-researched, so that you get the best quality. So don't delay now, boost your grades with our help!

Hire Assignment Helper Today!

Let's Book Your Work with Our Expert and Get High-Quality Content